Shibarium Exploit Thwarted as Attackers Target $1 Million in BONE Tokens

The Shiba Inu's Shibarium breach coincided with a major ShibaSwap upgrade to expand the decentralized platform's cross-chain functionality.

The Shiba Inu ecosystem faces scrutiny after an exploit on Shibarium’s bridge attempted to siphon off more than $1 million worth of BONE tokens.

On-chain data showed an effort to move about 4.6 million BONE, immediately drawing a response from the project’s developers.

Shiba Inu Bridge Exploit Coincides With Major ShibaSwap Upgrade

On September 13, Kaal Dhairya, a Shiba Inu developer, explained that the exploit was not a flaw in the underlying protocol. Instead, the attacker had gained control of validator keys, which allowed them to approve a fraudulent network state.

The maneuver was enabled by a flash loan, suggesting months of preparation and a deep understanding of the bridge’s design.

Independent investigators within the community pieced together how the operation unfolded.

According to Buzz, a contributor to K9 FinanceDAO, the exploiter used a flash loan on ShibaSwap to purchase millions of BONE and temporarily gain validator influence.

The hacker used a flash loan from Shibaswap for 4.6M BONE (the $1m BONE buy people were celebrating) and delegated it to win majority voting power over the validators, which allowed them to sign a malicious state on the chain.The hacker *may* have known that they compromised…

— Buzz.eth (@buzzdefi0x) September 13, 2025

With that stake, they pushed through the malicious transaction and simultaneously repaid the loan using funds siphoned from the bridge.

In total, blockchain records show 224.57 ETH and 92.6 billion SHIB tokens were siphoned.

Meanwhile, roughly 216 ETH went back into settling the loan, while the delegated BONE stayed trapped by unstaking delays. Developers froze those tokens before they could be withdrawn.

The attacker also attempted to sell about $700,000 worth of KNINE tokens. That effort was stopped when K9 DAO’s multisig moved to blacklist the wallet involved.

Shiba Inu developers have suspended staking operations to contain the impact of the exploit. They also moved stake manager funds into a hardware wallet secured with a six-of-nine multisig.

Dhairya described these measures as temporary until new keys are securely distributed and the full scope of the incident is confirmed.

The breach coincided with the rollout of a major ShibaSwap update. The new version extends beyond Ethereum to Polygon, Arbitrum, Base, and other networks, enabling direct token swaps without external bridges.

Lucie, a Shiba Inu ecosystem lead, said the upgrade strengthens ShibaSwap’s role as a multi-chain platform designed to attract liquidity while preparing the ground for deeper Shibarium integration.

“This upgrade positions ShibaSwap to attract liquidity from major blockchains while paving the way for Shibarium integration. It reinforces the Shib Ecosystem as a network that connects community culture with serious financial infrastructure,” Lucie stated.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

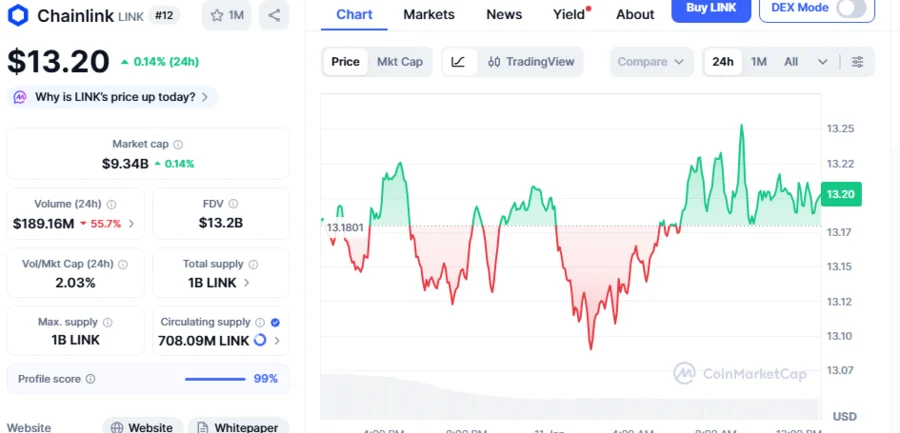

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026