Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks

Traders are using leverage in an attempt to lift bitcoin BTC$115,283.91 back to record highs, creating a high-risk environment that could result in a derivatives unwind to the downside if price begins to shift the other way.

Market analyst Skew warned one trader intent on opening a nine-figure long position to "maybe wait for spot to carry the buying so it doesn't create toxic flows."

$BTC

— Skew Δ (@52kskew) September 12, 2025

To the random 9 figure whale apeing into longs

maybe wait for spot to carry the buying so it doesn't create toxic flows pic.twitter.com/GOi1GZazl0

Bears are also adding leverage, with a separate trader currently dealing with a $7.5 million unrealized loss after shorting BTC to the tune of $234 million with an entry at $111,386. That trader added $10 million worth of stablecoins to maintain their position, with the liquidation currently standing at $121,510.

But the major liquidation risk is present to the downside, with data from The Kingfisher showing a large pocket of derivatives will be liquidated between $113,300 and $114,500, which could potentially prompt a liquidation cascade back to the $110,000 level of support.

"This chart shows where traders are over-leveraged," wrote The Kingfisher. "It's a pain map. Price tends to get sucked into those zones to clear out positions. Use this data so you don't end up on the wrong side of a big move."

Bitcoin is currently trading quietly around $115,000 having entered a period of low volatility, failing to break out of its current range for more than two months.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

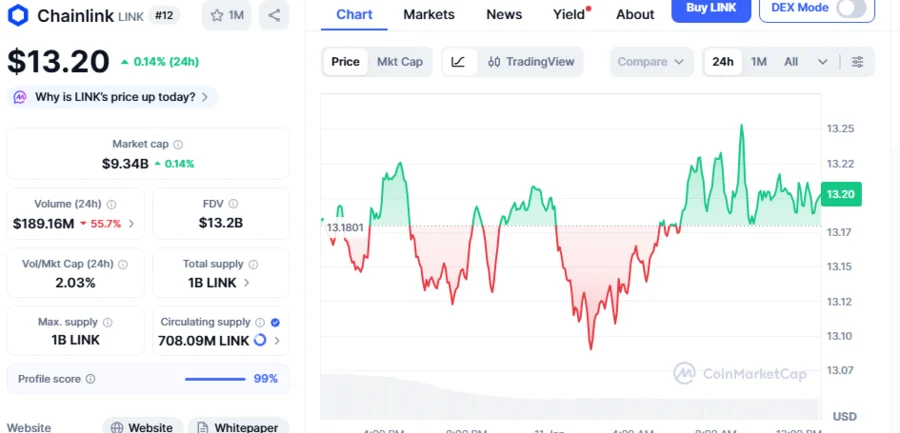

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026