One of the Buy Signals: Upgraded Iteration of the Buyback Method

Real revenue flows to holders, and the next step is to conduct buybacks more intelligently while maintaining transparency.

Real income flows to holders; the next step is to conduct buybacks more intelligently while maintaining transparency.

Written by: @0xINFRA

Translated by: AididiaoJP, Foresight News

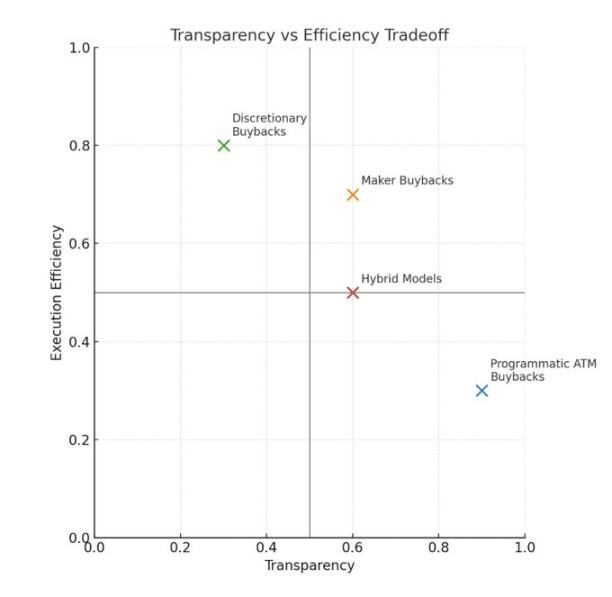

We are in the early stages of token value accrual. While programmatic market buybacks provide transparency and consistency signals, their reflexive nature leads to timing inefficiencies that are worth exploring through alternative execution methods.

Reflexivity Issues

When the market heats up, prices, activity, and fees rise in tandem, which drives programmatic buybacks to spend more funds during high-price periods. Conversely, when the market cools, activity and fees decrease together, reducing buyback spending during lower-price periods. This is a structural timing issue, causing buybacks to concentrate at market tops while lacking strength at market bottoms.

Reflexivity brought by TRUMP and net market buybacks driven by increased trading volume

Receiver vs. Provider: The Execution Issue

Most existing buyback plans purchase as receivers by accepting quotes from existing liquidity. This approach is simple and transparent but reduces market depth, causes high slippage, and may drive price movements during hot market periods. The execution process can be price-agnostic and unconcerned with trading volume.

Receiver buybacks remove liquidity from the market, create immediate price impact, and make purchases during activity peaks (when prices may be high). Protocol buybacks can be price-agnostic, but they should still value execution efficiency.

Provider buybacks offer an interesting alternative. Decentralized exchanges (DEXs) can conduct buybacks by providing liquidity rather than consuming it. This means adding liquidity in the form of buy orders, such as creating limit orders on order books or establishing one-sided concentrated liquidity market maker positions (a narrow range for a base asset, executed when the price enters that range).

Protocols can place buy orders at a fixed percentage below market price, based on income from the past 24 hours or 7 days, and adjust these orders to follow market changes. I believe this approach is especially effective when the buyback token is highly correlated with the capital used, for example: RAY/SOL, which is less volatile than RAY/USDC.

This method buys tokens directly from potential sellers while increasing liquidity depth, helping to mitigate downside volatility. For DEXs, provider buybacks accumulate tokens more efficiently while also improving the core product.

Smoothing Reflexive Curves

There are several ways to reduce the timing inefficiency in current models:

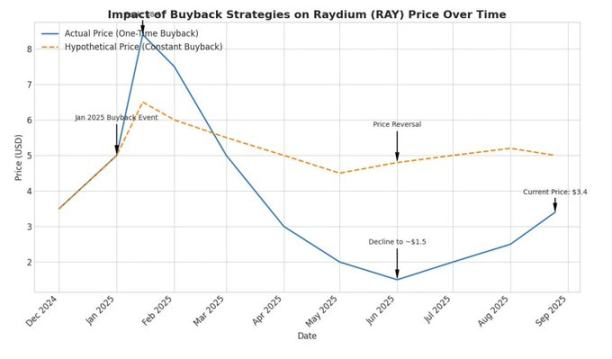

Time Smoothing: Use weekly income for buybacks and spread these buybacks over the following year. This creates independent buying pressure, unaffected by market conditions, and eliminates some reflexive factors. For example, Raydium allocated about $25 million for buybacks in January, which will be distributed at about $500,000 per week over the next year, offsetting some cyclical downturns caused by periods of reduced trading volume and income.

Value-Based Triggers: Protocols like @0xfluid are exploring dynamic allocation models. Their fully diluted valuation-based approach allocates a higher buyback percentage when tokens trade below certain valuation thresholds. Their time-weighted average price model triggers full buyback mode when the current price is below the 30-day average.

These models attempt to create counter-cyclical buying patterns, though they introduce complexity and may generate market signaling effects, potentially leading to perceived price ceilings.

Transparency Premium

The strongest argument for programmatic market buybacks is not efficiency, but transparency and consistency signals. A fixed percentage of protocol income is directly used for token buybacks, creating a clear and auditable value transfer. Token holders can calculate expected value accrual without relying on the discretionary decisions of centralized entities.

This transparency comes at a cost. Protocols give up optimal timing and execution in exchange for predictable, trustless value allocation. Regulatory considerations also favor programmatic approaches. Discretionary buybacks raise issues of information asymmetry, which systematic models avoid.

Signal and Substance

Buybacks serve a dual purpose: actual value return and consistency signaling. For many protocols, the signaling function may be more important than direct price impact, especially for smaller projects.

A $1 million monthly buyback plan will not alone drive the token price of a $500 million market cap protocol. But it demonstrates a concrete commitment to creating value for token holders using real protocol income. This is significantly different from pure speculation and extracting profits by lab entities.

Hypothetical example of time smoothing on market price

Mature Frameworks

We are witnessing the early stages of crypto protocols evolving toward traditional corporate financial principles, but with 24/7 global markets and powerful algorithmic execution capabilities that other industries may not be able to replicate.

Capital allocators are finally beginning to evaluate protocols based on fundamentals. We may be emerging from a "lemon market." We are at an early critical turning point, and the first strong teams committed to returning fundamental value to token holders should be commended. But as protocols like Raydium consider updating their models, it is very important to weigh the pros and cons of different approaches.

It is worth noting that hybrid approaches are possible. Raydium's treasury holds about $75 million in non-RAY assets, providing operational space and strategic flexibility for discretionary buybacks during market downturns. This balance sheet approach creates optionality beyond systematic buybacks. In fact, Raydium experimented with a discretionary provider buyback model in July, but there is still room for improvement, and the iteration process is ongoing.

Protocols should also weigh the opportunity cost of capital allocation against future growth needs. Holding a large amount of non-native treasury assets provides flexibility to optimize between systematic value return and strategic growth investments according to market conditions and opportunities.

Protocols experimenting with these capital allocation strategies—whether through provider execution, reflexivity smoothing, or hybrid systematic-discretionary buyback models—are building the playbook for mature tokenomics.

Looking Ahead

Real income now flows to holders, which is a clear improvement over previous cycles. The next step is to make purchases more intelligently while maintaining transparency and achieving disciplined execution.

Provider limit orders improve market depth, smoothing reduces timing risk, and clear reporting maintains trust. Each protocol will choose a combination that fits its product, users, and rules; as long as the policy is clear and auditable, this is acceptable.

The emerging standard is: prioritize provider methods wherever possible, smooth across time, and default to public reporting.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years