Here’s how a weak jobs report could spell gains for crypto

The August jobs report is in, and depending on your perspective, it’s either worrying or the next big catalyst for crypto. While economists were expecting jobless claims of 230,000, the reality arrived at 237,000. Job openings also missed the mark, coming in at 7.18 million versus the projected 7.38 million.

Along with July’s figures, the August jobs report confirms softness in the labor market, which is bad news for the economy but could lead to the keenly-awaited rate cut the crypto industry has been waiting for.

Why a weak jobs report is good news for crypto

So how does a slowing job market translate into crypto optimism? The link lies in the Federal Reserve’s next move. Weaker employment stats put more pressure on the Fed to cut interest rates.

When rates go down, borrowing across the board gets cheaper (think home mortgages, business loans, and yes, margin for crypto traders). This monetary loosening encourages greater risk-taking, new investments, and asset speculation, all of which are rocket fuel for crypto prices.

Sometimes it’s easy to forget, but crypto is more “macro” than most people think. Bitcoin and its siblings thrive in “risk-on” environments when investors are less anxious about the cost of borrowing and put that cash into something volatile or speculative. As soon as rate cuts look likely, traders pivot out of safer assets like bonds and chase growth, tech, and, increasingly, digital assets.

According to CME Group’s FedWatch tool, the odds of a September rate cut now sit at 97.4% after the jobs report numbers dropped. As crypto markets newsletter The Milk Road put it:

“Jerome Powell might as well pack scissors for September’s FOMC meeting.”

The market is practically begging for easier money, and crypto loves it when money is easy.

Will this setup kick off Uptober?

Seasonality also has a role to play. For the uninitiated, “Uptober” is the crypto world’s nickname for October, when digital assets (traditionally led by Bitcoin) tend to rally. Why? Some of it is technical, some is psychology, but it’s become a self-fulfilling trend: analysts and traders expect prices to climb once summer’s sluggishness is out of the way. If you layer a likely rate cut over this historical uptrend, the argument for a bullish Q4 gets stronger.

Of course, it’s not all upside. Fed rate cuts can and do increase inflation. The idea is simple: cheaper credit means more spending; more spending, especially if supply chains remain tight, means higher prices. But the Fed’s balancing act means this tradeoff is sometimes considered worth it, especially if it keeps more people employed, even if the dollar is slightly weaker. As The Milk Road notes:

“That’s the balancing game the Fed is forever playing.”

Crypto investors are particularly sensitive to these shifts because inflation has both positive and negative effects on digital assets. On the one hand, inflation can erode trust in fiat currencies, pushing more investors toward Bitcoin’s hard limit of 21 million coins.

On the other hand, unchecked inflation can also lead to policy instability and market volatility, which is never a friendly environment for speculative investments.

With the August jobs report confirming a cooling labor market, the narrative is clear: the environment is risk-on and might just spell gains for crypto.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

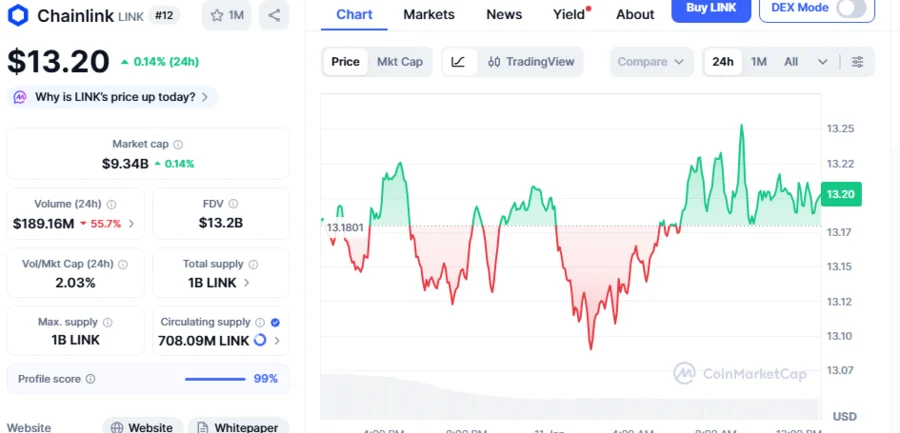

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026