QMMM Stock Soars 2,300% on $100M Crypto Treasury Pivot

QMMM Holdings stock skyrocketed 2,300% after announcing a $100M crypto treasury anchored by Bitcoin, Ethereum, and Solana. The firm pivots into blockchain and AI, but volatility and weak finances highlight investor caution.

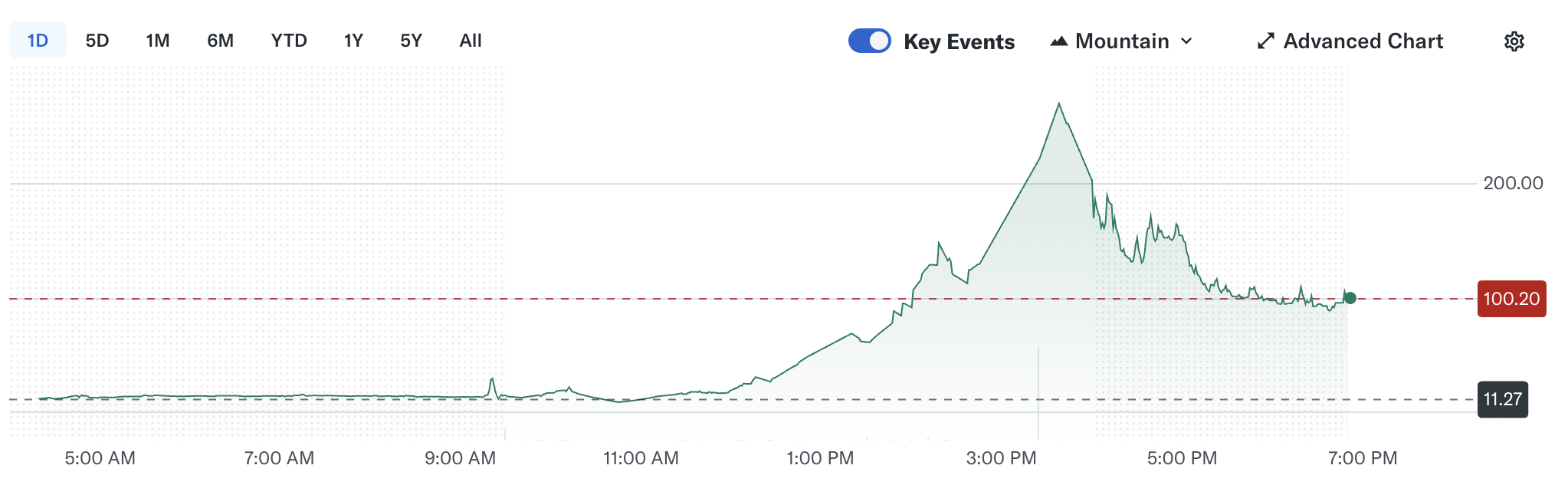

Shares of Hong Kong–based media company QMMM Holdings (QMMM) surged as much as 2,300% on Tuesday before closing 1,737% higher at $207 on Nasdaq. The rally followed the company’s announcement of a $100 million digital asset treasury anchored by Bitcoin, Ethereum, and Solana.

The extraordinary stock move underscored retail-driven momentum and speculation, though volatility quickly reappeared. Its shares dropped nearly 50% in after-hours trading to around $105.

QMMM Crypto Treasury Anchored by Bitcoin, Ethereum, and Solana

QMMM Holdings is a Hong Kong–based and Nasdaq-listed digital advertising and media firm now pivoting to blockchain and AI. As announced on Tuesday, the company confirmed it will build a diversified $100 million digital asset treasury across Bitcoin, Ethereum, and Solana.

Bitcoin will be the cornerstone of its resilience and market credibility. Ethereum’s smart contract architecture is expected to power AI-driven agents and decentralized applications, while Solana’s speed and scalability will support real-time analytics, metaverse interactions, and Web3 infrastructure.

The company’s January SEC filing showed only $497,993 in cash and a net loss of $1.58 million for fiscal 2024, leaving questions over how QMMM will finance its crypto accumulation. No further funding details were disclosed, and representatives did not respond to requests for clarification.

QMMM Stock Performance Over the Past Day / Source:

QMMM Stock Performance Over the Past Day

QMMM Stock Performance Over the Past Day / Source:

QMMM Stock Performance Over the Past Day

From Digital Media to Web3 Autonomous Ecosystem

Previously a digital advertising business, QMMM has recast itself as a blockchain-native firm. It announced plans for a decentralized data marketplace that uses AI-driven analytics to support investors, developers, and creators. The company aims to provide DAO treasury management tools, smart contract vulnerability detection, and metaverse enhancements.

“Our cryptocurrency initiatives, combined with our expertise in AI and digital platforms, are designed to create sustainable value for our stakeholders while reinforcing our role as a forward-looking technology company,” CEO Bun Kwai said in a statement.

Mr. Bun Kwai, founder of QMMM, became CEO and Chairman in June 2023 after years of leading subsidiaries. He holds a bachelor’s degree in digital graphic communication from Hong Kong Baptist University.

Analysts, Including Benzinga, Call It “Narrative-Driven Upside”

QMMM’s explosive surge outpaced moves across the sector, diverging from Canadian peer Sol Strategies, which fell 42% in its Nasdaq debut the same day.

Analysts noted the speculative nature of QMMM’s valuation jump, with Benzinga reporting one description as “narrative-driven upside” tied to crypto adoption rather than fundamentals.

Despite the initial enthusiasm, shares retraced heavily in after-hours trading, reflecting broader investor caution. With minimal institutional coverage and limited financial transparency, QMMM remains a high-risk play. Its pivot signals ambition to lead in Web3, but execution risks and funding challenges leave its long-term trajectory uncertain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes