BitMine strengthens treasury with purchase of US$65 million in ETH

- BitMine adds 14.665 ETH to its corporate treasury

- Largest corporate holder of ether now owns 1,75 million

- Ether surpasses Bitcoin with a rise of almost 20% in the month

BitMine Immersion Tech significantly expanded its Ethereum position this week, acquiring approximately $64,7 million worth of ETH through Galaxy Digital. The transaction was recorded in six on-chain transactions totaling 14.665 ETH, sent from the exchange's over-the-counter address.

Second data from Arkham Intelligence , the company already holds more than 1,75 million ether in its treasury, assets valued at approximately US$7,7 billion. This amount represents approximately 1,44% of the cryptocurrency's total supply, solidifying BitMine as the largest corporate holder of Ethereum in the world.

Although it hasn't officially announced any acquisitions since late August, on-chain records suggest the company is continuing to pursue its stated goal of reaching 5% of ETH's circulating supply. This strategy highlights the growing corporate appetite for the asset, at a time when institutional demand for Ether is showing signs of strengthening.

The move also occurs in parallel with other companies expanding their treasuries. SharpLink Gaming, the second-largest corporate holder of Ethereum, revealed this week the purchase of 39.008 ETH, bringing its total to 837.230 tokens. This brings the combined amount of ETH in publicly listed treasuries to 2,77 million units, according to market monitoring dashboards.

This corporate growth has directly influenced ether's performance compared to other crypto assets. While bitcoin has fallen 3% in the last 30 days, ETH's price has risen almost 20% in the same period. Analysts attribute the appreciation to increased institutional purchases, coupled with the expansion of financial products backed by the asset.

With this acquisition, BitMine not only strengthens its leadership among cryptocurrency treasury companies but also highlights the growing importance of Ethereum in global corporate portfolios. The trend of ETH concentration in large institutional players continues to shape the market and draw attention to the asset's role in the crypto ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges

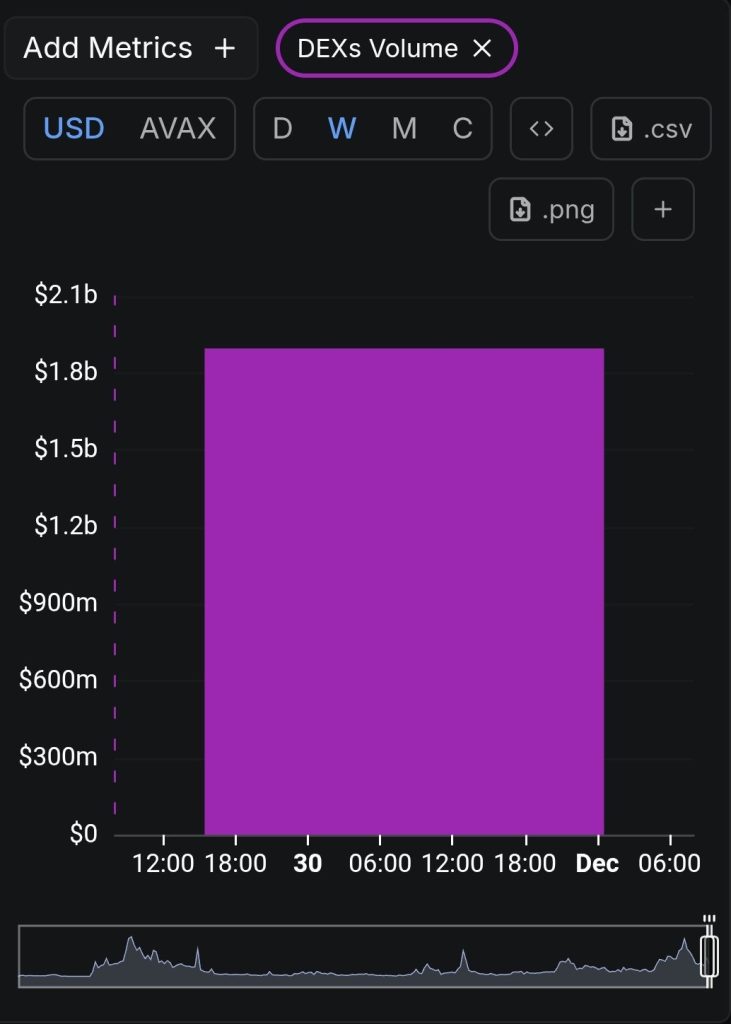

Avalanche (AVAX) Sees DEX Volume Surge as Price Rebounds From Key Support—Is a Major Breakout Near?

CZ Issues Market Warning as Crypto Exits Longest ‘Extreme Fear’ Streak