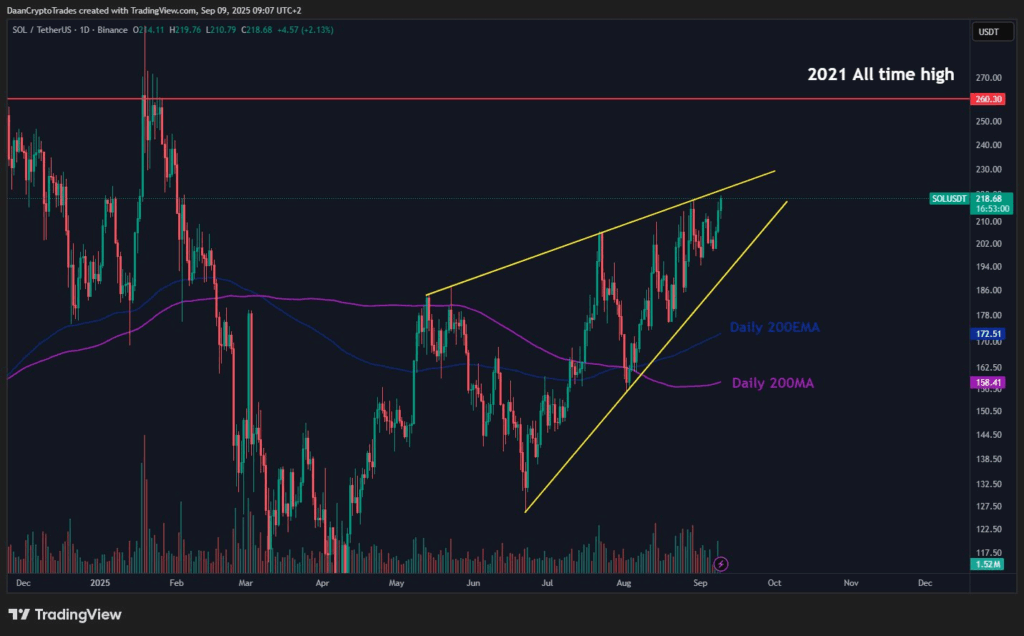

Solana price is consolidating above key support with rising momentum; the $220–$225 zone is the immediate resistance that will determine whether SOL can retest its $270 all‑time high within the coming sessions.

-

SOL holds higher lows and trades above the Daily 200EMA and 200MA, indicating a sustained bullish bias.

-

Immediate resistance sits at $220–$225; a decisive close above this range could open the path to $270.

-

Volume spikes during past breakouts confirm investor conviction; SOL remains ~19% below the 2021 peak.

Solana price update: SOL consolidates above support with rising momentum—watch $220–$225 for a breakout, then $270; read the technical outlook and key takeaways.

Solana holds strong above support with higher lows and rising momentum, but the $220 resistance zone will decide its push toward $270.

- Solana holds above key support with higher lows, showing resilience as traders eye the $220-$225 resistance and the $270 all-time high.

- Rising wedge momentum and strong recovery from $120 highlight buyer conviction while volume spikes confirm sustained investor participation.

- SOL trades 19 percent below its 2021 peak as bulls wait for a breakout, with moving averages signaling a steady bullish trend.

Solana (SOL) is approaching a key resistance level with the cryptocurrency currently trading at $218.68, having declined 4.57% in the last session according to technical analysis. Market structure remains constructive, with higher lows and clear support bands that set the stage for a potential retest of the 2021 highs.

How is Solana price positioned to retest the $270 all‑time high?

Solana price is positioned in a bullish consolidation above the Daily 200EMA ($172.51) and Daily 200MA ($158.41), indicating a favorable bias for bulls. A sustained breakout above $220–$225 would be the primary trigger to target $270, while failure could see a retest of the $170–$190 support corridor.

Why is the $220–$225 zone critical for SOL?

The $220–$225 range has acted as a short-term supply zone where momentum has paused. Breaking and closing above this zone on above‑average volume historically confirms continuation patterns. Technical indicators such as rising trendlines and higher lows support the breakout thesis; conversely, a rejection could prompt consolidation back toward the Daily 200EMA.

Source: Daan Crypto Trades

What do volume and moving averages reveal about investor sentiment?

Volume spikes during prior breakout attempts indicate institutional and retail participation, reinforcing directional moves. Trading above the Daily 200EMA and 200MA shows that longer-term buyers remain active. Recovery from the $120 zone this year demonstrates accumulation behavior and underpins a bullish market structure.

Frequently Asked Questions

How close is SOL to its 2021 peak?

SOL sits approximately 19% below its 2021 all‑time high of $270, trading near $218.68. A confirmed move above $225 would materially shorten that gap and target a retest of the peak.

What should traders watch for in the short term?

Traders should watch for a daily close above $225 on elevated volume, sustained trading above the Daily 200EMA, and the behavior of the ascending trendline support between $180–$190 for signs of continuation or failure.

Key Takeaways

- Immediate resistance: $220–$225 — decisive for next leg higher.

- Support structure: Daily 200EMA ($172.51), Daily 200MA ($158.41), and an ascending trendline near $180–$190.

- Actionable insight: Look for a daily close above $225 on above‑average volume to validate a move toward $270; manage risk with stops below $180.

Conclusion

Solana’s technical structure shows resilience as buyers maintain higher lows and moving averages confirm a bullish trend. The $220–$225 zone is the immediate battleground; a clear breakout above it would position SOL to challenge $270. Monitor volume, moving averages, and trendline support for confirmation, and adjust risk accordingly.