In the landscape of cryptocurrencies, Michael Saylor pioneered the concept of corporate reserves, becoming the first public company owner to adopt this strategy. In 2020, his initiative led to the accumulation of tens of billions of dollars worth of BTC reserves, significantly boosting his company’s profits and piquing the interest of others. As the scenario unfolded, popular altcoins like ETH, BNB , AVAX , SOL , and recently SUI Coin joined the list, officially marking the start of this reserve movement.

Establishing the SUI Coin Reserve

SUI Coin, one of the largest altcoins by market capitalization, has taken the essential step needed to stand out in a highly competitive environment. By announcing its reserve strategy, SUI Coin has elevated itself to the same league as Chainlink $23 , SOL, ETH, AVAX, BNB, and others.

The SUI Foundation, the body behind SUI Coin, has initiated the process with a public company. SUI Group Holdings Limited, the only publicly-traded company officially associated with the foundation, added 20 million SUI to its treasury just yesterday. The driving motivation behind such reserve formations for public companies is the potential for the increase in stock value that these reserves bring along.

Essentially, the company acquires SUI, which simultaneously inflates SUIG’s stock value, allowing it to issue more SUIG shares for cash and subsequently purchase more SUI Coins. This cycle, first successfully executed by Strategy, has served as an inspiration for numerous public companies now emphasizing crypto reserves.

The Future of SUI Coin

The reserve initiative is expected to bolster with the support of SUIG stocks on the NASDAQ, predicting a performance similar to MSTR. The escalating prices of cryptocurrencies, expanding reserves, rising stock prices, and increasing SUI Coin value will have a multiplying effect, accelerating this cycle.

Stephen Mackintosh, Chief Investment Officer of SUI Group, commented,

“Since initiating our SUI treasury strategy in late July, we’ve swiftly accumulated over 100 million SUI, underscoring our belief in the transformative potential of the SUI network and its crucial role in the future of decentralized finance.

We plan to continue pursuing capital raises to increase our SUI per share, enabling additional purchases of discounted locked SUI, thereby creating value for our shareholders.”

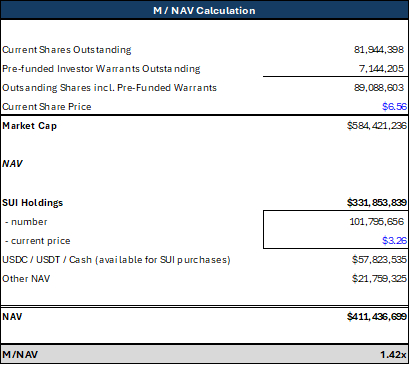

The company currently holds a total of 101.79 million SUI Coins, valued at approximately 332 million dollars. Each SUIG share equates to 1.14 SUI.