Key Notes

- Hyperliquid's USDH stablecoin proposal awaits on-chain validator voting approval, following the platform's standard governance process.

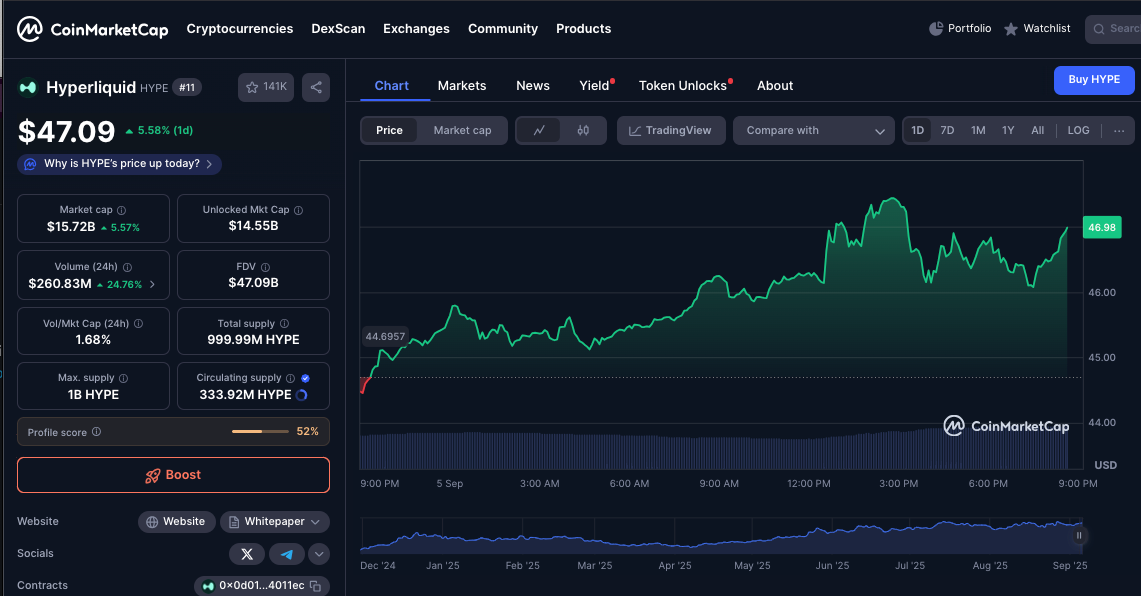

- HYPE token surged 3.4% to $47 following the announcement, demonstrating strong market confidence in the project's direction.

- Dual-token stablecoin architectures offer enhanced transparency by separating peg maintenance from yield generation mechanisms.

Prominent decentralized exchange Hyperliquid has unveiled plans to launch USDH, its proposed native dollar-pegged stablecoin, driving 3% intraday gains for HYPE.

The exchange confirmed via its official Discord channel that USDH’s proposal is now subject to validator vote before moving forward, similar to its asset delisting process.

HYPERLIQUID IS RELEASING $USDH

A Hyperliquid-first, Hyperliquid-aligned, and compliant USD stablecoin. pic.twitter.com/9oonRulXZD

— 800.HL (@degennQuant) September 5, 2025

Voting will take place directly on-chain at the first level, giving validators authority to approve the design and select the development team.

Hyperliquid Price Action on September 5, 2025 | Source: CoinMarketCap

Despite the buzz, USDH is not yet listed on Hyperliquid’s official site, leaving traders waiting for official confirmation. Still, the markets reacted positively as HYPE rose 3.4% on the daily chart, trading as high as $47 at press time, according to CoinMarketCap data .

Tether Co-founder’s Project Shows Decentralized Stablecoin Model

Since President Trump signed the Genius Act into law in July 2025, top players USDC and USDT have seen on-chain supplies hit new peaks, while attracting high-profile new entrants like Trump-backed WLFI’s USD1, and US Banking Giant JP Morgan, which also moved to launch their own stablecoin-like token , JPMD.

However, Hyperliquid’s proposal shows investors want decentralized stablecoins that do more than just peg to the dollar. The USTT, YLD, and STBL stablecoins founded by STBL, a decentralized stablecoin protocol chaired by Tether co-founder Reeve Collins, offer a working model for new dual-purpose tokens.

The future of finance isn’t just about tokenization. It's about building the infrastructure that makes it usable, trusted & accessible for all.

That’s the mission behind .

Very soon, we take another big step towards that vision.— Reeve Collins (@Reeve_Collins) September 5, 2025

A dual-token architecture offers real transparency. One token maintains the peg, another captures yield from the reserves. It’s transparent and gives users more control over risk and participation.

The model distributes yield tokens to users at mint, capturing returns from reserves like tokenized Treasuries and money market funds. Backed by overcollateralized assets and enabled by smart contract minting, the system removes intermediaries and delays.

Alongside the stablecoin news, Hyperliquid announced a major protocol update. Maker, taker, and user fees for dual-currency spot market pairs will fall by 80%. Public spot quotes will also become available, increasing transparency across the platform.

To activate these pairs, projects must lock a minimum amount of HYPE tokens. The exact collateral threshold and slashing rules will be disclosed in future updates.

next