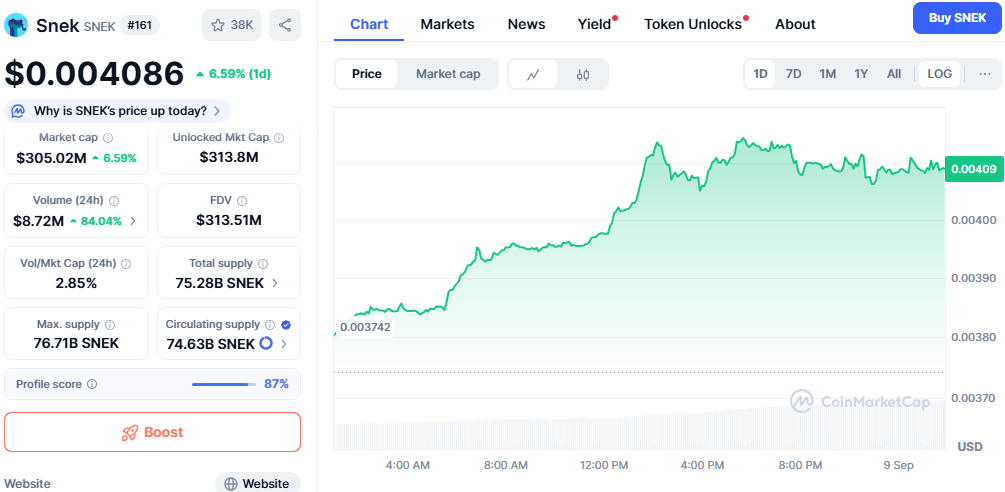

- Snek pushes higher with a 6.59% daily gain, showing steady growth and stability near the $0.0040 support level.

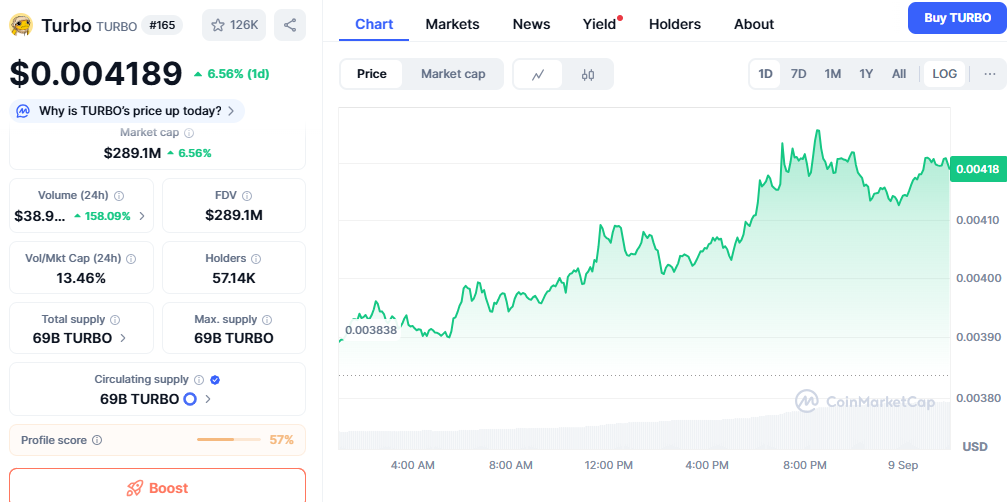

- Turbo surges on volume, posting a 158% spike in trading activity that fueled breakout moves near the $0.00420 resistance zone.

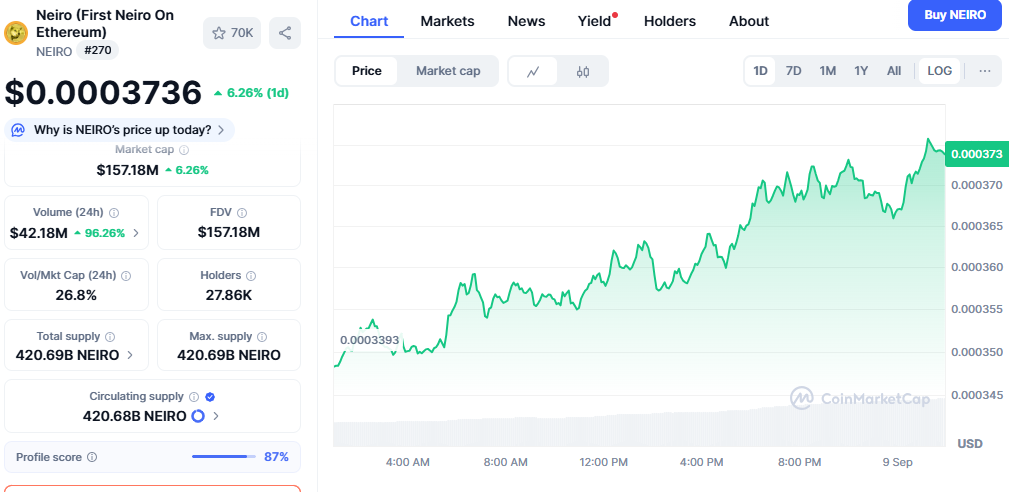

- Neiro strengthens liquidity, recording a 96% jump in volume and achieving one of the highest activity ratios in the market.

Altcoins gained renewed strength in daily trading as Snek, Turbo, and Neiro posted notable price increases with rising volumes. All tokens recorded a good upward trend that was backed by inflows of liquidity and community engagement. The session also showed that they have the potential of short-term profits and emphasized the aspect of resilience in the uncertain market conditions.

Snek (SNEK) Posts Steady Gains

Snek closed at 0.004086 after rising 6.59 per cent in the day, which raised its market capital to 305 million. The volume of the trade rose dramatically by 84 percent to $8.72 million as a new interest and active participation emerged short-term. Its fully diluted valuation reached $313.5 million, with 74.63 billion tokens circulating from a 76.71 billion supply cap.

Source: Coinmarketcap

Price action showed consistent upward momentum as Snek held above the $0.0040 support area. The token’s volume-to-market cap ratio of 2.85% suggested moderate liquidity compared to larger-cap competitors. Stability was aided by limited inflationary pressure to the point of near-maximum supply, which ensured more predictability in the market outlook.

The opposition was established at $0.00415 to 0.00420 range of resistance and at $0.0039 level of support. The token might be pushed to new heights when there is sustained momentum. However, if volume eases, consolidation may follow before another directional move occurs.

Turbo (TURBO) Extends Breakout Moves

Turbo closed the day at $0.004189, up 6.56%, raising its market cap to $289.1 million. Daily trading volume surged to $38.9 million, a 158% jump that confirmed strong buying activity. Circulating supply stood at 69 billion, showing that the full supply was already unlocked.

Source: Coinmarketcap

Charts reflected breakout moves as Turbo tested resistance near the $0.00420 level. A high volume-to-market cap ratio of 13.46% highlighted strong liquidity and short-term volatility. Its active community of more than 57,000 holders added consistent traction to daily performance.

Resistance held around $0.00420 to $0.00425, while support formed near $0.0040. Momentum-driven growth could push higher ranges, though retracement risk remains. Continued strong liquidity will decide whether upside targets hold in the near term.

Neiro (NEIRO) Shows Rising Liquidity

Neiro traded at $0.0003736 after rising 6.26% in a single day. Its market cap reached $157.18 million, supported by $42.18 million in daily volume. This marked a 96% increase, underscoring a surge in active participation.

Source: Coinmarketcap

The price trajectory displayed consistent upward growth through the session. A high volume-to-market cap ratio of 26.8% confirmed robust liquidity and increased speculative positioning. Holder numbers reached 27,860, showing steady community expansion.

Immediate resistance emerged near $0.000375 to $0.00038, while support held at $0.00036. Sustaining trade above support could enable further advances. Strong liquidity trends suggest Neiro has potential to extend momentum in the short term.