US Employment Data Strengthens Rate Cut Expectations, Spot Gold Surpasses $3,600 for the First Time

Jinse Finance reported that the latest US non-farm employment data is likely to be the decisive factor for the Federal Reserve to cut interest rates at its next meeting in two weeks. Gold prices continue to rise, with spot gold surging above $3,600 per ounce. Data released by the US Department of Labor on Friday showed that 22,000 new jobs were added in August, lower than economists' expectations of 75,000. Barbara Lambrecht, an analyst at Commerzbank Research, said: "Gold prices have finally broken through the upper limit of the trading range that has persisted for months." Concerns about the Federal Reserve's independence and increased geopolitical risks driving safe-haven demand have also contributed to this round of gains. After rising 27% in 2024, gold has soared more than 37% so far this year, mainly driven by a weaker dollar, central bank gold purchases, a looser monetary policy environment, and heightened geopolitical and economic uncertainty. Independent metals trader Tai Wong said: "Gold is hitting new highs, and bulls are watching for the clear trend of weakening employment to translate into multiple rate cuts. In the short and even medium term, concerns about the labor market outweigh concerns about inflation, and the outlook for gold is undoubtedly bullish. But unless there is a major market dislocation, I think gold prices are still far from $4,000."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Analysts: The Federal Reserve May Be Shifting Toward a Dovish Stance

Bloomberg Analyst: BTC May Fall Below $84,000 by Year-End, 'Santa Claus Rally' Unlikely to Occur

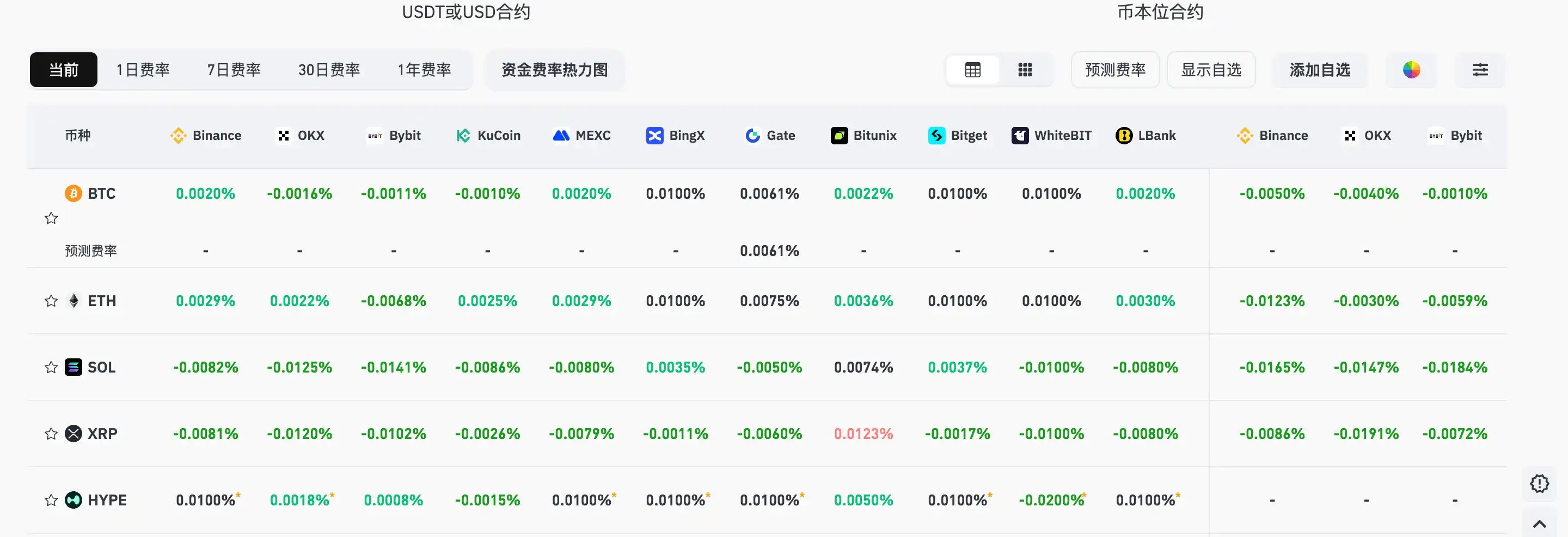

Current mainstream CEX and DEX funding rates indicate that the market remains broadly bearish.