U.S. employment data significantly revised downward: 911,000 fewer jobs added through March

Jinse Finance reported that the U.S. government stated on Tuesday that in the 12 months ending this March, the number of new jobs added to the U.S. economy may be 911,000 less than previously estimated. This indicates that signs of stagnation in job growth had already appeared before Trump implemented tough tariffs on imported goods. Economists had previously expected that the Bureau of Labor Statistics (BLS), under the U.S. Department of Labor, might revise down employment levels from April 2024 to March 2025 by 400,000 to 1 million jobs. Previously, employment levels from April 2023 to March 2024 had already been revised down by 598,000 jobs. This benchmark revision follows another announcement made last Friday—that job growth in August was nearly stagnant, and June saw the first decrease in jobs in four and a half years. In addition to being dragged down by uncertainty in trade policy, the labor market is also under pressure from the White House's tightening of immigration policies, which has weakened the supply of labor. At the same time, companies are turning to artificial intelligence tools and automation, which is also suppressing demand for labor. Economists believe that the downward revision of job growth data has little impact on monetary policy. The Federal Reserve is expected to resume interest rate cuts next Wednesday, after pausing its easing cycle in January due to uncertainty caused by tariffs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: Stablecoin circulating market cap returns to $305 billions, with a cumulative increase of 0.8% recently

S&P 500 index futures rise 0.2%

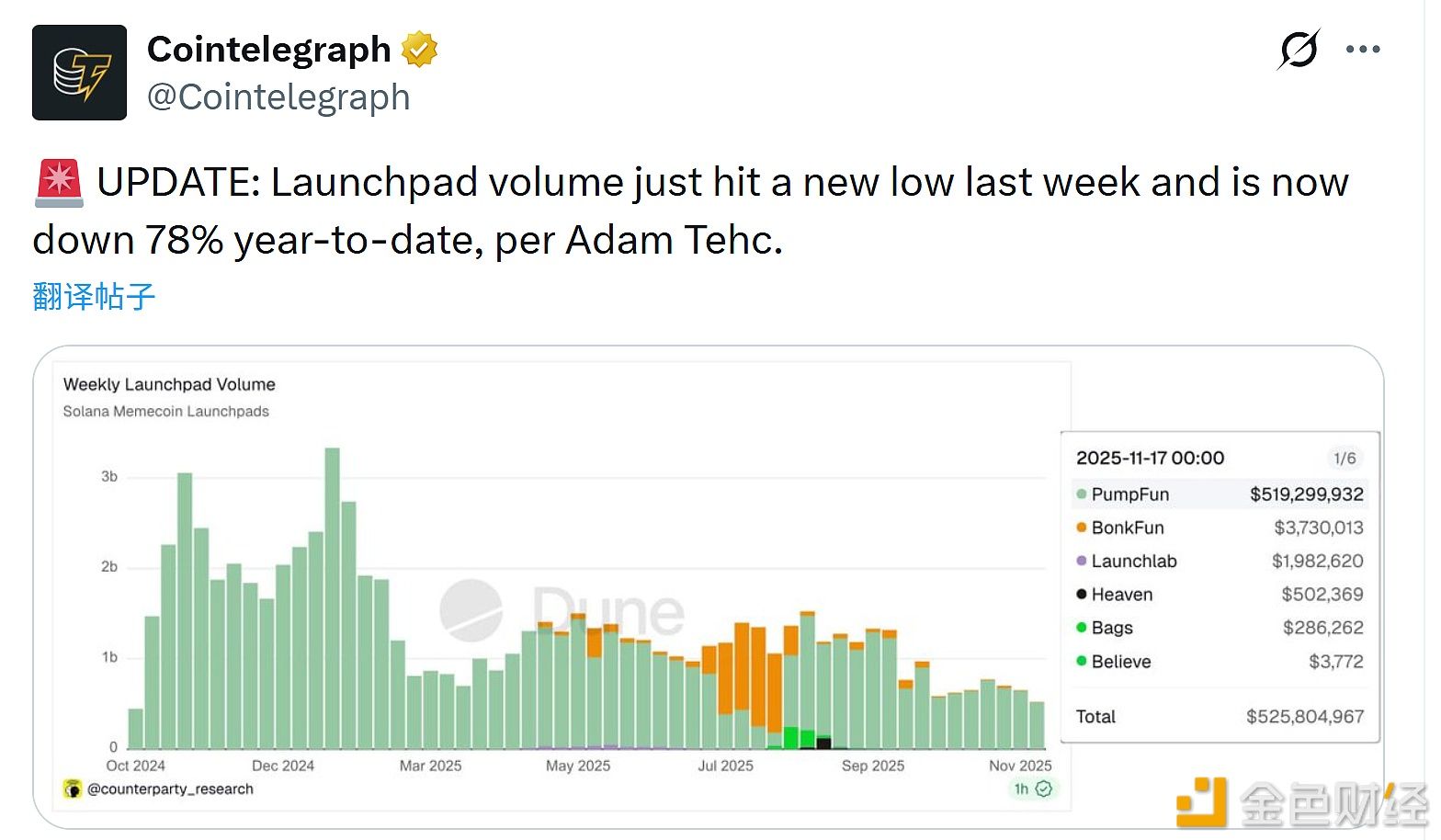

Adam Tech: Launchpad trading volume hit a new low last week