Ethereum Retires Holesky: What Does This Mean for ETH Price?

Ethereum is entering a new chapter in its development cycle. The Holesky testnet, once the largest proving ground for validator and upgrade testing, is being retired after two years of service. Its shutdown follows persistent issues like inactivity leaks and validator exit backlogs, which slowed down testing efficiency. To replace it, Ethereum has introduced Hoodi, alongside existing networks Sepolia and Ephemery, all designed to streamline testing ahead of the much-anticipated Fusaka upgrade. With Fusaka promising cheaper and faster rollups, these changes raise an important question: how will this transition affect Ethereum’s long-term growth and ETH’s price trajectory?

Ethereum Price Prediction: What Does This Mean for ETH Price?

Ethereum’s developer ecosystem is undergoing a major shift. The Holesky testnet, once the largest playground for validators and upgrades, is being shut down after two years. Its replacement, Hoodi, along with Sepolia and Ephemery, will take over critical testing roles. This move is tightly linked to the upcoming Fusaka upgrade, which aims to make Ethereum rollups cheaper and faster. The question is: how could these structural changes impact ETH’s market performance?

Why Holesky Shutdown Matters?

Holesky was not just a testnet—it was the staging ground for Ethereum’s most impactful upgrades, including Dencun and Pectra. Its scale allowed developers to stress-test proof-of-stake at a level close to mainnet conditions. But as the network aged, problems like inactivity leaks and validator exit backlogs made it inefficient. The decision to retire Holesky reflects Ethereum’s commitment to developer efficiency and smooth upgrade testing, which in turn reduces risk for the mainnet.

From a market perspective, Ethereum investors often price in the reliability of its upgrade pipeline. Smooth testnet-to-mainnet transitions reduce the probability of bugs or delays, which supports long-term confidence in ETH.

The Role of Hoodi, Sepolia, and Ephemery

The launch of Hoodi is more than just a replacement. It’s a clean slate designed to avoid Holesky’s validator issues while continuing to serve staking providers and infrastructure teams. Meanwhile, Sepolia remains the go-to for decentralized app testing, and Ephemery offers fast validator cycle resets. Together, this trio strengthens Ethereum’s developer backbone.

The timing aligns with Fusaka’s rollout, which spreads data storage more evenly across validators. If Fusaka delivers on its promise of making rollups cheaper and faster, Ethereum’s scalability narrative strengthens—an angle that could attract renewed institutional and developer interest.

Ethereum Price Prediction: ETH Price Chart Analysis

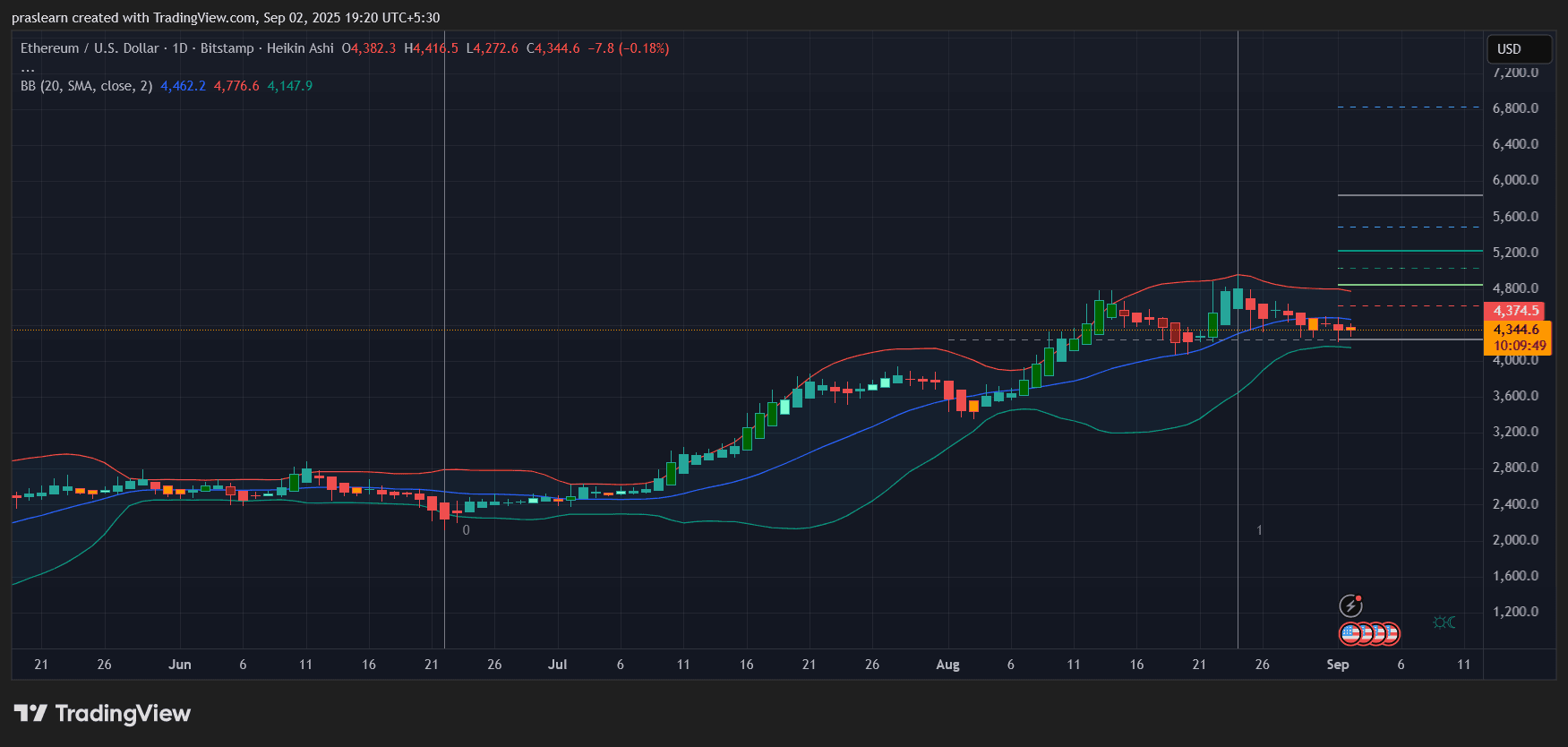

ETH/USD Daily Chart- TradingView

ETH/USD Daily Chart- TradingView

Looking at the daily chart, ETH is consolidating around the 4,340–4,400 range after retreating from August highs near 4,800. The Bollinger Bands show a squeeze forming, which usually precedes a breakout. The middle band is acting as resistance at around 4,462, while the lower band near 4,147 is immediate support.

The chart suggests Ethereum is in a cooling-off phase after its summer rally, but the structure hasn’t broken down. If $ETH holds above 4,150, the next bullish impulse could aim for 4,800 again, with breakout targets stretching toward 5,200–5,600. On the downside, a failure to defend 4,150 could open room toward 3,800.

Ethereum Price Prediction: Developer Confidence vs Market Patience

The Holesky shutdown itself is neutral in isolation, but paired with Fusaka and Hoodi’s arrival, the narrative leans bullish. Developers and validators gain stronger infrastructure, which lowers upgrade risks and strengthens $Ethereum long-term fundamentals. In markets, confidence often precedes capital flows.

Short term, ETH price may continue to range between 4,150 and 4,600 as traders wait for Fusaka implementation. A breakout above 4,600 post-upgrade news could ignite the next leg toward 5,200+. If sentiment sours, however, ETH risks a pullback to the 3,800–4,000 zone.

Ethereum’s decision to retire Holesky shows maturity in how it manages its upgrade cycle. For price action, it reinforces $Ethereum credibility but won’t act as a direct catalyst until Fusaka goes live. Expect $ETH to consolidate in the short term, with upside potential building into late 2025 as rollup improvements materialize.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Markets Face a Rollercoaster: What Happened in the Past 24 Hours?

In Brief Bitcoin price dropped by 2.4%, influencing overall crypto market sentiment. The top 10 cryptocurrencies saw a general decline over the past 24 hours. Market seeks stability amid cautious investor behavior and potential short-term volatility.