Key Market Insights for September 5th, how much did you miss out on?

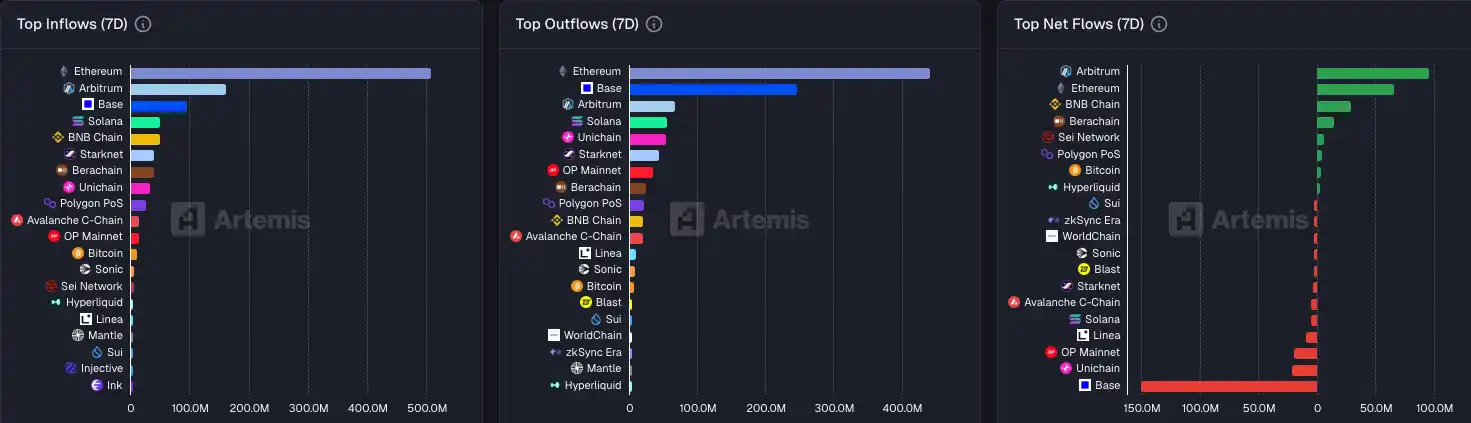

1. On-chain Funds: $162.7M flowed into Arbitrum this week; $246.6M flowed out of Base. 2. Largest Price Swings: $ASD, $AIAT 3. Top News: Hyperliquid's August revenue surpasses $1 billion, setting a new record.

Top News

1. Strategy Meets Profitability Level for S&P 500 Inclusion, Potential $16 Billion Liquidity Impact

2. Decentralized AI Project Awe (AWE) Now Listed on Coinbase

3. Ethereum Foundation Completes Partial Sell-Off, Retrieves 3.387 Million DAI from CEX

4. Justin Sun Transfers Unlocked $9 Million Worth of WLFI to HTX

5. James Wynn's "Pump Signal" Meme Coin with Only $157,000 Market Cap Surges Over 240%

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

WLFI

Today's discussions around WLFI largely focused on the controversy involving Justin Sun. World Liberty Financial (WLFI) blacklisted Sun's address after its token was allegedly manipulated. Sun was reportedly selling off WLFI using HTX exchange users' tokens to suppress WLFI's price. However, after the project froze his allocation, WLFI saw a significant increase in market value. This event sparked debates on Sun's ethics and credibility, with some users expressing doubts about the project's future.

HYPERLIQUID

Discussions about HYPERLIQUID today highlighted its strong presence and innovative features in the market. The platform's recent introduction of the HIP-3 upgrade, allowing users to create permissionless perpetual contracts, was seen as a significant innovation, earning Hyperliquid the nickname "AWS of Liquidity." Additionally, the platform's strong performance in revenue, buybacks, and market cap was noted, with $HYPE becoming the 17th largest digital asset. The community also focused on the potential of HyperEVM, with many believing it will play a key role in the overall ecosystem, despite some remaining skeptical. Meanwhile, attention was drawn to the platform's strategic buyback operations and its ability to attract institutional investors.

XRP

XRP has attracted significant attention today due to several key developments. One of the major highlights is Ripple expanding its RLUSD stablecoin into the African market and partnering with Chipper Cash, VALR, and Yellow Card. Additionally, the open interest for XRP futures contracts has reached $1 billion in a record time, and Bitwise has listed an XRP ETF on the primary Swiss stock exchange. At the same time, the XRP community is believed to have played a driving role in Ripple's victory in the SEC lawsuit. On the other hand, Coinbase has reduced its XRP holdings by 69%, sparking discussions about institutional fund outflows. These events have collectively propelled XRP to a prominent position in today's cryptocurrency discourse.

Featured Articles

1. "The Next Battle of Stablecoins: Titans of the Stablecoin Network"

In the second half of 2025, the stablecoin industry entered a new phase. In the past few years, companies like Tether and Circle have been core players in the stablecoin race, but their identities have always remained as issuers. The design and operation of the underlying networks have been entrusted to public chains like Ethereum, Tron, and Solana, and while the issuance scale of stablecoins has grown, users still have to rely on other systems for transactions. In recent months, this landscape has begun to change. Circle has launched Arc, Tether almost simultaneously released Plasma and Stable, and Stripe, in collaboration with Paradigm, introduced Tempo. Three stablecoin public chains focused on payments and clearing have emerged, indicating that issuers are no longer satisfied with just issuing coins; they want to control the network itself. Such concentrated actions are difficult to explain as mere coincidences.

2. "Today, Interviews Begin for 11 Federal Reserve Chair Candidates, How Will Trump Choose?"

In early September, the personnel and power structure around the Federal Reserve continued to evolve rapidly. On September 3, it was reported that the White House had made it clear that the next Federal Reserve chairperson would be finalized as soon as possible. Treasury Secretary Scott Bensett had initiated the interview process for 11 candidates and would begin a series of interviews this Friday, continuing for a week. Meanwhile, personnel and power moves around a "smooth transition" have continued to increase. On the one hand, Trump had previously dismissed the director of the Bureau of Labor Statistics (BLS), raising market concerns about the independence of official data. On the other hand, Federal Reserve Governor Adrienne Kugler submitted her resignation in early August, leaving a seat open for a new director. Stephen Miran, the former chairman of the White House Council of Economic Advisers (CEA), was nominated by Trump and attended a hearing before the Senate Banking Committee on September 4. In his written testimony, Miran emphasized "monetary policy independence," making the maintenance of independence the core expression in the confirmation process. With more and more actions unfolding, the market has been shrouded in fog, and the question of who will be the next Federal Reserve chairperson has become a focal point of market attention.

On-chain Data

On-chain Fund Flow for the Week of September 5

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes

Ethereum’s Layer‑2 Surge Signals Next ETH Price Rally—But a Key Hurdle Remains