CARDS token surges 200%+ as Raydium brings its tokenized Pokemon cards onchain

Raydium brings real-world Pokémon card trading to Solana by powering Collector Crypt, a tokenized marketplace where physical cards are vaulted, verified, and traded on-chain.

- Collector Crypt uses Raydium’s AMM infrastructure to enable on-chain trading of its tokenized Pokémon cards with instant liquidity.

- More marketplaces are joining the trend, including Courtyard (over $100M in Pokémon volume), Phygitals, Beezie, Grailed, and others ahead of the Pokémon franchise’s 30th anniversary in 2026.

- The marketplace’s native token CARDS tripled in value to a $140M FDV within 12 hours as tokenized Pokémon card trading heats up.

Tokenized Pokémon cards debut for trading

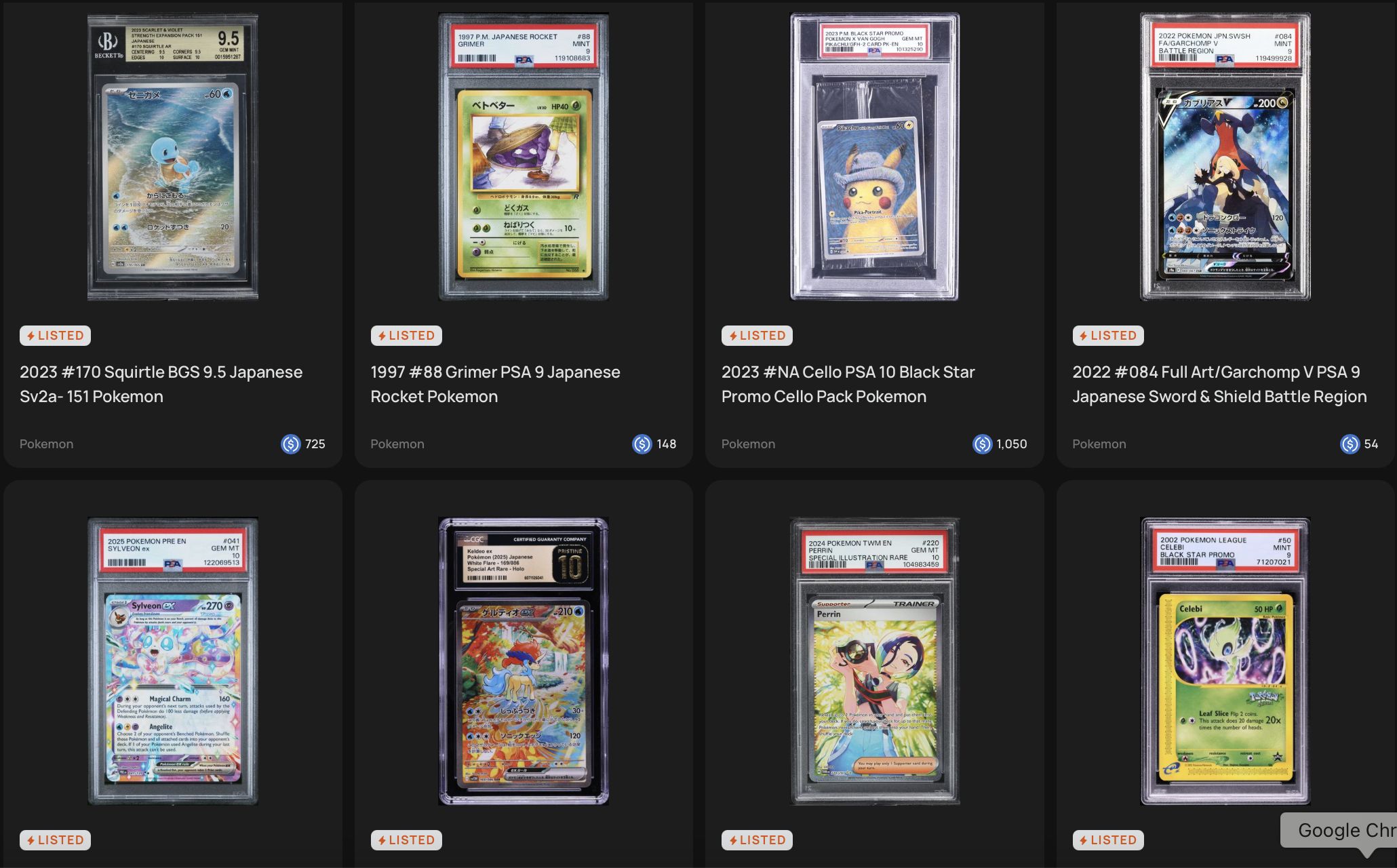

Raydium ( RAY ) has just brought real-world Pokémon card trading to the Solana blockchain by supporting Collector Crypt, a marketplace that securely stores physical Pokémon cards, authenticates them through professional grading, and converts them into digital tokens representing ownership.

By providing automated market maker infrastructure, Raydium enables these tokenized Pokémon cards to be traded efficiently and transparently on-chain. According to Raydium , Collector Crypt has already facilitated over $70 million in Pokémon pack sales, including a record $5 million in a single transaction cycle.

Source: Collector Crypt

Source: Collector Crypt

Meanwhile, CARDS, the marketplace’s native token, is gaining serious traction, surging over 200% in the past 24 hours, with its market cap standing at $58 million at press time.

Collector Crypt isn’t the only platform capitalizing on Pokémon nostalgia as the franchise approaches its 30th anniversary in 2026.

According to @huntersolaire , several other marketplaces are already tapping into the hype with token launches and airdrop incentives. Courtyard, for example, has seen over $100 million in Pokémon-related trading volume.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The most crucial year! The market is deeply manipulated, and this is the real way whales make money.

Social Sentiment Turns Bearish For XRP

ETF, derivatives, capitulation... Bitcoin falls back into a well-known spiral