Solana Price Hits 7-Month High, Even As SOL Traction Dips To April Lows

Solana is rallying near $219, but with RSI nearing reversal levels and network growth slowing, the token may face a cooling dip before resuming its uptrend.

Solana (SOL) continues to maintain its strong uptrend, with the token recently reaching fresh highs.

While the long-term outlook remains bullish, short-term investors may need to prepare for a potential dip. Historical patterns suggest corrections often follow periods of accelerated gains.

Solana Is Reaching Its Saturation Point

The Relative Strength Index (RSI) is approaching a critical zone. While RSI levels above 70.0 typically signal overbought conditions, Solana has historically reversed much earlier. In fact, past declines have begun when RSI crossed the 62 mark.

Currently, Solana’s RSI sits at 61, putting the altcoin on the edge of saturation. If the trend repeats, SOL may be primed for a short-term correction, potentially cooling off before resuming its broader uptrend.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Solana RSI. Source:

TradingView

Solana RSI. Source:

TradingView

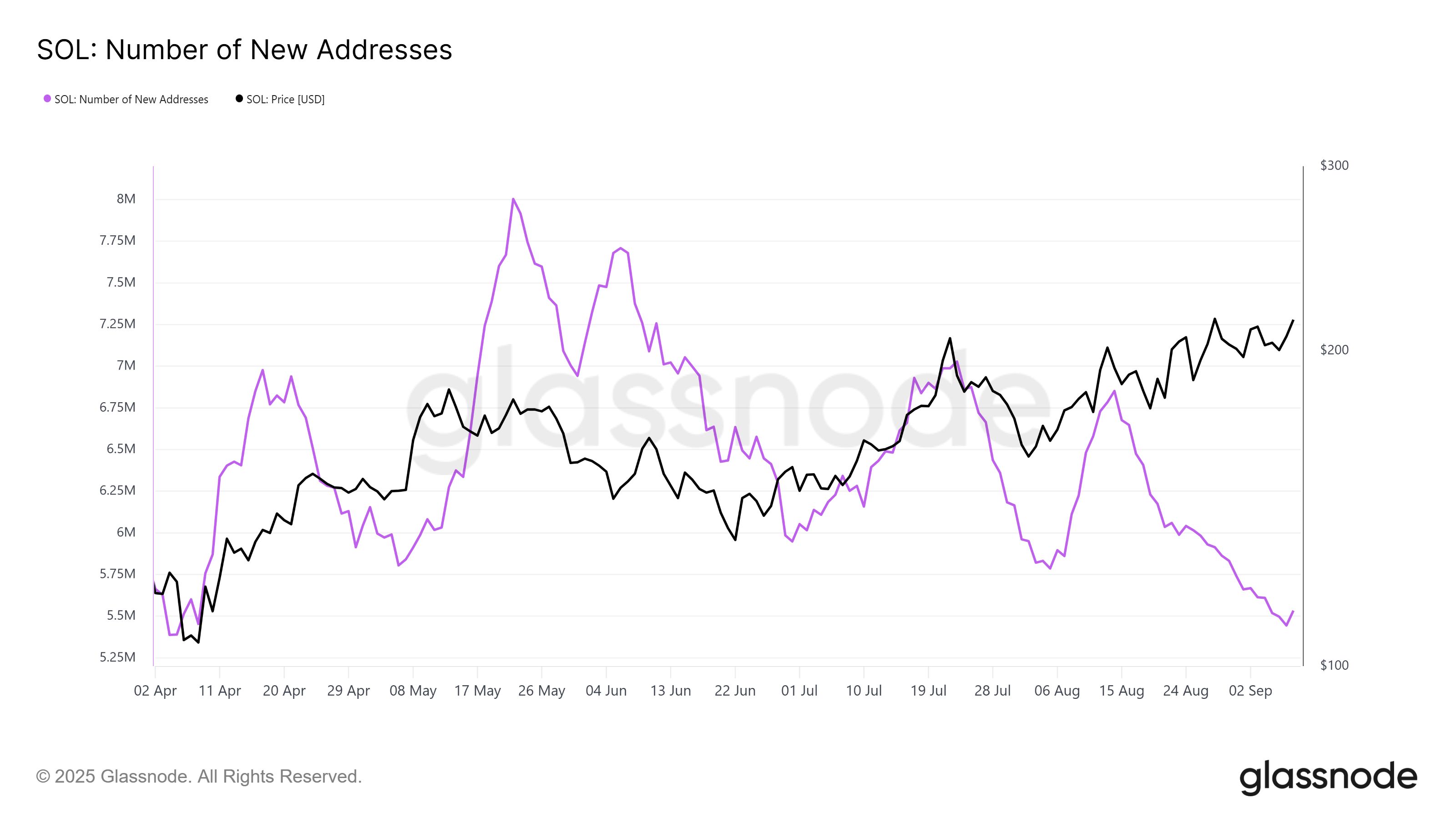

On-chain data reveals that new addresses on Solana have dropped to levels last seen in April. This marks a five-month low and indicates waning interest from fresh investors. For any asset, declining new entries can signal weakening momentum.

The decline may be tied to Solana’s month-and-a-half-long rally, which could appear overheated to new participants. With the risk of a pullback looming, some investors may prefer to wait rather than risk entering at a potential peak.

Solana New Addresses. Source;

Glassnode

Solana New Addresses. Source;

Glassnode

SOL Price Could See A Decline

At the time of writing, Solana trades at $219, holding firm above its $214 support floor. This represents a seven-month high, with the token facing resistance at $221. Sustaining this level will be crucial in shaping short-term direction.

Should momentum fade, Solana’s price could retrace to $206 or even lower, testing $195 as support. Such a correction would align with the RSI and address data signals pointing to short-term cooling.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

Conversely, if existing SOL holders push demand, the altcoin could defy bearish signals. A breakout above $221 would strengthen the bullish case, potentially driving Solana toward $232 and invalidating expectations of an imminent decline.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025