ON Semiconductor ( ON -0.46%) specializes in making chips for the automotive and industrial industries—both of which have faced recent challenges. Given this backdrop, the stock's 24% drop in value recently makes sense from a short-term market perspective.

But looking further ahead, there are strong arguments for considering this a prime opportunity to invest in ON Semiconductor (also called Onsemi). The industries it serves are expected to recover with time, and the company's leadership is actively positioning ON for both immediate efficiency and future expansion.

All in all, ON Semiconductor stands out as an appealing choice for investors who are willing to wait for long-term gains.

Image credit: Getty Images.

Onsemi: A growth opportunity at value pricing

Just as it's wise to purchase value stocks that have promising growth ahead, it's equally smart to consider growth companies when they're trading at attractive valuations. But don't just take this assessment at face value—Wall Street projections see ON Semiconductor earning $2.29 per share, which puts its stock at just a little over 21 times estimated 2025 earnings. While this ratio could seem steep, analysts believe 2025 will be a low point, with profits anticipated to rise by 29% in 2026.

On top of that, ON Semiconductor is a strong generator of cash. CFO Thad Trent recently shared, "So far this year, our free cash flow equals 19% of revenue, and we’re on pace to achieve a 25% free cash flow margin for the whole year." If consensus estimates hold and the company brings in nearly $6 billion in revenue in 2025, that would mean close to $1.5 billion in free cash flow (FCF).

With a current market value of $19.5 billion, ON is trading at only 13 times its projected 2025 free cash flow, even as that year is expected to be a cyclical trough for the business.

What's behind the low share price?

The main reason for the discounted valuation is the recent weakness in its key markets. The leadership team has intentionally concentrated on intelligent power and sensing technologies for automotive—especially electric vehicles—and industrial segments.

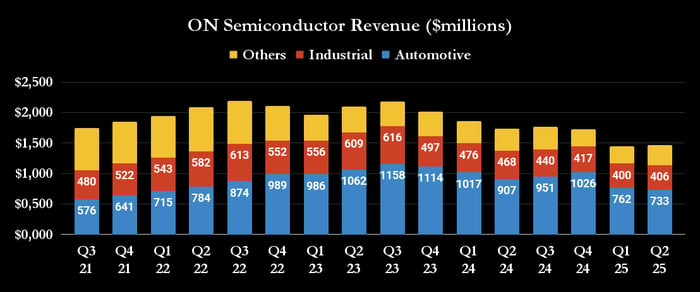

However, as the chart below reveals, these sectors have seen notable slowdowns during the last couple of years. The reasons include a pullback in EV investments—which many carmakers accelerated during pandemic lockdowns—and sluggish performance in the broader industrial sector.

Data provided by ON Semiconductor. Chart created by the author.

With borrowing costs still elevated, making car purchases more expensive, and with federal EV tax credits set to expire at the end of September, a sharp rebound in electric vehicle investment may not happen right away. Additionally, the Institute for Supply Management reports that U.S. manufacturing has shrunk for six consecutive months as of August.

So what makes the stock attractive now? There are three main reasons.

Signs of a turnaround

CEO Hassane El-Khoury recently pointed out on an earnings call, "We are noticing stabilization across our target markets." This is supported by steady gains in its industrial sales—helped in part by a twofold increase in revenue from AI data center applications. As mentioned before, Onsemi's collaboration with Nvidia to develop next-generation data centers seems underappreciated by the market.

El-Khoury also expects automotive revenue to grow sequentially in the third quarter, and first-quarter results appear to have marked the cycle’s bottom.

Ongoing measures to reinforce the company

The leadership continues to take decisive steps to bolster ON's long-term prospects, though some of these moves are making short-term results seem weaker. For instance, the company continues to streamline by divesting non-core operations—so about 5% of 2025 revenue will not recur in 2026.

Although this segment of revenue is not expected to have high margins over the long haul, management noted that losing it is currently dilutive to margins. This is because products like silicon carbide chips—primarily for EVs—are presently low margin, mainly due to weak demand leading to underused capacity. This suggests that as the EV market eventually recovers, ON Semiconductor’s profitability should improve significantly.

Image credit: Getty Images.

Promising long-term industry trends

Lastly, ON Semiconductor is positioned in markets that are set to benefit from powerful long-term trends, such as the shift to cleaner energy (including electric vehicles, charging stations, and automation), as well as the rise of smart factories and buildings. Its rapidly expanding AI data center segment is also driving meaningful growth.

While there’s a possibility of continued short-term headwinds, the stock’s current valuation and its growth outlook make it an attractive pick for investors focused on the future.