Staking Crisis: Kiln Security Vulnerability Triggers Withdrawal of 2 Million ETH

Original: Odaily (@OdailyChina)

Author: Azuma (@azuma_eth)

Original Title: 2 Million ETH Squeezed into Staking Exit Queue—What Happened?

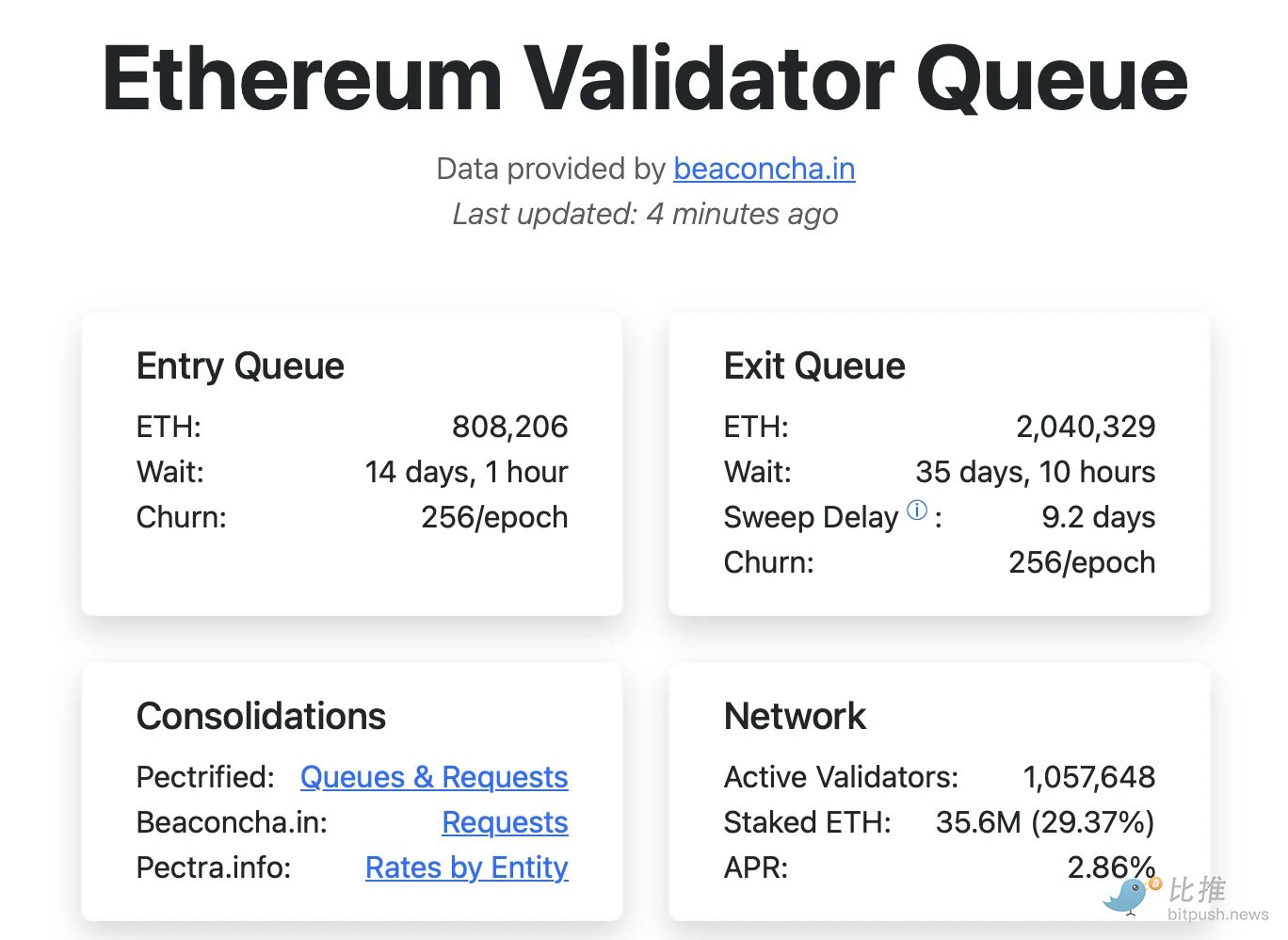

According to data from the Ethereum staking tracking website Validator Queue, as of 16:00 (GMT+8) on September 10, the number of ETH queued for unstaking on the Ethereum network has surged to 2,040,329, nearly doubling the previous all-time high of 1,058,531 set on August 29. The withdrawal time has also been significantly delayed to about 35 days and 10 hours. Meanwhile, the current number of ETH queued for staking is temporarily reported at 808,206, with an estimated queue time of about 14 days and 1 hour.

Such a large-scale, sudden concentration of ETH unstaking is rare—does it mean a super whale is retreating? If so, a sell-off of millions of ETH would inevitably have a whale-sized impact on ETH and even the entire cryptocurrency market... However, after comprehensively reviewing the related market dynamics, we found that there are clear signs behind this event, and ETH holders need not panic excessively.

The incident originated from a security event yesterday. On the evening of September 8, Swiss-based cryptocurrency platform SwissBorg was hacked for 192,600 SOL (worth about $41.3 million). Afterwards, SwissBorg disclosed that the theft occurred because the API of one of its staking partners was compromised, allowing hackers unauthorized access to the staking wallet and enabling them to transfer the related assets.

The partner that was hacked was later identified as staking service provider Kiln, which subsequently issued a statement: “SwissBorg and Kiln are investigating a potential unauthorized access incident involving a staking operations wallet. We became aware of this on September 8, 2025. The incident resulted in abnormal transfers of SOL tokens from the wallet used for staking operations. Upon discovery, SwissBorg and Kiln immediately initiated incident response plans, contained the activity, and contacted our security partners. SwissBorg has suspended Solana staking transactions on the platform to ensure other users are not affected.”

So how is this related to the concentrated ETH unstaking? The key reason is that Kiln is not a staking service provider focused solely on the Solana ecosystem; its staking services cover most PoS networks, including Ethereum.

This morning, Kiln officially announced again that “for security reasons, all ETH staking will be withdrawn in an orderly manner.” The main content of the announcement is as follows:

Following yesterday’s announcement regarding the Solana incident involving SwissBorg, Kiln is taking additional precautionary measures to ensure the security of all network client assets. As part of the response, Kiln has begun the orderly exit of all its Ethereum (ETH) validator nodes today. This exit process is a preventive measure aimed at ensuring the continued integrity of staked assets.

This decision prioritizes the interests of clients and the broader industry, and is based on collaboration with key stakeholders and advice from leading security companies.

Client assets remain secure at all times. The exit process is expected to take 10 to 42 days (the exact duration varies by validator node), after which the network will complete fund withdrawals within 9 days as planned. Validator nodes will continue to earn rewards during the exit period. The delay is enforced at the protocol level based on the number of exiting validator nodes, and Kiln cannot change this at will.

Withdrawals are automatically processed by the Ethereum protocol and will be returned directly to your wallet or the smart contract used during the staking process, after which they can be withdrawn.

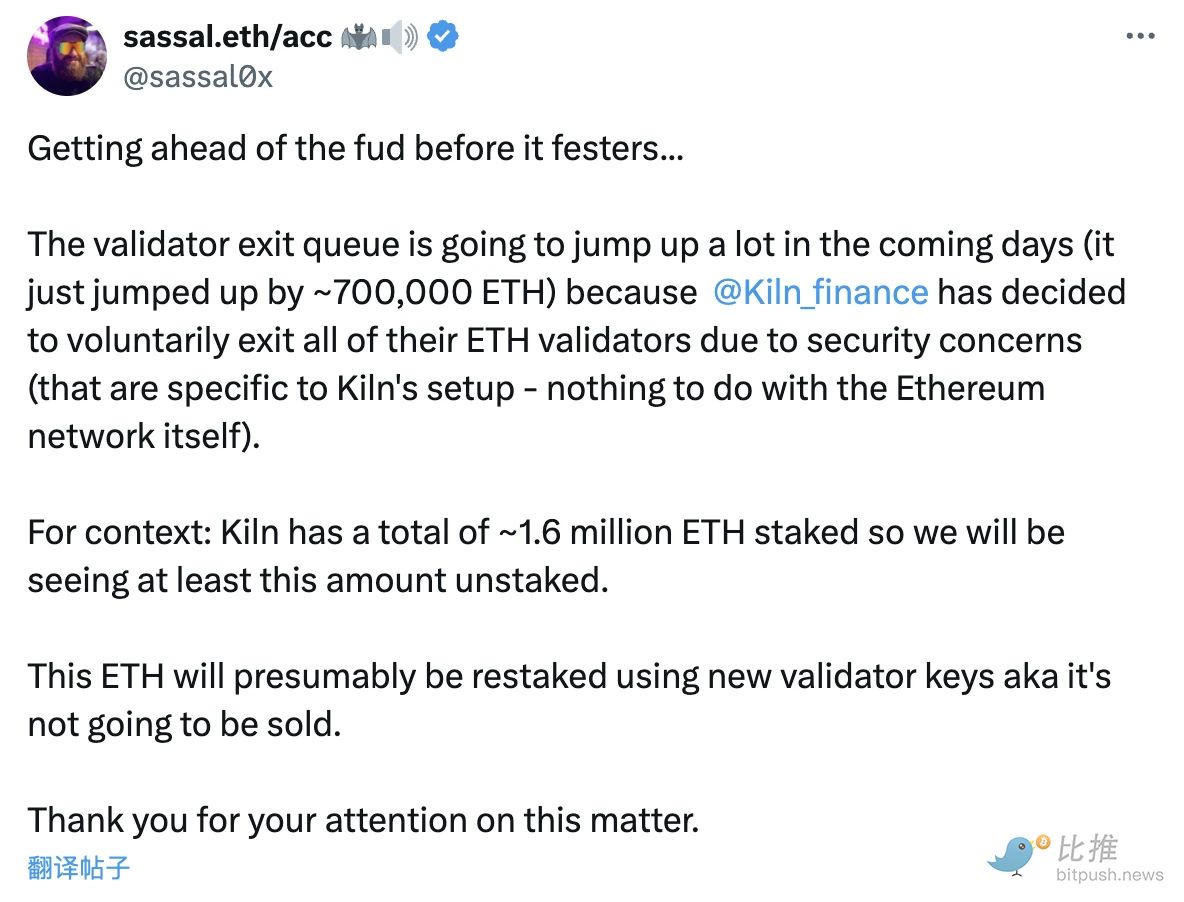

According to well-known Ethereum developer sassal.eth, Kiln has staked a total of about 1.6 million ETH. Therefore, the market may see a corresponding amount of ETH entering the unstaking queue in a short period, but this does not mean these ETH will be sold. Kiln may use new validator node keys to restake these ETH.

In short, today’s surge in ETH queued for unstaking is essentially Kiln conducting risk mitigation operations. Most of this ETH belongs to clients like SwissBorg who staked through Kiln’s services. While it’s possible that some clients may take this opportunity to sell, it is expected that the majority of ETH will be restaked through Kiln (after risk is eliminated) or other staking solutions. Therefore, the market need not be overly concerned.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins in 2025: You Are in Dream of the Red Chamber, I Am in Journey to the West

But in the end, we may all arrive at the same destination through different paths.

XRP’s Extreme Fear Level Mirrors Past 22 % Rally

Critical Bitcoin Bear Market Signal: 100-1,000 BTC Wallet Buying Slows Dramatically

Stunning Bitcoin Whale Awakening: Dormant Addresses Move $178M After 13 Years