A Review of Major Market Crashes in Crypto History

The cryptocurrency market often experiences low performance and high volatility in September. Historical crash data shows that the decline rate has gradually slowed, dropping from an early 99% to 50%-80%. Recovery periods vary depending on the type of crash, and there are significant differences between institutional and retail investor behavior. Summary generated by Mars AI. The content generated by the Mars AI model is still being iteratively updated for accuracy and completeness.

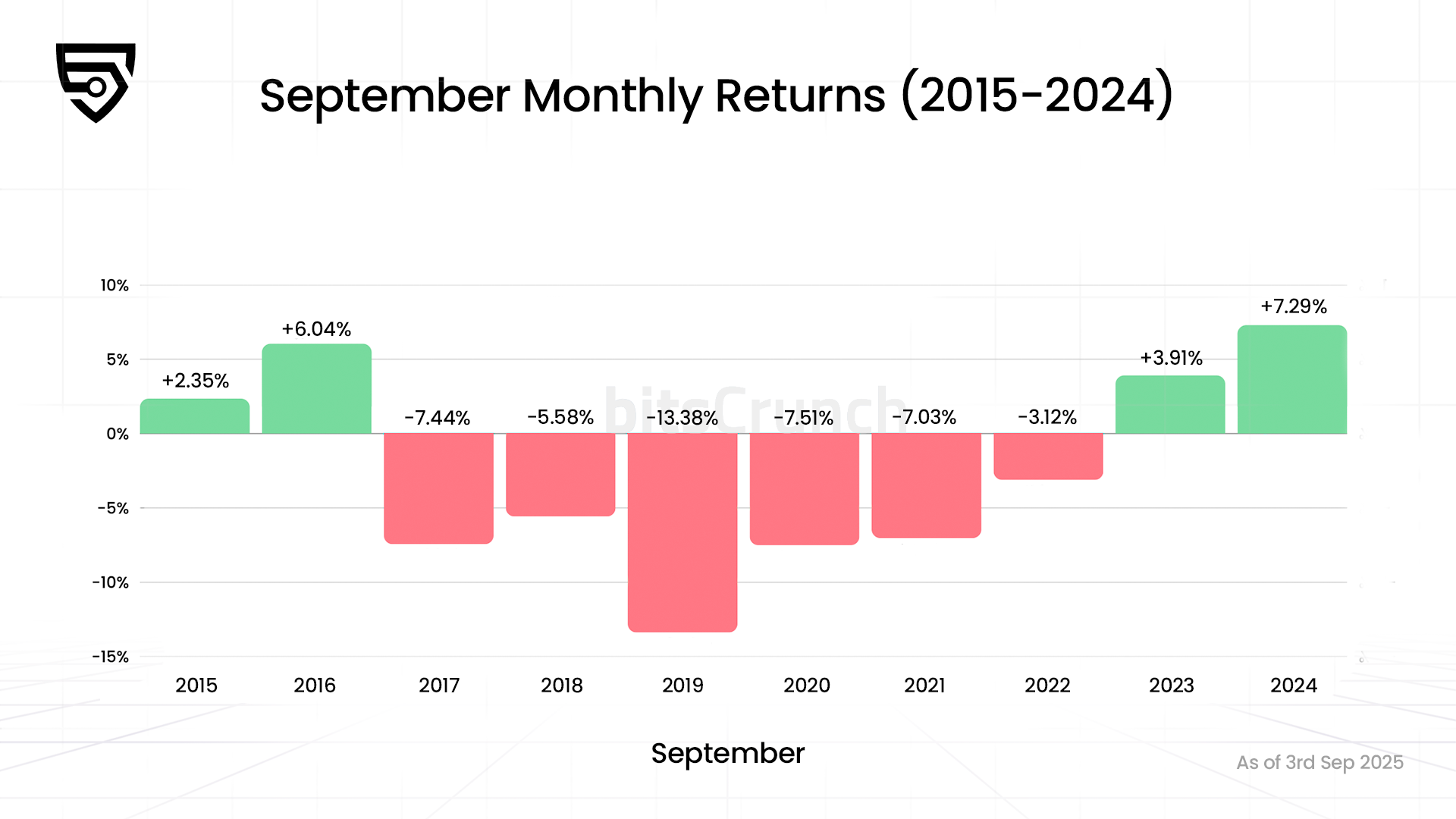

Entering September, the cryptocurrency market often ushers in a period of turbulence. Historical data from bitsCrunch shows that this month is typically marked by declining prices and increased volatility, making it a period that many investors approach with caution. However, seasonal adjustments are just a microcosm of the market’s dramatic swings—the truly heart-stopping moments are the market crashes that have occurred and may happen again.

Data source: bitsCrunch.com

By analyzing over 14 years of market data, crash patterns, and trading behaviors, we can glean insights into the history of cryptocurrency market crashes from the numbers.

The Evolution of Crypto Asset Crashes

Cryptocurrency crashes are by no means random events; rather, they are an inevitable part of the crypto ecosystem’s path to maturity. According to bitsCrunch data, the early market saw “devastating crashes” with drops as steep as 99%, but has now gradually transitioned to “relatively moderate corrections” of 50%-80%.

Bitcoin’s Unforgettable Plunges

The 2011 “Doomsday Crash” (99% Drop)

Bitcoin’s first major crash was nothing short of “tragic.” In June 2011, Bitcoin’s price reached $32—an astronomical figure at the time—only to plummet 99% to just $2. The world’s largest Bitcoin exchange at the time, Mt. Gox, suffered a security breach, directly causing Bitcoin’s price to briefly fall to $0.01 (though this price was largely the result of manipulation). Even so, the “psychological trauma” from that crash was real, and it took Bitcoin several years to regain market confidence.

The 2017-2018 Bubble Burst (84% Drop)

This was the most “iconic” of all cryptocurrency crashes: in December 2017, Bitcoin’s price soared to a high of $20,000, but by December 2018, it had dropped all the way to around $3,200. At the time, the ICO bubble had driven all asset prices to absurd highs, but “market gravity” inevitably arrived as expected.

The “cruelty” of this crash lay in its duration—unlike the early market’s “sharp drop and quick stop” pattern, this crash was more like a “slow-motion train wreck,” lasting over a year and wearing down even the most steadfast HODLers.

The 2020 COVID-19 “Black Thursday” (50% Drop)

March 12-13, 2020, is destined to go down in cryptocurrency history—during these two days, all asset prices simultaneously “lost control.” Bitcoin fell from about $8,000 to $4,000 in less than 48 hours. What made this crash unique was that it “crashed in sync” with traditional markets, but crypto assets then skyrocketed afterward.

The 2021-2022 “Crypto Winter” (77% Drop)

From Bitcoin’s peak of nearly $69,000 in November 2021 to its low of about $15,500 in November 2022, this crash was not driven by exchange hacks or regulatory panic, but by macroeconomic forces and institutional investor behavior triggering a wave of sell-offs. At that time, “institutional players” had officially entered the market, fundamentally changing the logic of market downturns.

Ethereum’s “Darkest Moments”

The 2016 DAO Hack (45% Drop)

On June 18, 2016, the newly established decentralized investment fund “DAO” was hacked, resulting in a loss of $50 million, and Ethereum’s price plunged over 45%. But the dollar loss alone does not capture the full picture: in May 2016, the DAO had raised $150 million worth of Ethereum through crowdfunding, and during the same period, Ethereum’s price climbed to a peak of about $20.

Digital Asset Bubbles and Bursts

Ethereum became the “core pillar” of several market booms—at the start of 2017, its price was less than $10, but by January 2018, it had soared above $1,400. However, when the market bubble burst, Ethereum was hit even harder than Bitcoin. At the end of 2021, Ethereum’s price gradually declined from its peak after the boom, and the downward trend continued into 2024.

Types of Market Crashes

Based on our analysis, we categorize cryptocurrency crashes as follows: “Extinction-level crashes” (drops over 80%), such as the crashes in 2011 and 2017-2018; “Major corrections” (drops of 50%-80%), such as during the COVID-19 pandemic and the bear market earlier this year; and “Routine fluctuations” (drops of 20%-50%).

The recovery patterns for different types of crashes also vary: extreme crashes require 3-4 years for full recovery, and after recovery, there is often an “overshoot” of 2.5-5 times; major corrections have a recovery cycle of 18-30 months.

During major crashes, liquidity doesn’t just decrease—it almost “vanishes into thin air.” Bid-ask spreads widen by 5-20 times during crashes, market depth drops by 60%-90% at peak stress, and trading volume surges by 300%-800% in the initial panic phase, even exceeding 1000% during the “investor capitulation” stage. This creates a vicious cycle: price drops lead to reduced liquidity, reduced liquidity amplifies price swings, and greater price swings further compress liquidity.

Can We Predict Crashes in Advance?

bitsCrunch data clearly reveals the behavioral differences of different types of investors during crashes. For retail investors, the correlation between price drops and panic selling is as high as 87%; they rely heavily on social media sentiment, and their “buy high, sell low” behavior is remarkably consistent.

Institutional investors, on the other hand, behave quite differently: 65% of institutions adopt a “counter-cyclical buying” strategy during crashes, and their risk management capabilities are stronger, but once they choose to sell, they can actually amplify the magnitude of the crash; at the same time, institutions are much more sensitive to macroeconomic factors than retail investors.

Social media sentiment can serve as an “early warning signal” for major crashes, reflecting market risk 2-3 weeks in advance; meanwhile, Google searches for “Bitcoin crash” are a “lagging indicator,” usually peaking only when the crash actually occurs. In addition, when the “Fear and Greed Index” falls below 20, the accuracy rate for predicting major market volatility can reach 70%.

One of the most notable changes in the dynamics of the cryptocurrency market is its increasing correlation with traditional markets during times of crisis. Crypto market volatility moves in sync with stock prices, while showing an inverse relationship with gold prices. Specifically, during crises, the correlation coefficient between Bitcoin and the S&P 500 Index is 0.65-0.85 (highly positive), with gold it is -0.30 to -0.50 (moderately negative), and with the VIX (Fear Index) it reaches 0.70-0.90 (extremely positive).

Therefore, we can identify a series of “early warning indicators”: declining network activity, the Fear and Greed Index, RSI (Relative Strength Index) divergence (which can provide 2-4 weeks of advance warning), widening credit spreads, and so on.

Conclusion

Cryptocurrency crashes are not random events—they have patterns, causality, and evolutionary trajectories. Although this market remains highly volatile, it is becoming more analyzable, predictable, and even, to some extent, controllable.

Understanding this is not about avoiding volatility, but about learning to coexist with it. Crashes will come again, but they will increasingly resemble storms rather than tsunamis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.