AAVE price is showing bullish accumulation as large whale withdrawals and a smart trader buy tighten supply and push momentum higher; technicals — an ascending trendline and Fibonacci targets — suggest $371 then $430 as potential upside if $298 support holds.

-

Whale accumulation and smart trader buys reduce exchange supply, supporting higher AAVE prices.

-

Derivatives order flow and a Long/Short Ratio of 1.76 show trader conviction but raise short-term volatility risk.

-

Liquidation clusters between $317–$335 are key zones that could trigger sharp moves if breached.

AAVE price breakout? AAVE shows bullish accumulation and trendline support; watch $298 support and $371–$430 targets. Read on for trade risks and liquidation zones.

What is driving AAVE’s recent bullish accumulation?

AAVE’s bullish accumulation is driven by significant whale withdrawals from exchanges and strategic buys by large traders that reduce circulating exchange supply. These moves, combined with leveraged long positioning in derivatives, increase upside pressure while concentrating short-term volatility risk.

How significant were the recent whale moves and smart buys?

One smart trader purchased 4,831 AAVE worth $1.58 million, while a whale withdrew 25,097 AAVE valued at $7.9 million. Over the past week the whale has withdrawn 167,451 AAVE worth roughly $53.65 million. These outflows tighten available supply on exchanges and support the bullish narrative.

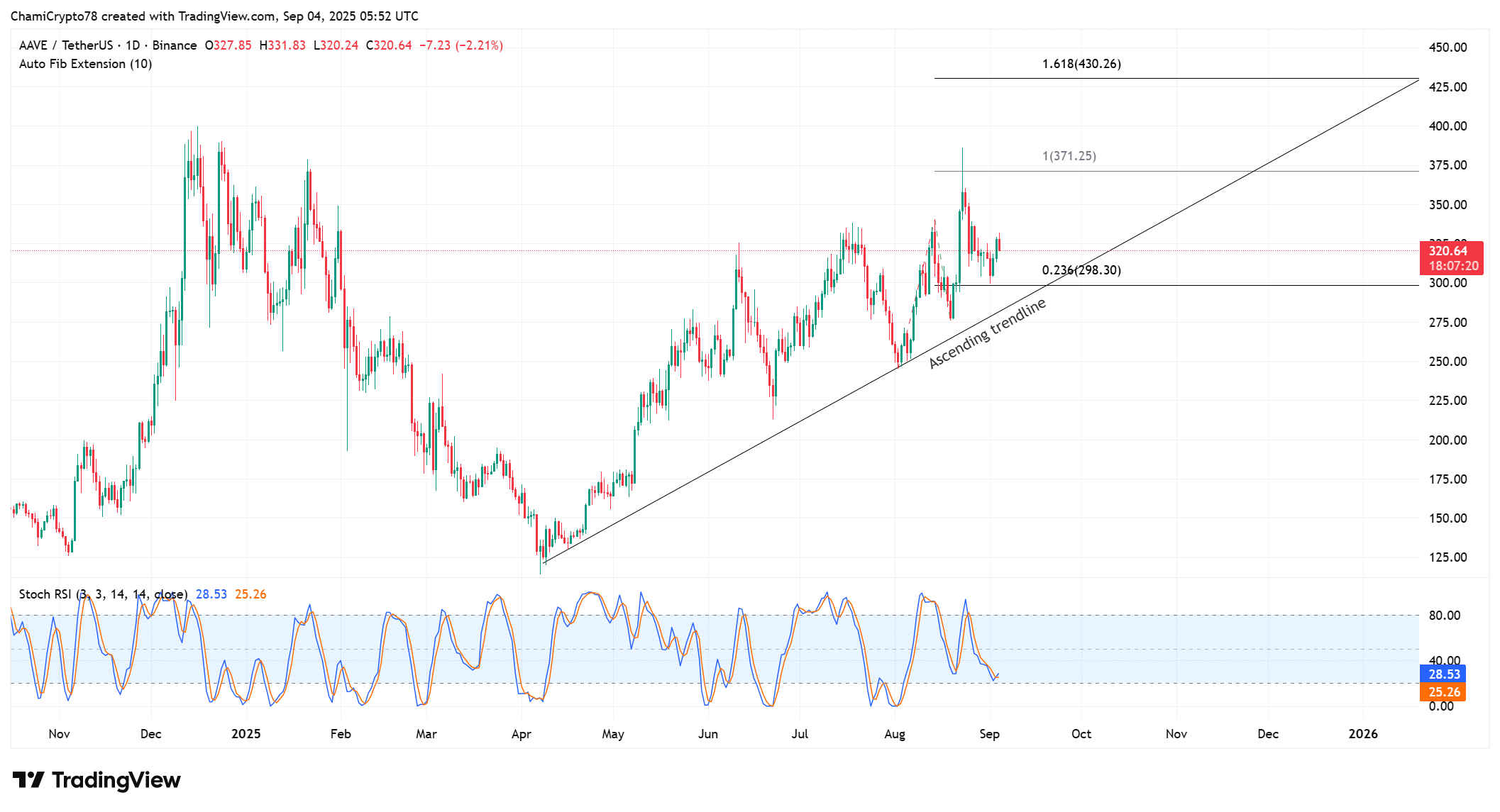

Is the ascending trendline preparing AAVE for a breakout?

Price action respects an ascending trendline active since April, with immediate support around the $298 Fibonacci level. The bullish case remains valid while this trendline holds.

Fibonacci extensions place first resistance at $371, with a 1.618 extension near $430 as a higher target. A clear break below $298 would invalidate the bullish setup and risk a deeper retracement.

Source: TradingView

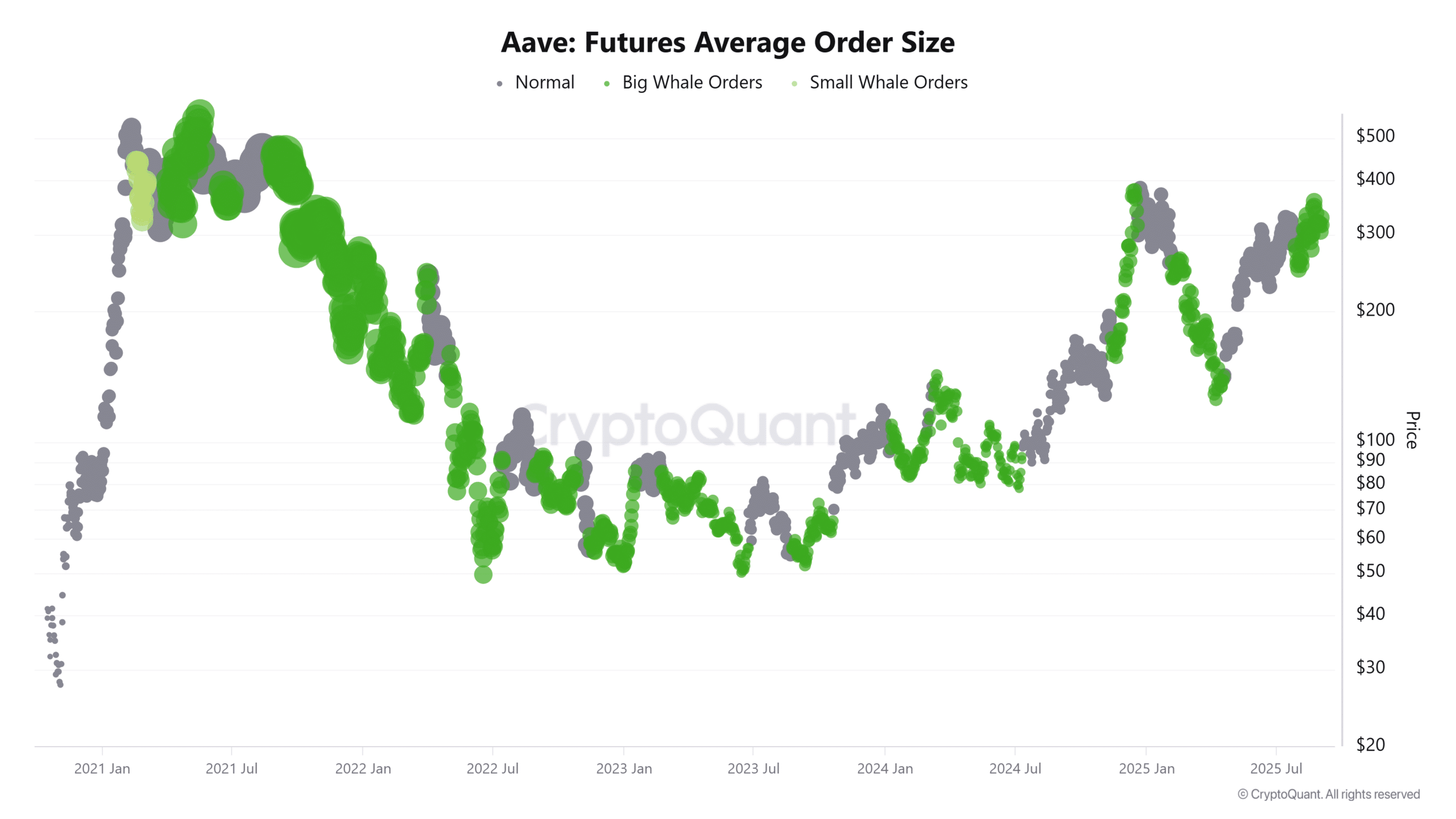

How are futures markets and whale order flow influencing direction?

Futures order flow shows outsized average order sizes, indicating large players are establishing substantial leveraged positions. This activity often precedes sharper directional moves due to liquidity impacts when whales enter or exit positions.

While such order flow amplifies the bullish case, it also raises the risk of rapid volatility if large positions are unwound.

Source: CryptoQuant

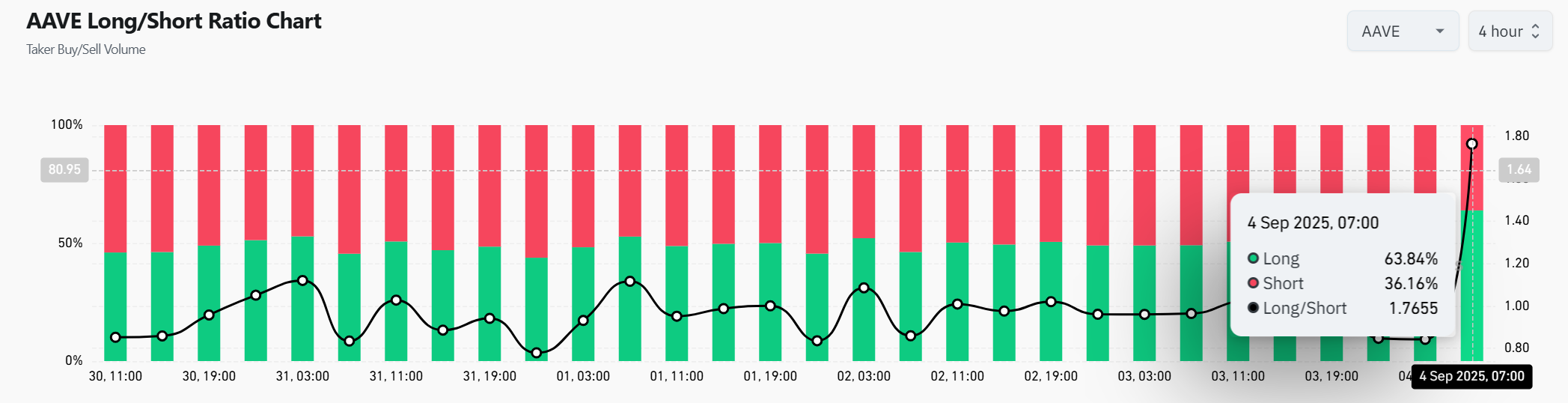

Why does the Long/Short Ratio favor bullish conviction?

The Long/Short Ratio climbed to 1.76, with longs at 63.84% and shorts at 36.16%, signaling trader conviction that AAVE may extend higher. This imbalance aligns with whale accumulation and levered long dominance, increasing the chance of sustained upward momentum.

Traders should remain cautious: concentrated long exposure can accelerate corrections if sentiment shifts suddenly.

Source: CoinGlass

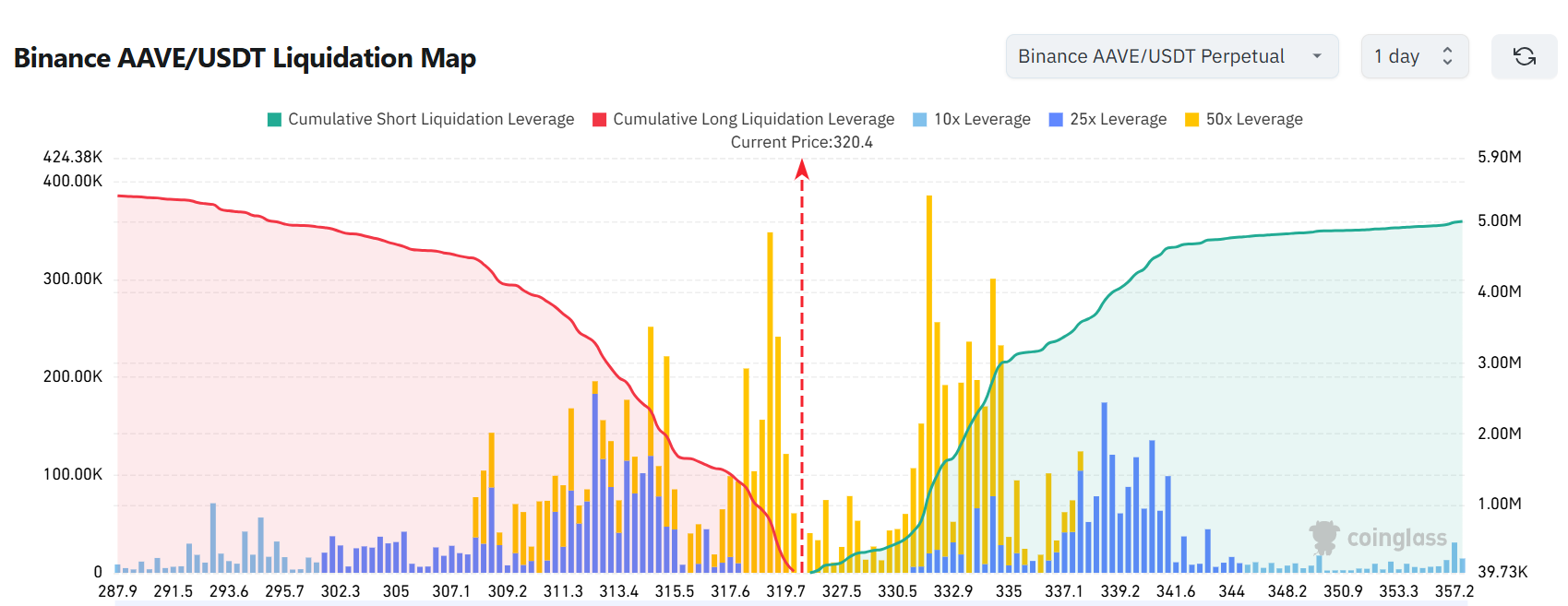

What do liquidation clusters reveal about short-term risk?

Liquidation heatmaps show concentrated risk between $317 and $335. A climb above $335 could squeeze shorts and accelerate upside, while a break below $317 risks a cascade of long liquidations and sharp downside pressure.

With whales positioned heavily and a leveraged long bias, the outcome in this narrow range is likely to determine the next major swing for AAVE.

Source: CoinGlass

Frequently Asked Questions

How likely is AAVE to reach $430?

Reaching $430 depends on the ascending trendline holding above $298 and a sustained push through $371 resistance. Whale accumulation and leveraged longs support this path, but traders must watch liquidation clusters and order flow for signs of exhaustion.

What levels should traders watch for risk management?

Key risk-management levels are $298 (trendline support), $317 (lower liquidation band) and $335 (upper liquidation band). A break below $298 suggests deeper retracement; a break above $335 could trigger short-covering momentum.

Key Takeaways

- Whale accumulation reduces supply: Large withdrawals and smart buys support upward pressure.

- Derivatives amplify direction: A 1.76 Long/Short Ratio and oversized futures orders favor bulls but increase volatility risk.

- Key levels to watch: $298 trendline support, $317–$335 liquidation band, targets at $371 and $430.

Conclusion

Short-term technicals, whale behavior, and leveraged long dominance combine to favor an AAVE price breakout scenario while emphasizing risk around liquidation clusters. Traders should prioritize $298 support and monitor order flow for confirmation before increasing exposure. COINOTAG will continue tracking on-chain flows and derivatives metrics for updates.