Bitcoin Slips Below $110K as Analysts Weigh Risk of Deeper Pullback

Bitcoin's (BTC) feeble bounce this week ran out of gas on Thursday, with prices slipping back below $110,000 and some market watchers warning of a deeper pullback.

The largest cryptocurrency fell 2.2% over 24 hours to $109,500, erasing half the gains it made from the weekend's low of $107,000 as it topped $112,600 on Wednesday. Ether (ETH), Solana's SOL (SOL) and Cardano's ADA (ADA) all fell more than 3% over the past 24 hours.

Digital asset treasury stocks also bled. The largest corporate BTC owner Strategy (MSTR) dropped 3.2% and is 30% down since July. Japan-based MetaPlanet (3355) lost 7% and trades 60% lower than its June high, while KindlyMD (NAKA) slid another 9% and is now down 75% since mid-August. Ether-focused vehicles BitMine (BMNR) and SharpLink Gaming (SBET) dropped 8%-9%.

How low BTC could fall?

Worries about further downside are growing louder, with some observers pointing to September historically being one of bitcoin’s and and the broader crypto market's weakest months.

At the same time, gold, the old-school safe haven and inflation hedge, broke out to fresh records above $3,500 following a multimonth consolidation, seemingly sucking capital from riskier plays.

A new report from Bitfinex noted that BTC has entered its third straight week of retracement from the August all-time high of $123,640. Historically, bull-market corrections averaged around 17% peak-to-trough, suggesting the market is nearing the typical limit of its drawdowns, the report said.

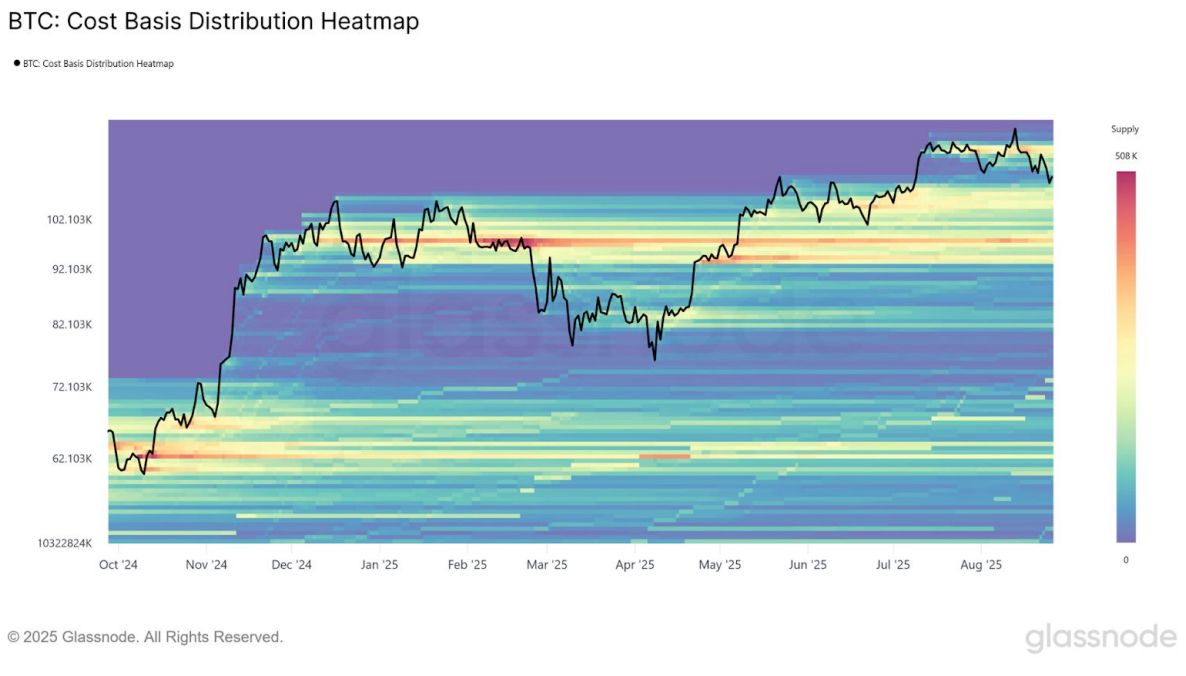

However, there's a risk of a deeper pullback, the analysts warned. The short-term holder realized price, a gauge of newer investors’ cost basis of buying BTC, currently sits near $108,900, less than 1% below BTC's current price. If that level fails as support, it could open the way to a deeper retracement, with a dense supply cluster between $93,000 and $95,000 likely providing a durable floor, the report said.

Joel Kruger, market strategist of LMAX Group, remains more optimistic.

September has usually been a month of consolidation ahead of stronger fourth-quarter performance, he said, adding that this year’s correction might be shallower if ETF inflows, corporate treasury allocations and regulatory tailwinds materialize.

Read more: Bitcoin Options Tilt Bearish Ahead of Friday's Expiry: Crypto Daybook Americas

UPDATE (Sept. 4, 16:00 UTC): Adds BTC supply cluster chart.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Hot Picks: The Fed Cuts Rates and Indirectly "Injects Liquidity"! Silver Replaces Gold as the New Favorite?

The Federal Reserve is cutting interest rates and starting bond purchases, while Japan and other regions may turn to rate hikes. Silver repeatedly hits record highs, SpaceX is set for a 1.5 trillion IPO, and Oracle becomes the litmus test for the AI bubble. The Russia-Ukraine peace process is stuck on territorial issues, the US seizes a Venezuelan oil tanker... What exciting market events did you miss this week?

Key Highlights to Watch at Solana Breakpoint 2025

How does Solana seize market share in an increasingly competitive landscape?

Crucial Alert: ZRO Leads This Week’s $100M+ Token Unlocks – What Investors Must Know

Revealed: Why Tether’s $1.1 Billion Juventus Acquisition Bid Was Rejected