Worldcoin Price Rallies Amid New Quantum Security Commitment

Worldcoin rallied on the launch of its quantum-secure APMC initiative, with inflows and accumulation signaling a potential breakout above $1.08

Worldcoin (WLD) price surged 16% in the past 24 hours, following the launch of its anonymized multi-party computation (APMC) initiative. The project includes contributions from Nethermind, the University of Erlangen-Nuremberg (FAU), and UC Berkeley’s Center for Responsible Decentralized Intelligence (RDI).

It also brings in the Korea Advanced Institute of Science and Technology (KAIST) and the University of Engineering and Technology in Peru (UTEC). The APMC launch is designed to strengthen Worldcoin’s quantum-secure technology, adding momentum to the cryptocurrency’s growth.

Worldcoin Holders Remain Bullish

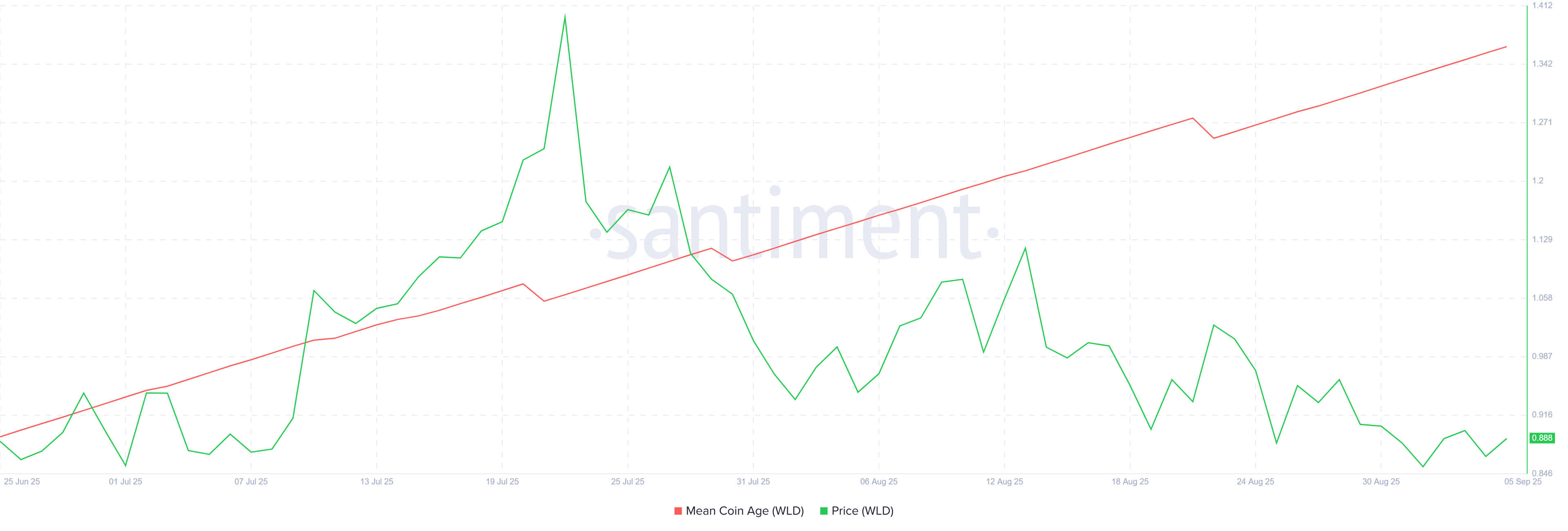

Long-term holders (LTHs) are showing renewed conviction, with data from the MCA highlighting a clear preference for accumulation over selling. This behavior reflects increasing confidence in WLD’s future, particularly as major institutions endorse its security-focused developments.

The steady incline in the MCA suggests that committed holders are not only preserving but also expanding their stakes. Such behavior strengthens the foundation for WLD’s current recovery.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

WLD MCA. Source:

WLD MCA. Source:

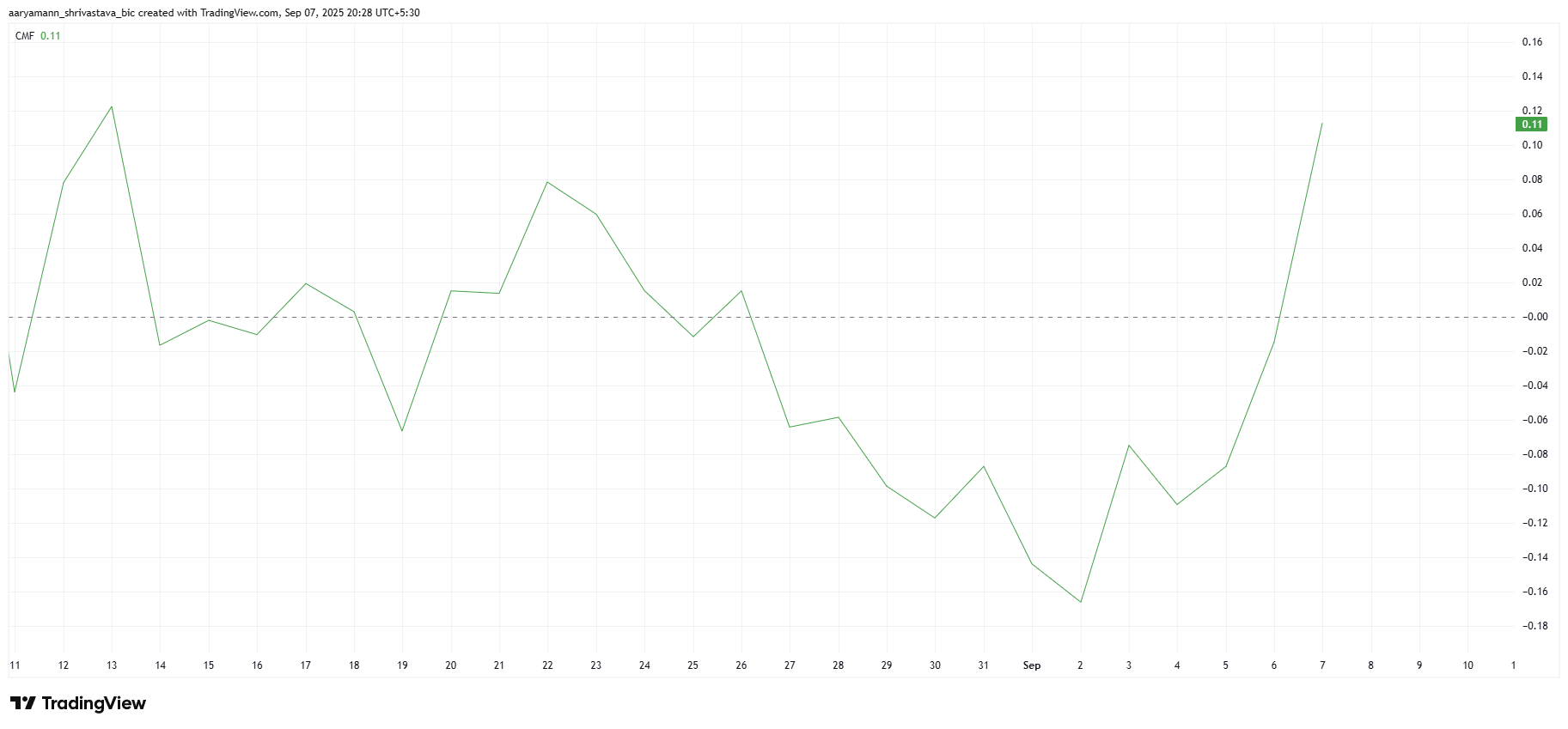

On-chain activity also supports Worldcoin’s broader momentum. The Chaikin Money Flow (CMF) indicator has recorded a sharp uptick in recent sessions, pointing to strong inflows into the cryptocurrency. A positive CMF signals sustained demand that could extend the rally.

The timing coincides directly with the APMC announcement, which appears to have catalyzed buying interest. By pushing the CMF well above the zero line, the development confirms a bullish stance for WLD in the near term.

WLD CMF. Source:

WLD CMF. Source:

WLD Price Can Continue Rising

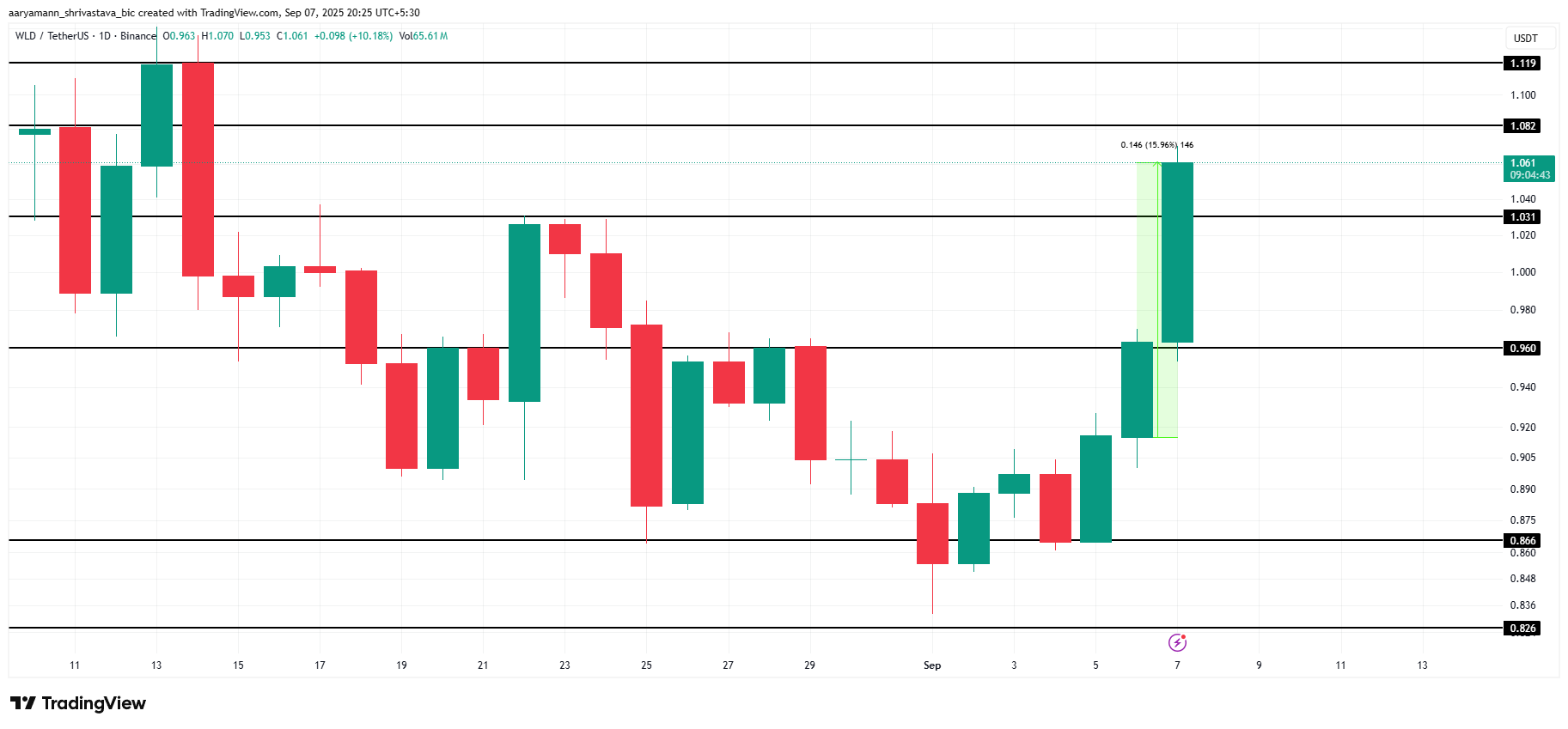

WLD climbed by nearly 16% over the last 24 hours, emerging as one of the best-performing altcoins. The altcoin is changing hands at $1.06, with $1.08 acting as a key barrier that may shape its immediate price direction.

The factors mentioned above suggest that WLD could note a successful breakout above $1.08, pushing it toward $1.11, marking a monthly high. This would likely boost investor sentiment and potentially draw further capital into the asset.

WLD Price Analysis. Source:

WLD Price Analysis. Source:

On the other hand, profit-taking could reverse the recent rally. If selling pressure builds, WLD may retreat to $1.03 or lower to $0.96, wiping its recent gains and invalidating the bullish thesis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.