Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?

With the injection of new liquidity, three cryptocurrencies could become the biggest winners this month.

The Federal Reserve's September meeting is becoming a pivotal moment for global markets. After months of fighting inflation, the Fed is now almost certain to cut rates following August's disappointing jobs report. Investors who once debated whether rates would remain unchanged now see a rate cut as inevitable—at least 25 basis points, with the possibility of a deeper 50 basis point cut. For crypto traders, this shift in monetary policy could ignite a spark in September, injecting new liquidity into bitcoin and altcoins at a critical time.

Fed's September Decision: Rate Cut Almost Certain

The Federal Reserve has been balancing two competing goals: controlling inflation and supporting employment. For most of this year, the focus has been on controlling inflation, keeping rates above normal levels. But August's jobs report changed the situation. Hiring fell far short of expectations, creating a new priority—protecting the labor market from further decline.

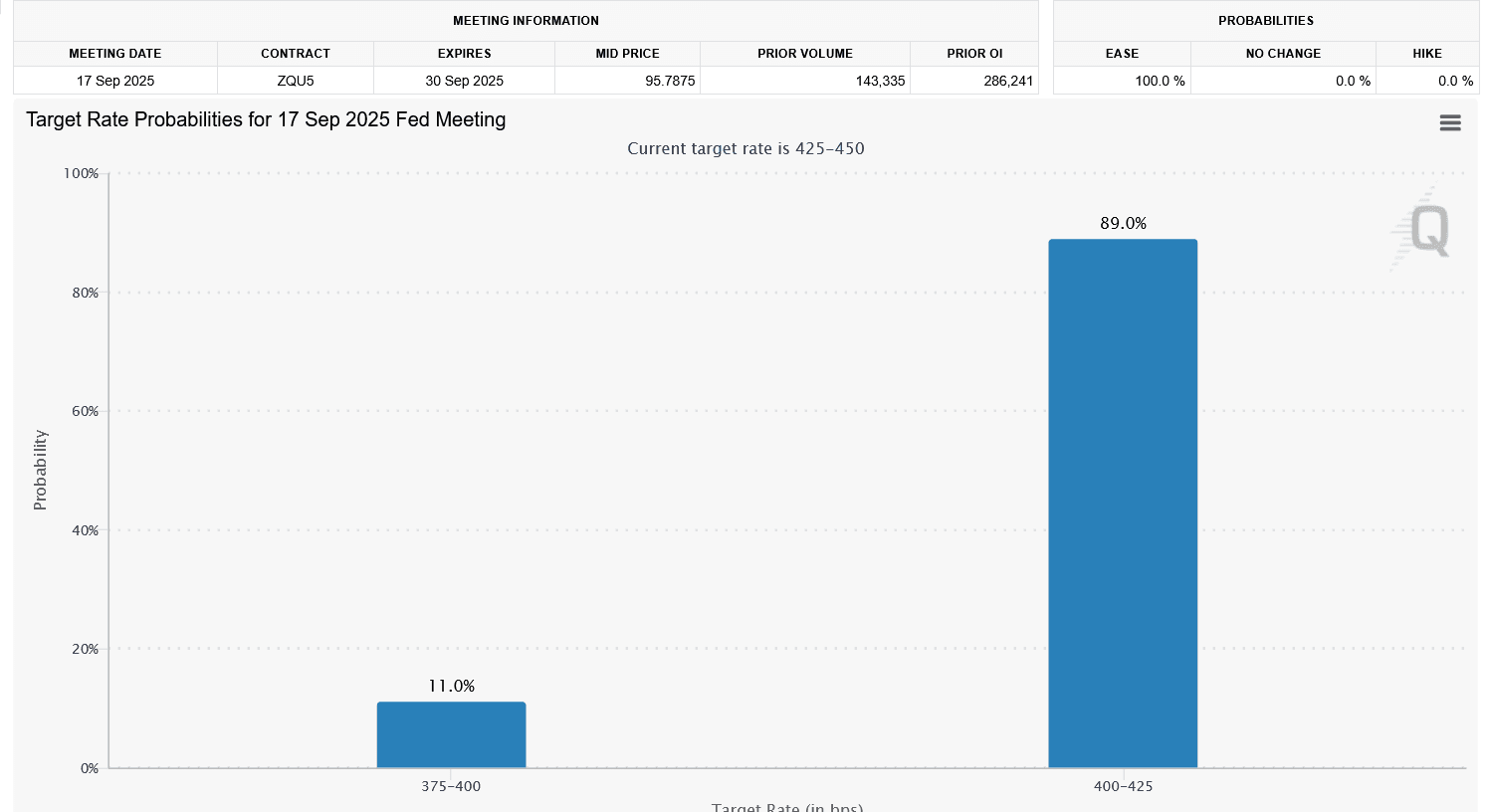

Now, the market almost universally believes a rate cut in September is a done deal. According to the CME FedWatch tool, there is a very high probability that the Fed will cut rates by at least 25 basis points, with a 14% chance of a larger 50 basis point cut. Just a week ago, investors were still debating whether the Fed would keep rates unchanged. That debate is now over.

Why Are Rate Cuts Important for Risk Assets?

Lowering interest rates predictably triggers a chain reaction in financial markets. When borrowing costs fall, investors tend to move funds from low-yield bonds to higher-return opportunities like stocks and cryptocurrencies. Liquidity injections also stimulate speculative demand, especially in volatile assets like bitcoin and altcoins.

This is why cryptocurrencies have historically performed well during periods of monetary easing. Cheap capital creates a risk-on appetite, and bitcoin's narrative as an inflation hedge and alternative asset often draws attention. Meanwhile, altcoins benefit even more, as traders seek higher returns once bitcoin rallies.

Market Context: Inflation and Employment

Tensions remain. Inflation is still above the Fed's 2% target, and tariffs introduced by President Trump could push consumer prices higher. This means the Fed is cutting rates not because inflation is under control, but out of concern for further deterioration in the job market.

This balance is important for crypto investors. If inflation re-accelerates after the rate cut, bitcoin may attract safe-haven interest as an alternative store of value. But if the rate cut successfully stabilizes growth without reigniting inflation, liquidity will drive a broader rally in risk assets, including Ethereum and mid-cap coins.

Which Three Coins Could Benefit Most in September?

Against this backdrop, here are three top coins likely to benefit:

1. Bitcoin (BTC)

BTC is likely to be the first beneficiary once the Fed confirms a rate cut. Historically, bitcoin has performed well under monetary easing, serving both as a hedge against policy risk and as a major liquidity magnet for institutional funds. The September meeting could be the catalyst for breaking current resistance levels, with BTC potentially retesting higher ranges within weeks.

2. Ethereum (ETH)

Ethereum will benefit not only from macro liquidity but also from renewed focus on smart contracts and the DeFi ecosystem. When borrowing costs fall in traditional finance, yield-seeking investors often rediscover Ethereum's DeFi protocols. ETH's recent network upgrades have also strengthened its long-term value, making it a strong second choice for a September rally.

3. Solana (SOL)

Solana benefits from the speculative cycle that follows rallies in bitcoin and Ethereum. Its ecosystem is expanding rapidly, especially in DeFi and NFT infrastructure. If liquidity returns to the market, $SOL's high beta characteristics make it more likely to achieve outsized percentage gains compared to $BTC and $ETH.

What This Really Means for September Trading

The Fed's mid-September decision is more than just a routine policy adjustment. It marks the possible beginning of a return to monetary easing. For crypto traders, this means preparing for a liquidity-driven rally.

The top-down view is simple:

- Rate cuts inject risk appetite.

- Bitcoin absorbs the first wave of capital inflows.

- Ethereum and Solana follow closely, offering higher returns as liquidity spreads through the market.

If inflationary pressures reappear, bitcoin's appeal as a store of value will be further enhanced. If inflation cools, altcoins will shine even more. In either case, September seems set to reward crypto investors who position themselves ahead of the Fed's move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

Ethereum treasury demand collapses: Will it delay ETH’s recovery to $4K?

Can BNB price retake $1K in December?

Trending news

More[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems

Bitcoin (BTC/USD) Price Alert: Bitcoin Breaks Major Resistance - Next Stop $100,000?

![[Bitpush Daily News Selection] Trump actively hints at Hassett as the next Federal Reserve Chairman; Bloomberg: Strategy may consider offering bitcoin lending services in the future; Strategy CEO: Strategy sets $1.4 billion reserve through stock sale to ease bitcoin selling pressure; Sony may launch a US dollar stablecoin for payments in gaming, anime, and other ecosystems](https://img.bgstatic.com/multiLang/image/social/44682a8c7537c9a9b467e17ed74a704d1764777241317.jpg)