The Pioneer of Domestic Stablecoins, Serving 5 Years in Prison, Passively Holding Tether Equity and Bitcoin

The OG of the Crypto World, Guo Hongcai, suddenly posted a photo of Zhao Dong standing in Crypto Valley on his social media, causing a stir among all the old players. Some speculated that it was about time for Zhao Dong to be released from prison, while others claimed it was an old photo and he was still incarcerated.

Regardless of his current incarceration status, we should all learn about the story and vision of this prominent figure in the Chinese stablecoin space.

Image Source: Weibo account "Nan Gong Yuan 2022"

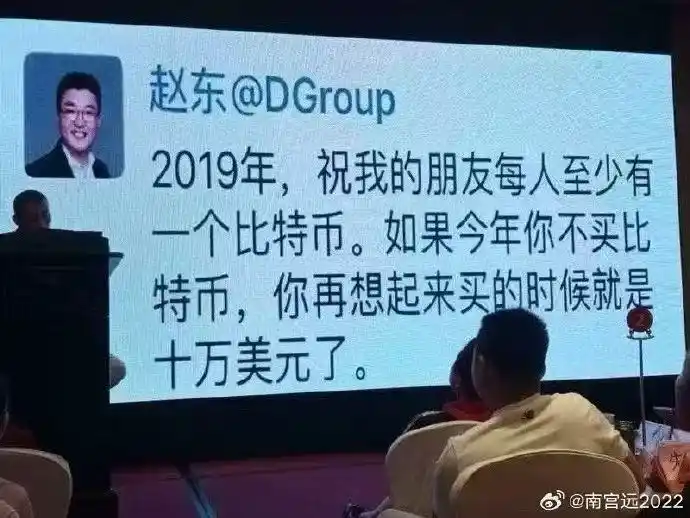

Zhao Dong has always had good connections in the industry and frequently participates in various conferences and AMAs.

He was originally a co-founder of Moji Weather, and after coming out, he joined Garage Coffee, embarking on his second entrepreneurial journey. Garage Coffee is a magical place known as a hub for internet entrepreneurship trends and directions and also serves as an internet entrepreneurship museum. In 2013, he bought his first Bitcoin there, recommended by a friend named Wu Gang, who later became the CEO of BTC China.

During his time at Garage Coffee, he met some of the earliest Bitcoin players, including Wu Gang, Li Lin, Li Xiaolai, Bao Er Ye, Zhao Guofeng, and Du Jun, who are now big names in the crypto industry.

Image Source: Weibo account "Garage Coffee"

With a technical background, Zhao Dong saw the potential in Bitcoin and started accumulating coins. In the first wave, he bought 2,000 bitcoins at an average price of 500 RMB each. Later, he purchased more, coupled with Bitcoin's skyrocketing price in 2013, quadrupling in value that year. It is said that his assets had already exceeded 100 million RMB during that time.

Unfortunately, Zhao Dong started leveraging and got liquidated. It was rumored that he lost 9,000 bitcoins in a day and owed over 60 million RMB. This led him to focus heavily on OTC trading to repay his debts, as the market depth was insufficient at that time.

He engaged in all kinds of trades, even earning 50-60 RMB on small trades. With luck, he could earn more on larger trades. He would buy coins directly from miners, receiving them as soon as they were mined. However, the first-generation Chinese mining machine manufacturer, who he bought from, has since disappeared.

Through off-exchange deals, Zhao Dong managed to clear his debts and began accumulating assets once again. In 2016, due to the infamous Bitfinex hack, he received Bitfinex's issued BFX tokens and became a shareholder of Bitfinex. This event seemed to solidify his close relationship with Bitfinex.

Bitfinex and USDT issuer Tether are the same group of people. Later, Dong Ge directly obtained USDT through collateralization, which also laid the foundation for his later lending business. He also briefly became the spokesperson for Tether in the Chinese-speaking region.

Rumor has it that Dong Ge had 10,000 Bitcoins at his peak, which is 1/2100 of the total Bitcoin supply, equivalent to $1.2 billion today.

However, everything came to a sudden halt in June 2020. After a 312 crash that had just passed three months, news suddenly came that Zhao Dong had been taken away. He never spoke out again after that. A year later, reports emerged that he had been sentenced to two years for money laundering and aiding fraud, later revealing his involvement in foreign exchange.

Many people say that in today's photos, Zhao Dong is smiling too happily, making it unlikely that he just came out of prison. For someone who holds the equity of Tether, the world's largest stablecoin group, and has a significant passive Bitcoin position to this day, if he could indeed come out early, many would be happy for him.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services