Dogecoin (DOGE) Targets New Highs as Profit-Takers Step Aside and Addresses Surge

Dogecoin is gaining traction with a 10% surge, fueled by rising active addresses and fewer profit-takers, setting sights on higher targets.

Leading meme coin Dogecoin (DOGE) has broken free from its sideways trend, recording fresh daily highs since September 7. At press time, the crypto trades at $0.2373, marking a 10% surge over the past two days.

The breakout comes as on-chain activity intensifies and profit-taking slows, signaling renewed confidence among DOGE holders.

DOGE Price Jumps on Rising On-Chain Activity

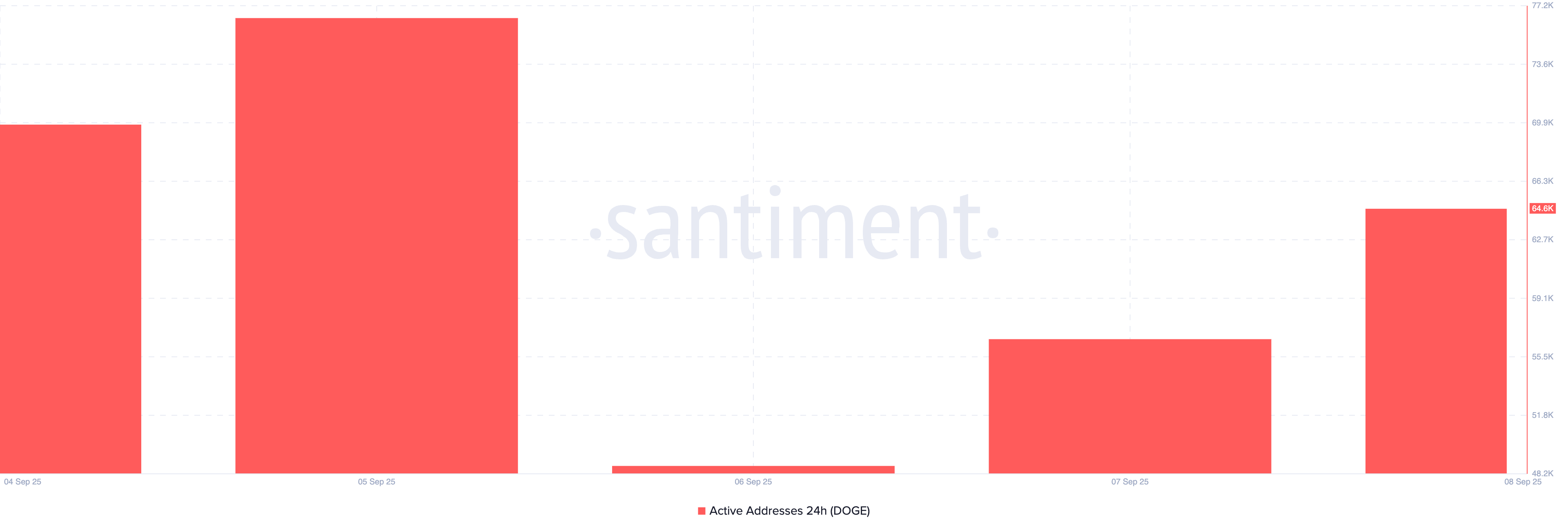

DOGE’s double-digit rally is closely tied to a rise in its daily active on-chain addresses since September 7. This reflects stronger market participation and growing investor interest in the meme coin.

Per Santiment, the number of unique active addresses involved in DOGE transactions has soared 16% in the past two days.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

DOGE Active Addresses. Source:

Santiment

DOGE Active Addresses. Source:

Santiment

A rise in daily active addresses signals heightened engagement with the network, as more unique participants trade the asset. This expansion in user activity usually precedes a bullish price action, since it indicates stronger demand and greater liquidity.

DOGE’s 16% uptick in active addresses validates the recent price surge and also suggests that the rally is supported by organic user demand rather than short-lived speculative trades.

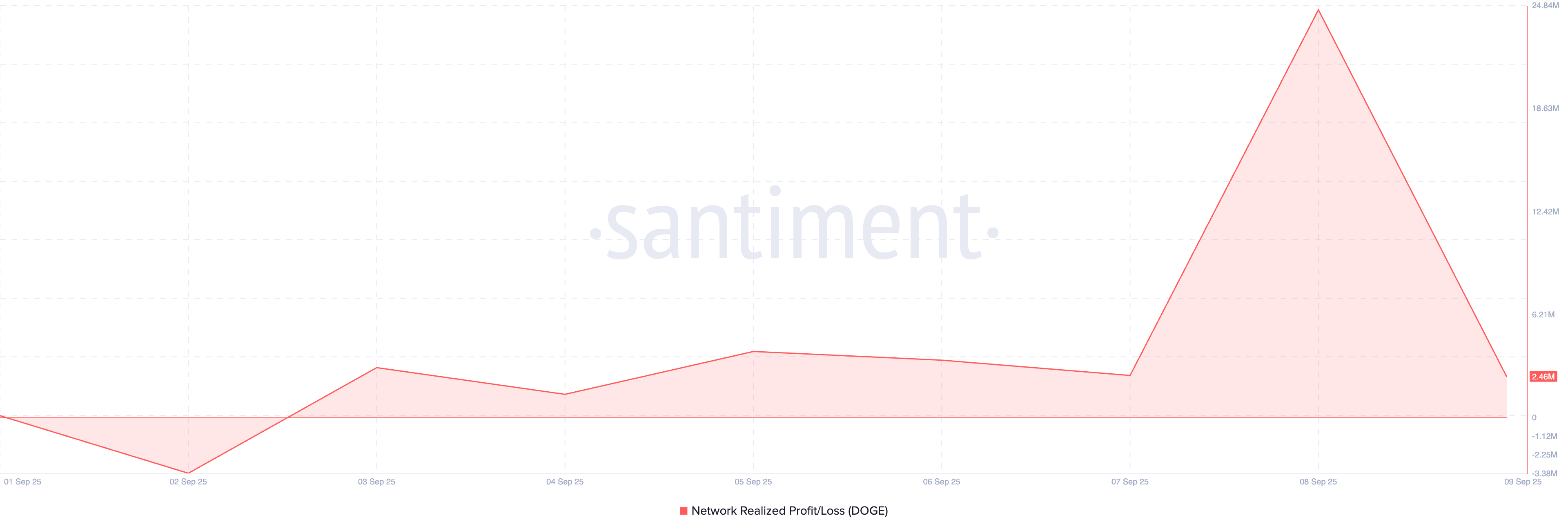

Furthermore, the dip in DOGE’s Network Realized Profit and Loss (NPL), which shows that fewer traders are locking in profits, supports the bullish outlook.

According to Santiment, this figure stands at 2.46 million and continues to decline at press time, indicating that realized gains on the network are shrinking.

DOGE Network Realized Profit and Loss. Source:

Santiment

DOGE Network Realized Profit and Loss. Source:

Santiment

This metric tracks the net profit or loss of all coins moved on-chain, based on the price at which they were last transacted. A rising NPL suggests increasing profitability across the network, while a declining NPL signals that fewer participants are cashing out gains.

With fewer investors in realized profits, traders are less motivated to sell, extending their holding periods. This holding behavior helps reduce immediate supply pressure on the market, further strengthening DOGE’s upward trajectory.

Dogecoin Price Eyes $0.2557—But Can $0.2347 Support Hold?

As more investors hold rather than exit, DOGE builds further upward momentum, with the price likely to extend its rally toward $0.2557.

DOGE Price Analysis. Source:

DOGE Price Analysis. Source:

On the downside, a reversal could push DOGE back to the immediate support at $0.2347. Failure to defend this level may trigger a deeper pullback toward the breakout line at $0.2203.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

Summarizing the "holistic reconstruction of the privacy paradigm" from dozens of speeches and discussions at the Devconnect ARG 2025 "Ethereum Privacy Stack" event.

Shareholder Revolt: YZi Labs Forces BNC Boardroom Showdown

Halving Is No Longer the Main Theme: ETF Is Rewriting the Bitcoin Bull Market Cycle

The Crypto Market Amid Liquidity Drought: The Dual Test of ETFs and Leverage