Rose by Any Other Name: But We All Want “USDH” Name

The fight for Hyperliquid’s USDH ticker is one of crypto’s biggest stablecoin battles, with billions at stake and governance power shifting to community validators.

One of the fiercest battles in stablecoin history unfolds on Hyperliquid: the fight for control of the USDH ticker, a prize worth billions.

As Paxos, Frax, Agora, and even Hyperliquid’s own Native Markets team enter the race, the community faces the ultimate question: Who will shape the future of this stablecoin?

Four Contenders and the $5.5 Billion Prize

USDH is a new stablecoin within the Hyperliquid (HYPE) ecosystem, a decentralized exchange gaining massive traction. Remarkably, the ticker “USDH” — the official label to identify the stablecoin on the platform — has become the target of intense competition. This competition is among major players.

Stablecoin USDH from Hyperliquid. Source:

Stablecoin USDH from Hyperliquid. Source:

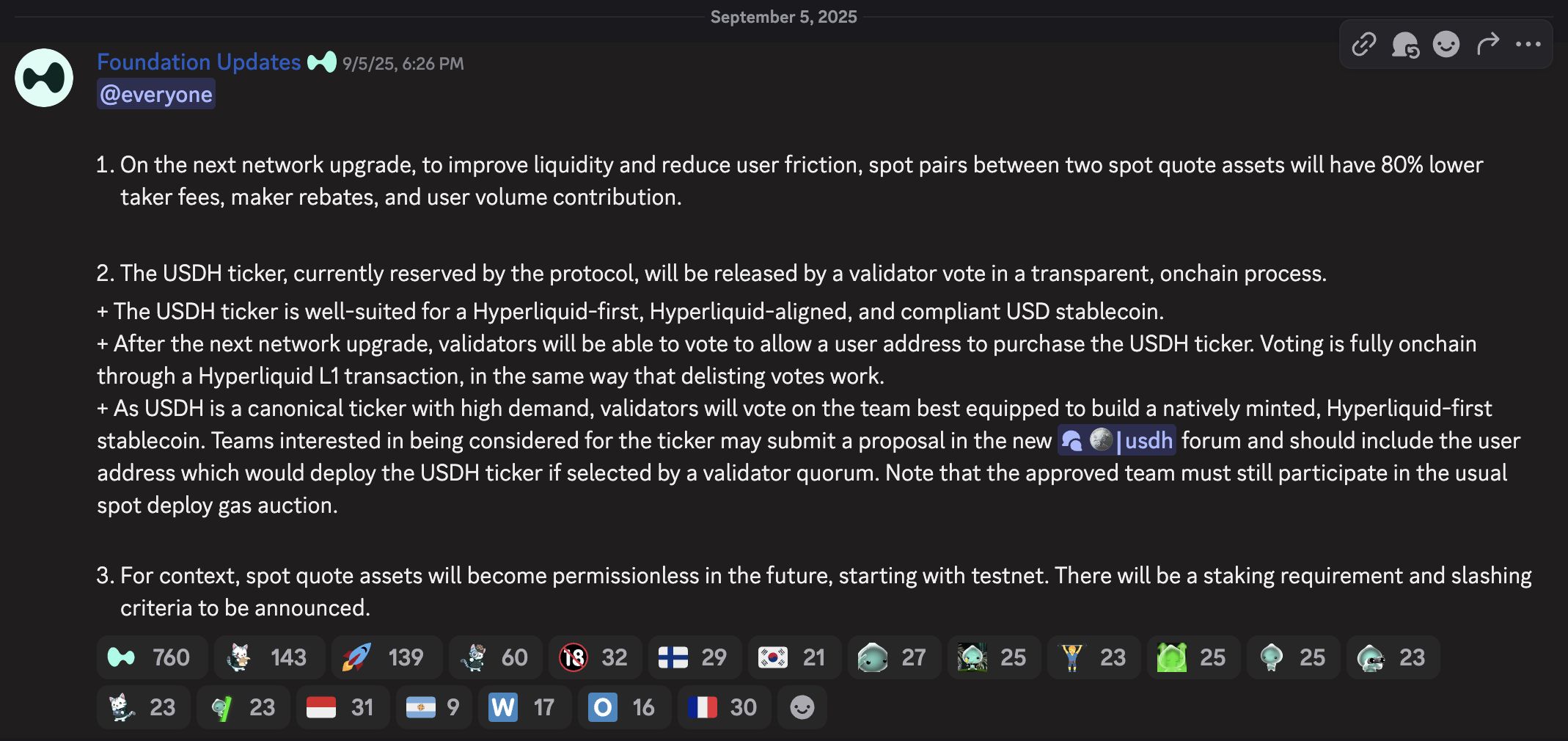

Hyperliquid validators will directly vote to decide which group gets to own the USDH ticker. This contrasts sharply with traditional stablecoins, which a single company usually issues. Here, control is democratized through community voting, turning crypto into one of the most transparent and competitive races ever seen.

Four official proposals have been submitted: Paxos Labs, Frax Finance, Agora, and Native Markets as of this week. The scale of the competition for the USDH ticker has stunned the market, with over $5.5 billion in stablecoins in circulation. According to Gauthamzzz, approximately $220 million in annual revenue is tied to whoever secures the USDH ticker. This is no longer just about branding — it’s about control over a critical financial infrastructure.

From a Ticker to the Future of Stablecoins

While many celebrate this as “the biggest stablecoin bidding war in crypto history”, skepticism remains. Analyst Ryan Watkins argues that the real question isn’t whether a “big institution” or a “native team” wins. Instead, it is up to the winner to ensure proper alignment with Hyperliquid’s long-term vision.

Others have voiced concern that the current proposals are “quite concerning.” They warn that these proposals could reduce transparency and pave the way for greater centralization. On the flip side, community enthusiasm is undeniable. According to Zach, the momentum behind the vote shows that people “see the opportunity and are excited about the control it will bring.” Some have even described the event as “peak crypto” — a rare moment where traditional finance and native DeFi collide in an open, chaotic, yet groundbreaking contest.

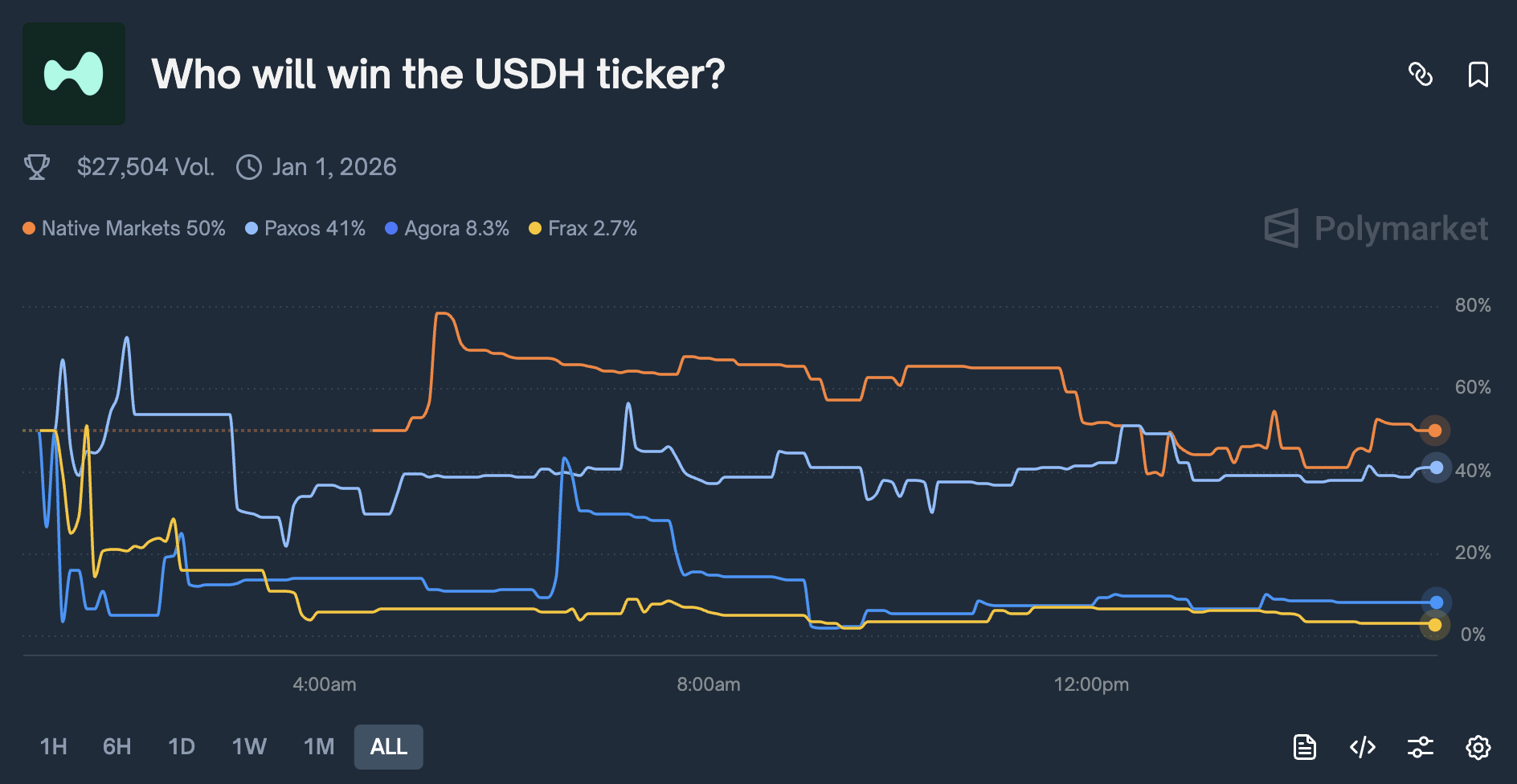

The excitement has even spilled over into prediction markets. Polymarket launched a bet on “Who will win the USDH ticker?” This underlines that USDH is not just another ticker symbol, but a symbol of the shifting balance of power in the stablecoin space.

Native Markets is predicted to be the winner. Source:

Native Markets is predicted to be the winner. Source:

The outcome will set a critical precedent. Will traditional financial institutions with deep pockets dominate stablecoins, or will they remain in the hands of native community-driven teams? Either way, the USDH battle will become a case study in how DeFi can democratize financial control. It will also test how much the community truly values decentralization.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes