Hyperliquid may become an airdrop hub, with USDH one of the main mechanisms to farm points

Hyperliquid is exiting the age of high-profile whales and moving back into airdrop season. The platform may evolve, boosting its activity with new TGE and airdrop incentives.

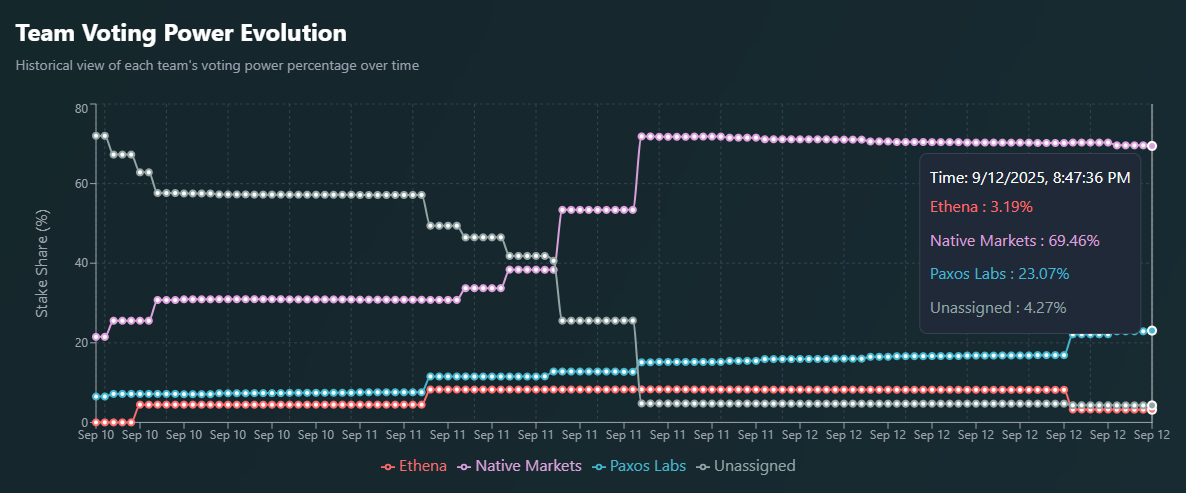

Hyperliquid may move beyond being a simple derivative platform and return to the age of airdrops. The creation of a native USDH ticker and stablecoin may have additional effects in the ecosystem, depending on how the fees are allocated. The USDH competition was highly contested, but external teams did not gain traction, and some, like Ethena, gave up.

One of the expectations was that Native Markets, the platform’s own team, would not only create USDH but also build a whole new ecosystem of incentives. The community is already counting on the potential airdrops, which will reach one of the most active crypto communities and many high-profile whales.

Hyperliquid has been growing steadily, with its perpetual futures volumes reaching 12.2% of the activity on Binance. The chain carries 672,034 users, with over 1,500 new users daily flowing in regularly. All changes and perks may boost Hyperliquid volumes to a new range. As open interest recovered above $13.3B, Hyperliquid is once again in the spotlight.

The native HYPE token also rallied, recently breaking above $57. The asset traded at $55.56, with more hikes expected, as users and whales accumulated HYPE and prepared to hold for the long term.

USDH activity may be used for airdrop incentives

The community expects that USDH activity may be used as a farming mechanism, with new tokenized incentives.

As Native Markets wins the USDH ticker prepare for:

– New Native Markets token airdrop farm

– Vampire attack on USDC/USDTWhy? Because NM proposed:

– 50% of yield goes to HYPE buybacks.

– 50% goes to ecosystem growth.That second half is basically a new HL airdrop farm. Who… pic.twitter.com/Y59qvRZKyH

— Ignas | DeFi (@DefiIgnas) September 12, 2025

A second HYPE airdrop is also seen as a possibility. The Hyperliquid ecosystem currently has an extremely limited list of tokens, as most of the focus was on HYPE and on trading BTC, ETH, and SOL, as well as smaller, riskier tokens.

The Hyperliquid blockchain carries only around $2.7B in natively minted tokens, including wrapped assets. PURR remains the only meme token, specifically created for the Hyperliquid community.

Potentially, up to 29 new projects are developing their tokenomics and eventual airdrops, preparing to turn Hyperliquid into a hub for additional DeFi activities. The airdrops may invite whales, while also boosting the participation of retail traders.

HYPE and UNIT are considered the most in-demand assets, with tickers ranging from elite to speculative or meme-based.

Circle won’t give up on USDC on Hyperliquid

Circle, the issuer of USDC, aims to retain its assets on the Hyperliquid ecosystem. On-chain data shows a wallet linked to Circle is also highly active on the Hyperliquid ecosystem.

The wallet injected $4.6M to acquire 80K HYPE tokens using the Hyperliquid spot market. Circle also experimented with mints and burns on the native Hyperliquid network, suggesting the company may be looking for a way to launch native, not bridged USDC. If Hyperliquid chooses another main stablecoin, Circle’s role may diminish, sending the bridged USDC back into the ecosystem.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

"Five simultaneous shocks" hit! The logic behind this round of bitcoin's plunge is completely different from the past

The investment logic of bitcoin is changing, and the importance of risk management has been brought to an unprecedented level.

The covert battle in the crypto industry intensifies: 40% of job seekers are North Korean agents?

The report shows that North Korean agents are deeply infiltrating the crypto industry using fake identities, accounting for up to 40% of job applications. They are obtaining system access through legitimate employment channels, and the scope of their influence far exceeds industry expectations.

Berachain exposed for signing dual contracts with VCs, allowing lead investors to invest without risk

Another VC has already lost $50 million.

Etherscan's Surcharge Scandal Exposes Ethereum Ecosystem's Data Dependency Dilemma

Etherscan's decision to stop offering free APIs across multiple chains has sparked an industry debate, reflecting a deeper contradiction between the commercialization and decentralization of blockchain data infrastructure.

Trending news

MoreFederal Reserve December Rate Cut: A Comprehensive Analysis of Supporters and Opponents

[Bitpush Daily News Selection] The probability of a 25 basis point Fed rate cut in December rises to 80%; Trump orders the launch of the "Genesis Mission" plan to vigorously promote the AI scientific research revolution; Fed's Daly: The job market may suddenly deteriorate, supports a rate cut in December; Bloomberg analyst: Bitcoin ETF shows signs of stabilization, IBIT short interest falls to a six-month low