Dogecoin is Pumping: What’s Next?

Dogecoin price is once again stealing the spotlight, posting sharp gains as institutional and corporate interest builds around the original meme coin. CleanCore Solutions has stepped in with a massive $148 million purchase, while the long-awaited U.S. spot Dogecoin ETF from Rex-Osprey is finally nearing its debut. Despite a series of delays, market sentiment hasn’t wavered, and DOGE’s daily chart now shows a powerful breakout that could mark the beginning of a fresh rally.

Dogecoin Price Prediction: Corporate and Institutional Momentum

Dogecoin is back in the spotlight after a quiet few months. The big catalyst this time is CleanCore Solutions (ZONE), which just bought over 500 million DOGE worth $148 million. CleanCore isn’t just holding; it’s branding itself as an official Dogecoin treasury company in partnership with House of Doge. That move essentially positions DOGE as part of corporate balance sheet strategy, something we’ve mostly seen before with Bitcoin.

On top of that, the much-anticipated U.S. spot Dogecoin ETF (ticker: DOJE) from Rex-Osprey is finally on deck. Despite delays, Bloomberg’s ETF desk says trading is now expected any day. This would mark the first U.S.-regulated ETF designed for an asset with no utility other than community and meme power. That novelty factor alone is drawing eyeballs.

Market Reaction: DOGE Daily Trend

DOGE/USD Daily Chart- TradingView

DOGE/USD Daily Chart- TradingView

The delays around the ETF didn’t cool DOGE price. In fact, the Dogecoin price has surged more than 8% today and is up double-digits on the week. Traders are clearly pricing in both the CleanCore accumulation and the ETF approval narrative. The psychology here is simple: institutions are validating DOGE, and retail investors want in before the “ETF effect” takes hold.

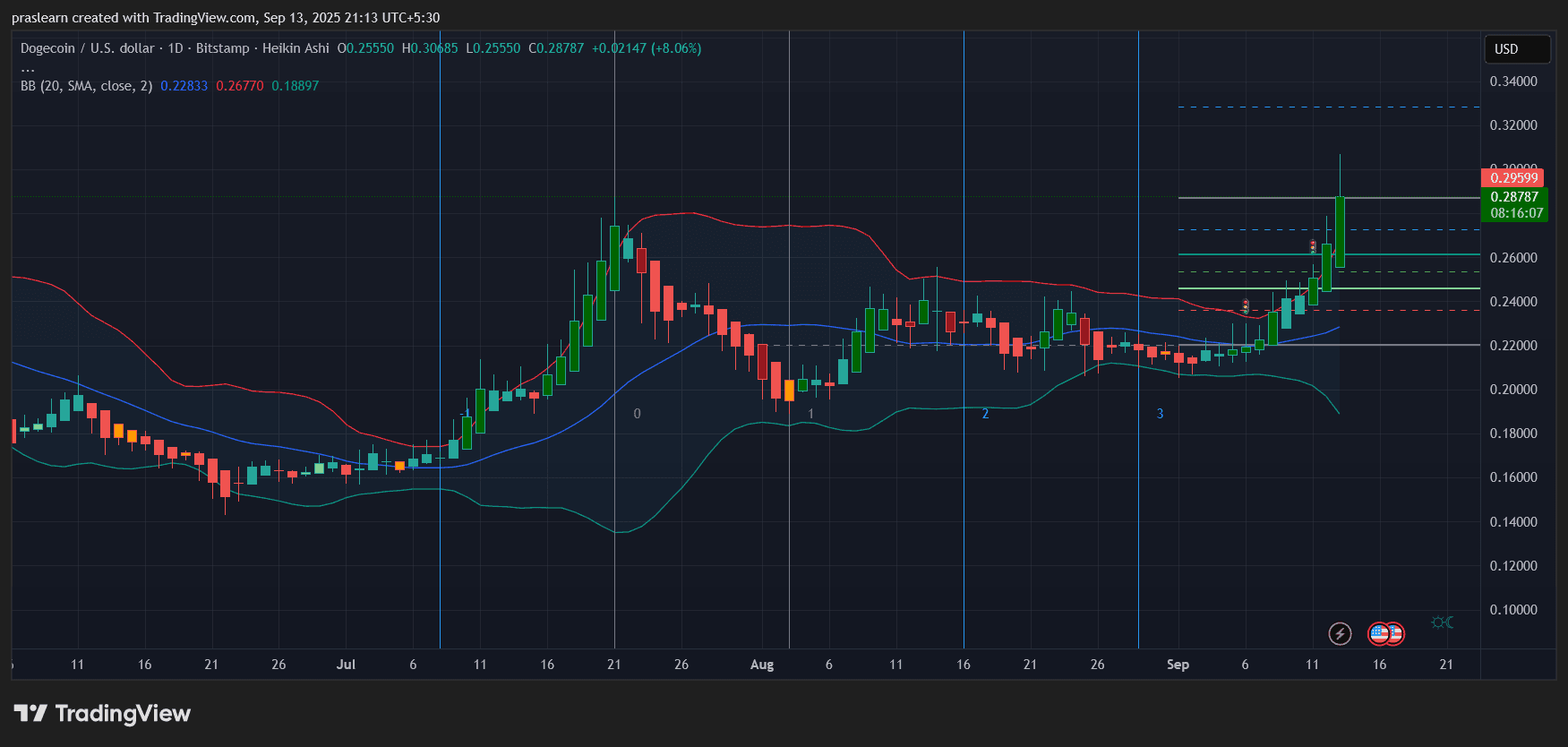

Looking at the daily chart:

- Price breakout: DOGE just smashed above its Bollinger Band mid-line and upper resistance levels, hitting $0.306 before pulling back slightly to $0.287. That breakout candle is large and backed by strong momentum.

- Support zones: Key support now sits at $0.255, which was the breakout level, and $0.240 below it. As long as DOGE holds these levels, the bullish structure remains intact.

- Resistance zones: Immediate resistance is $0.295–$0.300. If DOGE can break and close above that range, the next upside target sits at $0.320 based on Fibonacci extensions. Beyond that, $0.340 is on the radar.

- Momentum indicators: Bollinger Bands are widening, signaling volatility expansion. Heikin Ashi candles remain strong green with minimal wicks, showing trend strength.

This setup resembles the July breakout that carried DOGE from $0.20 to $0.30 in a matter of days. The difference now is that institutional catalysts are stronger.

What Could Derail the Rally?

While momentum is hot, there are risks:

- If the Dogecoin ETF launch faces another SEC delay, short-term enthusiasm could fade.

- A quick retracement to retest the $0.255 support wouldn’t be surprising, especially if traders take profits.

- Broader crypto market weakness (Bitcoin or Ethereum corrections) could drag DOGE down despite its own story.

Dogecoin Price Prediction: Can DOGE Price Push Higher?

With institutional buying already underway and the Dogecoin ETF launch imminent, DOGE price is positioned for another leg up . A decisive daily close above $0.295 could open the path to $0.32–$0.34 in the coming week. If momentum stalls, expect $DOGE to consolidate between $0.255 and $0.295 before its next move.

The takeaway is that $Dogecoin isn’t just riding memes anymore—it’s entering the structured world of ETFs and corporate treasuries. That shift is powerful fuel for price discovery, especially if retail momentum kicks in once the Dogecoin ETF starts trading.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne