Date: Sat, Sept 13, 2025 | 05:54 AM GMT

The cryptocurrency market continues to show strength amid the anticipated potential US Federal Reserve rate cuts, with Ethereum (ETH) reclaiming the $4,700 mark today. Following this, several major altcoins are flashing bullish signals — including Algorand (ALGO).

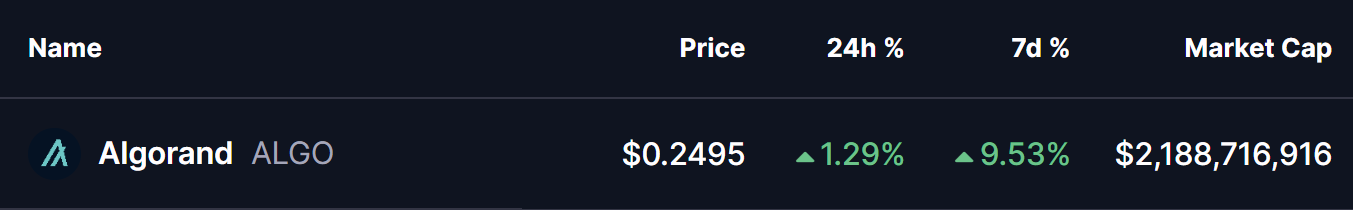

ALGO has turned green with a 10% gain over the past week, and more importantly, its chart is now displaying a key pattern formation that hints at a potential breakout in the sessions ahead.

Source: Coinmarketcap

Source: Coinmarketcap

Descending Triangle in Play

On the daily chart, ALGO has been consolidating inside a descending triangle pattern — a formation where lower highs compress against a relatively flat support zone until a decisive move occurs.

Recently, ALGO rebounded strongly from its support base near $0.2240, an area that also coincides with the 100-day moving average ($0.2292). This defense by buyers has allowed the token to bounce back, with price now sitting near $0.2495, just below the triangle’s upper resistance trendline.

Algorand (ALGO) Daily Chart/Coinsprobe (Source: Tradingview)

Algorand (ALGO) Daily Chart/Coinsprobe (Source: Tradingview)

This setup positions ALGO right at the apex of the triangle, suggesting that a sharp move — either up or down — is on the horizon.

What’s Next for ALGO?

If bulls manage to sustain momentum and push a breakout above the descending trendline, ALGO could quickly target $0.3650 — a potential 46% rally from current levels. Such a breakout would not only confirm strength but also attract fresh inflows from traders eyeing the breakout move.

On the flip side, if ALGO fails to break above resistance, the token could revisit the $0.2292 support region, putting pressure back on buyers to defend this critical level.