Bitcoin May Need an 8% Dip to $101,000 Before a New All-Time High, History Suggests

Bitcoin is steady above $110,000, but historical trends suggest a dip to $101,634 may be necessary to trigger its next all-time high breakout.

Bitcoin’s price is recovering from a recent dip that briefly tested investor conviction. Trading above key support, the crypto king continues to reinforce its long-term uptrend.

However, historical trends suggest that BTC may first need a slight correction before pushing toward a new all-time high (ATH).

Bitcoin Needs to Fall In Order To Rise

Bitcoin’s path to a new record might require an 8.7% decline in the coming days. The $101,634 level holds the 38.2% Fibonacci Retracement line, which has historically served as a launch point. Each bounce from this Fib level in prior rallies triggered a rapid surge in BTC’s value.

A similar setup could be forming now. If Bitcoin retraces to this crucial level, it may provide the base for the next strong rally. Historically, such moves have helped reset market momentum and also built the foundation for sustainable growth, potentially leading BTC beyond its current highs.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin Historical Support Level. Source:

Bitcoin Historical Support Level. Source: TradingView

Bitcoin Historical Support Level. Source:

Bitcoin Historical Support Level. Source: TradingView

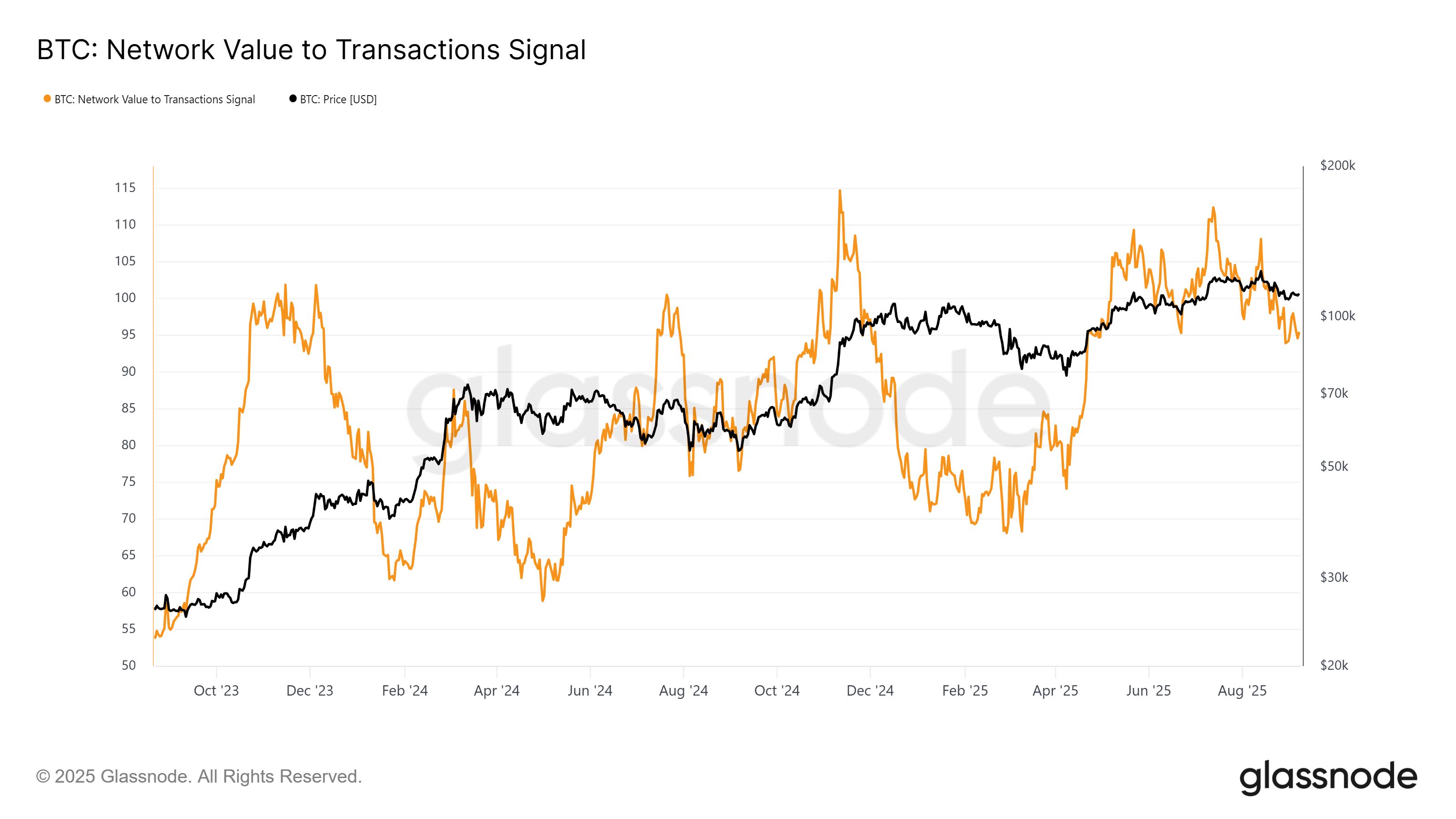

The broader momentum signals caution. The Network Value to Transactions (NVT) ratio, often used to assess whether Bitcoin is overvalued relative to on-chain activity, has been declining. Typically, an uptick in NVT coincides with overheated conditions and precedes a price drop. Instead, the indicator’s cool-off suggests subdued activity.

This cooling market dynamic reduces the likelihood of an immediate sharp decline, making it harder for BTC to touch the Fibonacci retracement level. Without such a dip, the historical playbook may not unfold as expected, potentially delaying Bitcoin’s move toward a new ATH.

Bitcoin NVT Signal. Source:

Bitcoin NVT Signal. Source: Glassnode

Bitcoin NVT Signal. Source:

Bitcoin NVT Signal. Source: Glassnode

BTC Price May Continue Its Rise

At the time of writing, Bitcoin trades at $111,340, holding firm above the $110,000 support. This resilience reinforces the four-month uptrend line and signals potential short-term gains. The momentum is intact, with BTC eyeing higher levels.

If sustained, Bitcoin could climb past $112,500 and head toward $115,000. Yet to reach a new ATH, history suggests BTC might need to drop to $101,634 first, setting the stage for a stronger breakout.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source: TradingView

On the flip side, if profit-taking escalates, BTC could slip toward the retracement level sooner. However, should fear-driven selling dominate, the price risks falling below $100,000, which would invalidate the bullish outlook and extend the correction phase.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025