SEC and CFTC Team Up For New Pro-Crypto Push

The SEC and CFTC are aligning on sweeping crypto reforms, from 24/7 trading to innovation exemptions, raising both opportunities and risks.

The SEC and CFTC are joining forces to launch a new series of Crypto Policy Roundtables on new areas of interest. Topics include prediction markets, 24/7 TradFi trading, “innovation exemptions” from law enforcement, and more.

Many of these changes would be quite sweeping, broadly aligning with Trump’s laissez-faire agenda towards crypto. Still, rapid radical restructuring could damage market confidence in unforeseen ways.

SEC and CFTC Unite

The SEC and CFTC have both been working to reform crypto regulations, and they’ve been making a lot of breakthroughs. Since the CFTC was reduced to one Commissioner, it’s been undertaking drastic actions to turbocharge the process. Now, the two agencies are joining forces:

“It is a new day at the SEC and the CFTC, and today we begin a long-awaited journey to provide markets the clarity they deserve. By working in lockstep, our two agencies can harness our nation’s unique regulatory structure into a source of strength for market participants, investors and all Americans,” the Commissions’ Chairs claimed in a joint statement.

In the short term, the SEC and CFTC are expanding the Crypto Policy Roundtables, which have been influencing federal Web3 policy for several months now.

The two Commissions declared a series of interest areas that these Roundtables will focus on, clearly stating their next policy goals.

Many of these areas share one common theme: a laissez-faire attitude and a reduction in crypto enforcement. For example, the statement called attention to prediction markets, hoping to make them available to the US “regardless of where the jurisdictional lines fall.” This aligns with the CFTC’s recent move to reduce enforcement on Polymarket.

A Wishlist of Radical Changes

The SEC and CFTC set several even more drastic goals. For example, they floated opening certain TradFi markets to crypto-style 24/7 trading instead of aligning with the US business day. They also plan to consider loosening restrictions on perpetuals contracts, portfolio margining, and more.

Most importantly, these agencies even proposed creating “innovation exemptions” for DeFi firms. This would allow Web3 companies to openly skirt existing financial regulations while constructing a new regulatory framework.

The last time the SEC and CFTC came together, they nearly permitted stock markets to offer tokens, so they have the power to accomplish this ambitious goal.

Still, let’s zoom out a little. So far, these Commissions are only making commitments to discuss policy in a series of Roundtables, but they’re proposing extremely radical shifts.

Commissioners from both the SEC and the CFTC have already heavily criticized this outright favoritism towards crypto. If anything, this trend is accelerating.

If this entire policy wishlist becomes a reality, it could be a gigantic investment opportunity, but it would also remove many critical guardrails.

These Commissions will have to be careful to balance Web3 growth and development with the needs of the entire financial ecosystem. Otherwise, damaged trust could cause big problems.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

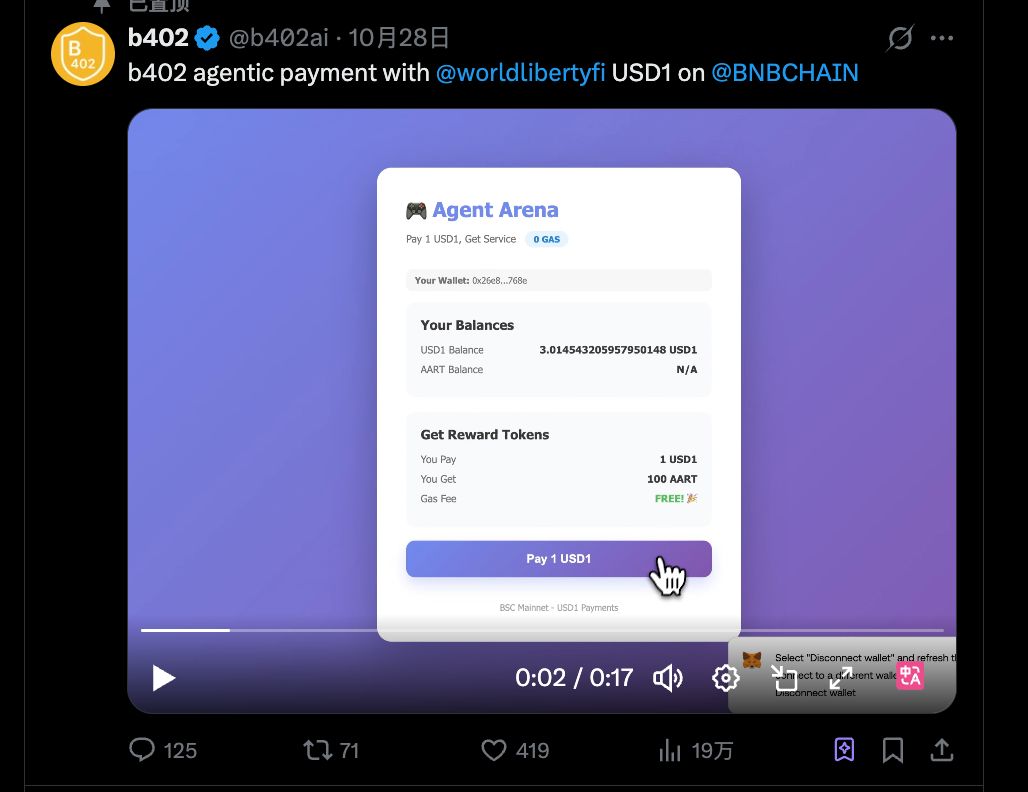

Interpretation of b402: From AI Payment Protocol to Service Marketplace, BNBChain's Infrastructure Ambitions

b402 is not just an alternative to x402 on BSC; it could be the starting point for a much bigger opportunity.

Shutdown Leaves Fed Without Key Data as Job Weakness Deepens

Institutional Investors Turn Their Backs on Bitcoin and Ethereum

Litecoin LTC Price Prediction 2025, 2026 – 2030: Can Litecoin Reach $1000 Dollars?