Bitcoin is trading under $110,000 in a compressed range, with momentum weakened and risk signals mixed; a clean daily close above $110,000 would likely confirm a relief rally, while failure to break higher could extend compression and increase downside risk.

-

Bitcoin near-term outlook: $110K is key resistance; a daily close above it could trigger a rally.

-

Momentum indicators show fading strength under $120K, keeping price compressed between $107K–$118K.

-

Risk Oscillator readings have moved from high-risk in early 2025 to mixed levels; recent signals suggest caution as momentum nears neutral.

Bitcoin $110K resistance front and center — monitor momentum and risk signals for a confirmed breakout. Read how traders should prepare now.

Bitcoin holds below $110K with momentum compressed as traders watch risk signals and await a breakout to confirm the next big rally.

- Bitcoin sits at $109,200 as $110K acts like a wall, and traders say a close above could spark a big relief rally soon.

- Risk signals show pressure easing but still unstable, meaning Bitcoin may stay stuck in compression unless momentum clearly shifts.

- SwissBlock notes momentum is fading under $120K, but a clean breakout above $110K could finally repair structure and lift prices.

Bitcoin remains trapped below the critical $110,000 resistance as analysts weigh the next directional impulse. Market readings show compressed momentum and mixed risk conditions, keeping price action rangebound until a decisive breakout or breakdown occurs.

Bitcoin Vector commented that “$BTC boxed in compression with $110K hardening into strong resistance.” That view implies a daily close above $110,000 would restore bullish structure and likely trigger a relief rally. Conversely, continued failure to breach $110K could extend compression and raise the probability of a corrective leg.

Source: Bitcoin Vector

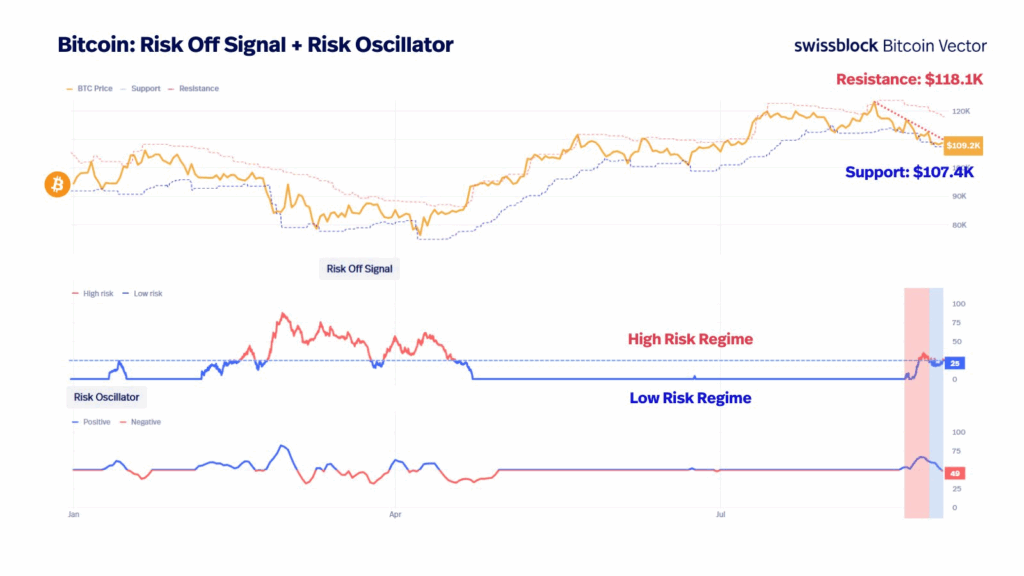

Price action shows current trading around $109,200 with technical resistance near $118,100 and support near $107,400 on the referenced chart. These levels create a tight band where momentum and macro risk readings will determine the next directional bias.

What are the current risk signals and how do they affect Bitcoin?

Risk indicators shifted throughout 2025, with high-risk readings early in the year and lower readings mid-year. Risk signals now sit in mixed territory, meaning downside pressure is easing but stability is not yet confirmed. Traders should treat current conditions as ambiguous until consistent readings align with price structure.

How has the Risk Oscillator impacted price ranges?

The Risk Oscillator tracked elevated readings from January–March, fell below 25 from April–June supporting recovery, then moved mixed in July–August. Positive oscillator readings in April assisted the bounce from $85,000 to $100,000, while weakening momentum in July contributed to pullbacks into the low $105K area. Current neutral-to-diminishing readings keep a breakout from being a high-probability event until confirmed.

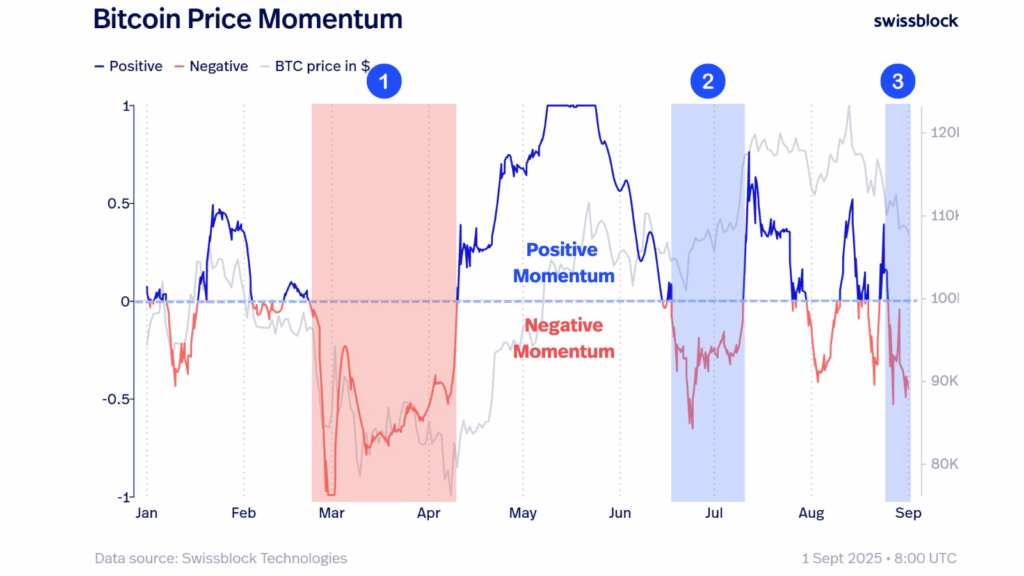

Why is momentum under $120K significant for Bitcoin?

Momentum under $120K indicates the market lacks the bullish follow-through needed to extend gains. SwissBlock’s phase analysis shows a shift from bearish to bullish earlier in 2025, followed by fading momentum since late August. That fading trend means resistance at $110K and $118K is harder to clear without renewed buying pressure.

Source: SwissBlock

How should traders prepare for a potential breakout?

Traders should watch for a daily close above $110,000 as the primary confirmation for a relief rally. Confirming signals include rising momentum indicators, declining implied volatility, and improving risk readings. Position sizing and clear stop levels near $107,400 can limit downside if compression persists.

Frequently Asked Questions

What happens if Bitcoin fails to close above $110K?

Failure to close above $110,000 would likely extend price compression and increase the chance of another corrective leg. Traders should watch support near $107,400 and adjust risk exposure accordingly.

How can traders confirm a sustainable rally?

A sustainable rally requires a daily close above $110K, improving momentum indicators, and risk readings that move from mixed to supportive. Confirmation across these factors reduces the risk of a false breakout.

Key Takeaways

- $110K is the decisive level: A daily close above it would likely restore bullish structure and trigger relief buying.

- Momentum remains compressed: SwissBlock and other analyses show fading strength under $120K, keeping price in a narrow range.

- Manage risk proactively: Watch support at $107,400, use clear stops, and wait for multi-factor confirmation before expanding positions.

Conclusion

Bitcoin’s near-term trajectory hinges on whether buyers can clear the $110,000 barrier. Front-loaded risk and momentum signals currently keep price compressed, making confirmation essential before calling the next major rally. Monitor the outlined levels and indicators, and adjust trading plans accordingly.