Fed Rate Cut in September: Which 3 Coins Could Explode?

The Federal Reserve’s September meeting is shaping up to be a pivotal moment for global markets. After months of holding firm against inflation, the Fed is now almost certain to cut interest rates following a dismal August jobs report. Investors who once debated whether rates would stay unchanged now see a rate cut as inevitable—25 basis points at minimum, with a chance of a deeper 50-point move. For crypto traders, this shift in monetary policy could be the spark that lights up September, driving fresh liquidity into Bitcoin and altcoins at a critical juncture.

Fed’s September Decision: Rate Cut Almost Certain

The Federal Reserve has been juggling two competing goals: controlling inflation and supporting employment. For most of the year, the focus leaned heavily on inflation control, keeping rates higher than normal. But the August jobs report flipped the script. Hiring came in much weaker than expected, creating a new priority—protecting the labor market from further decline.

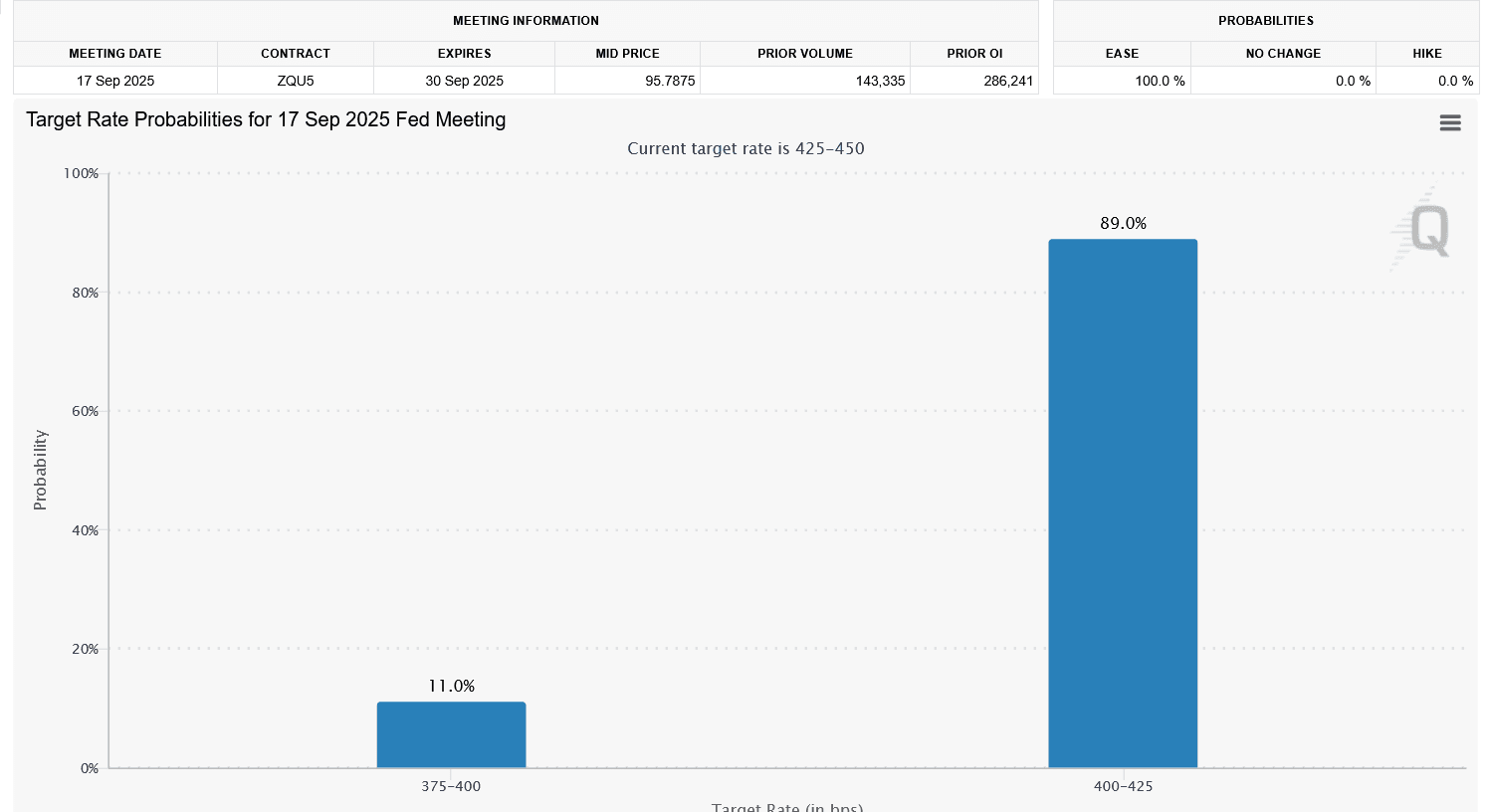

Now, markets view a September rate cut as almost a done deal. According to the CME FedWatch tool , there is overwhelming certainty the Fed will cut at least 25 basis points, with a 14% probability of a larger 50-point cut. Just a week ago, investors were debating whether the Fed might hold steady. That debate is over.

Why a Rate Cut Matters for Risk Assets?

Lower interest rates ripple across financial markets in predictable ways. When borrowing costs fall, investors tend to move money away from low-yield bonds and into higher-return opportunities like equities and cryptocurrencies. Liquidity injections also fuel speculative demand, especially in volatile assets such as Bitcoin and altcoins.

This is why crypto has historically thrived in dovish monetary cycles. Cheap money creates risk appetite, and Bitcoin’s narrative as a hedge against inflation plus an alternative asset often gains traction. Altcoins, meanwhile, benefit disproportionately because traders seek higher returns once Bitcoin rallies.

Market Context: Inflation vs. Jobs

There is still tension . Inflation remains above the Fed’s 2% target, and tariffs introduced by President Trump could add fuel to consumer prices. That means the Fed isn’t cutting because inflation is under control, but because it fears the job market weakening more dramatically.

This balancing act matters for crypto investors. If inflation reaccelerates after rate cuts, Bitcoin may attract safe-haven interest as an alternative store of value. But if the rate cuts manage to stabilize growth without reigniting inflation, liquidity will drive a broader rally across risk-on assets, including Ethereum and mid-cap coins.

Which 3 Coins Could Benefit Most in September?

Given this backdrop, here are the top 3 coins poised to benefit:

1. Bitcoin (BTC)

BTC will likely be the first mover once the Fed confirms its cut. Historically, Bitcoin thrives on monetary easing, both as a hedge against policy risk and as the primary liquidity magnet for institutional money. The September meeting could be the catalyst for a break above current resistance levels, with BTC potentially retesting higher ranges within weeks.

2. Ethereum (ETH)

Ethereum stands to gain not just from macro liquidity but also from renewed interest in smart contracts and DeFi ecosystems. With lower borrowing costs in traditional finance, yield-seeking investors often rediscover Ethereum’s DeFi protocols. ETH’s recent network upgrades also strengthen its long-term case, making it a strong second pick for September upside.

3. Solana (SOL)

Solana benefits from speculative cycles that follow Bitcoin and Ethereum rallies. Its ecosystem has been rapidly expanding, particularly in the areas of DeFi and NFT infrastructure. If liquidity returns to the market, $SOL high beta profile makes it a candidate for outsized percentage gains compared to $BTC and $ETH.

What This Really Means for September Trading

The Fed’s decision in mid-September is more than a routine policy adjustment. It signals the beginning of a potential shift back toward accommodative monetary policy. For crypto traders, this means preparing for a liquidity-driven rally.

The top-down view is straightforward:

- A rate cut injects risk appetite.

- Bitcoin absorbs the first wave of inflows.

- Ethereum and Solana follow, offering higher returns as liquidity spreads through the market.

If inflation pressures resurface, Bitcoin’s store-of-value appeal strengthens further. If inflation cools, altcoins shine brighter. Either way, September looks set to reward crypto investors positioning ahead of the Fed’s move.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After Pectra comes Fusaka: Ethereum takes the most crucial step towards "infinite scalability"

The Fusaka hard fork is a major Ethereum upgrade planned for 2025, focusing on scalability, security, and execution efficiency. It introduces nine core EIPs, including PeerDAS, to improve data availability and network performance. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.