Analysts Increase IREN Price Target: Will The Stock Keep Rallying?

IREN stock has surged nearly 300% as it pivots from Bitcoin mining to AI cloud, with analysts forecasting major upside.

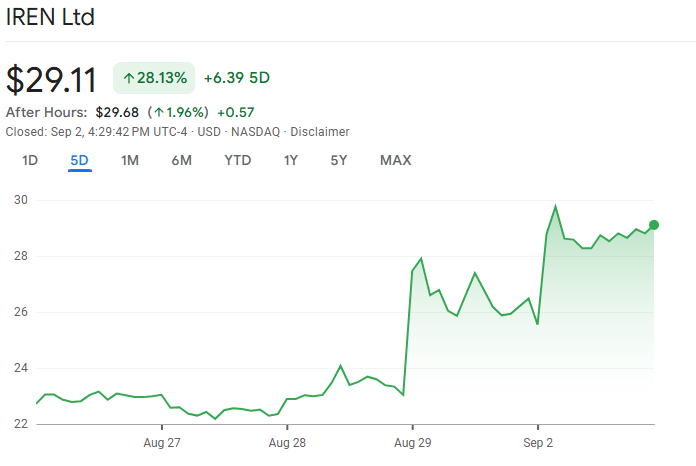

Nasdaq-listed Bitcoin mining company IREN Ltd. is currently one of the hottest stocks on Wall Street. IREN has rallied nearly 300% since March and 74% over the past month. After tumbling at the start of the year, the Bitcoin miner’s stock has almost quintupled from its April lows. The stock almost made a break for $30 before experiencing a pullback, but recent price targets from analysts suggest a new all-time high is inevitable.

IREN Price Target

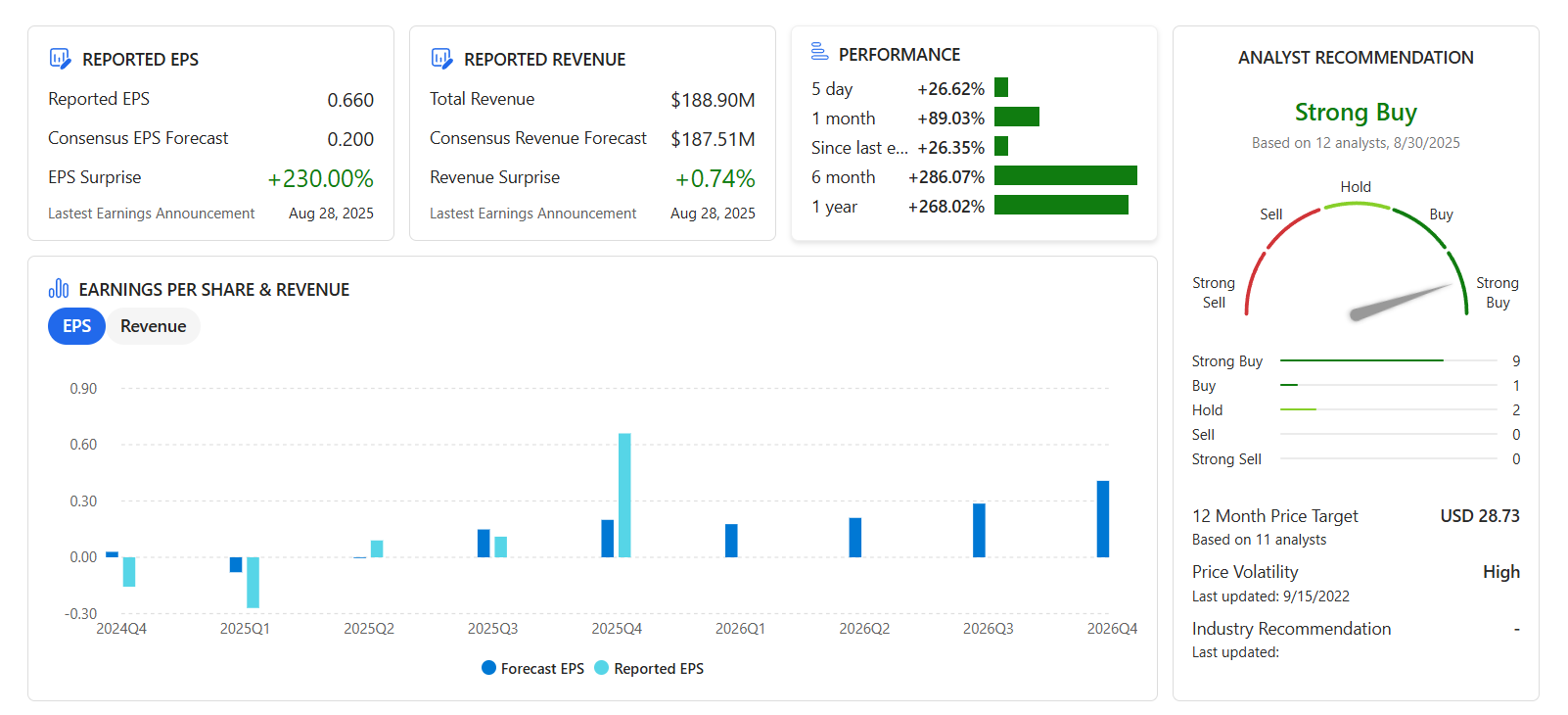

Canaccord Genuity raised its IREN price target from $23 to $37 per share after IREN’s earnings report. They weren’t the only ones. H.C. Wainwright assigned a $36 price target, while Roth Capital believes IREN can reach $35 per share.

All three of these price hikes suggest massive upside from IREN’s $26.48 closing price at the end of August.

IREN Price Chart. Source:

IREN Price Chart. Source:

What Caused The Rally?

IREN has been a Bitcoin miner since it was founded in 2018. But the infrastructure necessary for Bitcoin mining has given IREN an advantage in scaling AI infrastructure.

The company has spotted an opportunity to build out AI infrastructure with its Bitcoin mining knowledge, and investors have noticed.

However, the transition from crypto mining to AI isn’t new, and IREN isn’t the only stock benefiting from this trend.

Hive Digital Technologies Executive Chairman and Co-founder Frank Holmes recently joined BeInCrypto to discuss several high-growth catalysts for crypto miners pivoting to artificial intelligence.

Meanwhile, IREN’s Q4 FY25 earnings results confirmed the bullish thesis while presenting new information.

Revenue increased by 168% in fiscal 2025, reaching $501.0 million. Bitcoin mining brought in $484.6 million, while AI Cloud Services only generated $16.4 million.

IREN Analysts’ Performance Summary. Source:

IREN Analysts’ Performance Summary. Source:

AI Cloud Services are a small slice of revenue now, but the company’s recent Nvidia chip expansion and its new Nvidia Preferred Partner status suggest cloud revenue will accelerate.

Also, leadership even told investors in the Q4 FY25 press release that the AI Cloud segment can produce an annualized $200 million to $250 million by December 2025.

Enthusiasm Builds On Social Media

Investors are excited about how much IREN’s AI Cloud Services can scale. Also, a rising Bitcoin price will result in higher profits for the company’s Bitcoin mining business. Many of those investors are talking on social media.

IREN stock has its own Reddit page that sees daily activity from a growing userbase. Still, most of the excitement is taking place on X. IREN’s X account received a flood of engagement and positive comments when it reported FY25 results.

$IREN today reported its FY25 results.Key highlights:– Record Revenue of $501m (Including record quarterly revenue of $187m in Q4 FY25)– Record Net Income of $87m– Record EBITDA of $278m– Record Adj. EBITDA of $270m– Expansion to 10.9k GPUs & $200-250m AI Cloud annualized… pic.twitter.com/zh1qiMYXOR

— IREN (@IREN_Ltd) August 28, 2025

The #MiningMafia founder also tweeted that he might trim his IREN position once it reaches $420 per share.

Another X user said IREN is the type of stock that can rise by over 100% and “still be undervalued.” Eric Jackson, the investor behind OPEN’s stock 1,000% rally, believes IREN can be a 100x stock.

Just went live on TV with @cvpayne on @foxbusiness

— Eric Jackson (@ericjackson) August 22, 2025Broke down why $OPEN, $IREN, and $CIFR are 100-bagger plays. And why I want @Drake to roll with the $OPEN Army to flex on Kendrick. Let’s ride.

pic.twitter.com/OcDNOL3Xnb

Where Does IREN Price Go From Here?

Social media enthusiasm doesn’t guarantee that a stock will reach any of the price targets that investors see on platforms like X.

However, IREN stock’s movement from $5 to nearly $30 per share within a few months, strong retail investor participation, price hikes from analysts, and an enticing long-term opportunity make IREN stock promising.

If IREN reaches $200 million to $250 million in annualized revenue from its AI Cloud Services, the stock will likely march higher.

Many analysts are anticipating that scenario, and if AI Cloud Services reaches that benchmark, it’s easy to wonder how much this segment will accelerate in 2026 and beyond.

Overall, artificial intelligence is still in its early innings. While Nvidia has become a giant in the AI industry and other chipmakers continue to hit record highs, it’s the relatively small crypto miners that may present the next wave of long-term capital appreciation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.