Bitcoin Stalls at $115,000, But On-Chain Activity Says “Not for Long”

BTC price is consolidating below resistance, but surging on-chain activity and profit levels suggest a fresh rally could be ahead.

Leading cryptocurrency Bitcoin currently hovers below a critical resistance level at $115,892 after two failed attempts to break higher in recent sessions. The stalled price action suggests a period of consolidation may be forming.

However, on-chain indicators still flash signs of growing bullish momentum, hinting that a stronger rally remains on the horizon.

Bitcoin Struggles at Resistance, But Wallet Growth and Profitability Fuel Optimism

Readings from the BTC/USD one-day chart highlight BTC’s struggle to close decisively above $115,892 over the past two trading sessions, a level that now stands as a barrier against upside.

Interestingly, despite this short-term hesitation, on-chain data suggests market strength is still building.

According to Glassnode, the number of BTC addresses holding a non-zero balance has climbed to its year-to-date high. At press time, this stands at 54.37 million wallet addresses.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin New Address Growth. Source:

Glassnode

Bitcoin New Address Growth. Source:

Glassnode

A non-zero balance wallet refers to any Bitcoin address that holds at least a fraction of BTC, signaling active participation in the network.

When the number of these wallets climbs, it reflects rising retail and institutional interest and deeper network adoption, which could sustain a BTC price surge in the near term.

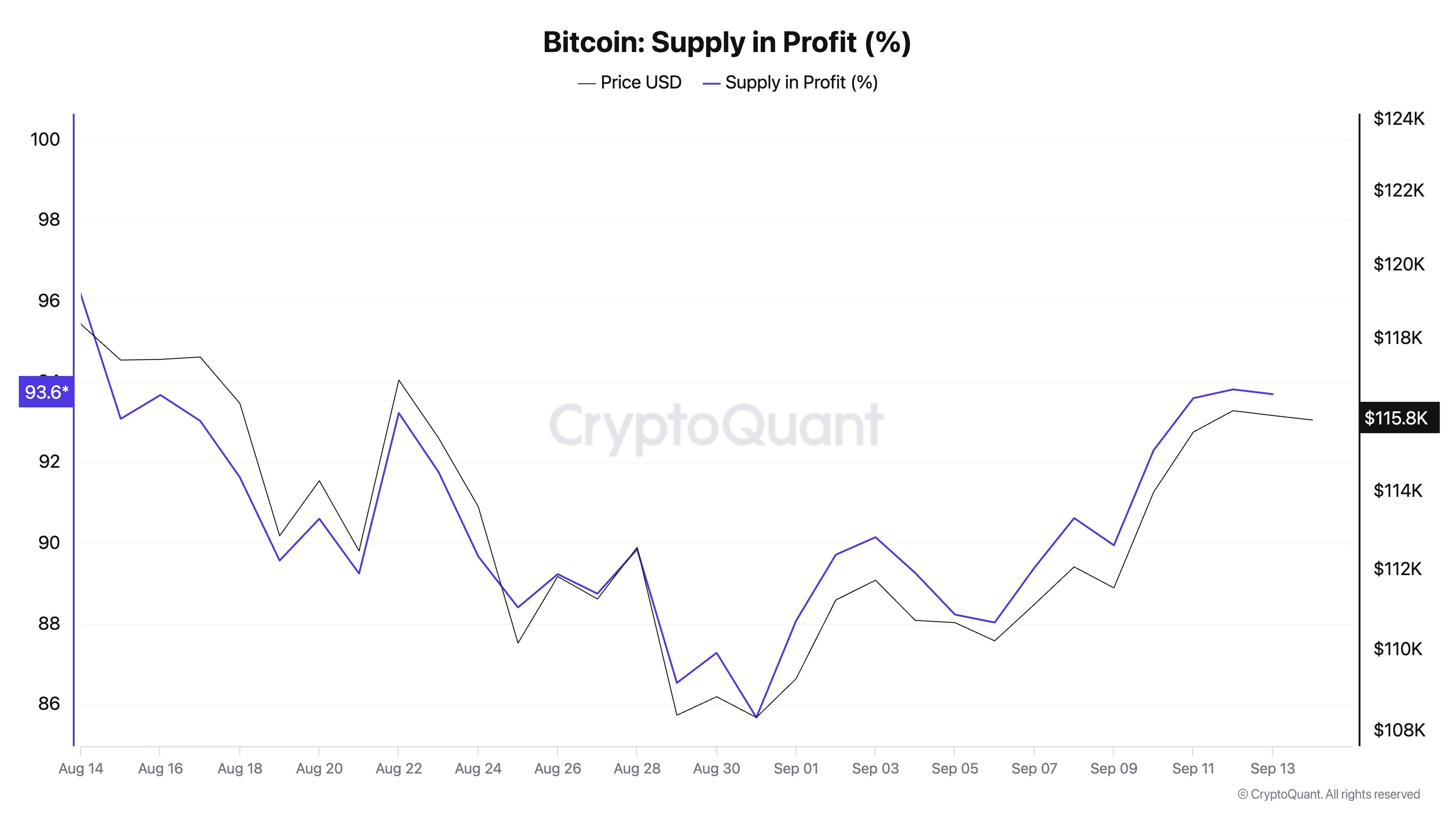

Further strengthening the bullish outlook, data from CryptoQuant reveals that 93.6% of Bitcoin’s circulating supply is currently in profit, a trend that has historically been followed by strong bullish phases.

BTC Supply in Profit. Source:

CryptoQuant

BTC Supply in Profit. Source:

CryptoQuant

In a new report, pseudonymous CryptoQuant analyst Crypto Avails explained that the long-term average of this metric is around 75%, meaning the current level is significantly above normal.

At 93.6%, the analyst argued the trend points to strong optimism and sustained momentum.

“The market is clearly in bull mode. This might scare those thinking “everyone’s in profit, time to run,” but I see it as a positive — it keeps the market’s excitement alive,” Crypto Avails stated.

Break Above $115,892 Could Unlock $122,000

With on-chain activity heating up and profitability reaching levels previously followed by rallies, BTC might be gearing up for another climb.

A decisive break above the $115,892 resistance could trigger a rally toward $119,367. If buy-side pressure strengthens here, BTC could extend its gains and rally to $122,190.

BTC Price Analysis. Source:

TradingView

BTC Price Analysis. Source:

TradingView

However, if bearish dominance grows, BTC could extend its sideways trend and even plunge downward to $111,961.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin plunges 30%. Has it really entered a bear market? A comprehensive assessment using 5 analytical frameworks

Further correction, with a dip to 70,000, has a probability of 15%; continued consolidation with fluctuations, using time to replace space, has a probability of 50%.

Data Insight: Bitcoin's Year-to-Date Gains Turn Negative, Is a Full Bear Market Really Here?

Spot demand remains weak, outflows from US spot ETFs are intensifying, and there has been no new buying from traditional financial allocators.

Why can Bitcoin support a trillion-dollar market cap?

The only way to access the services provided by bitcoin is to purchase the asset itself.

Crypto Has Until 2028 to Avoid a Quantum Collapse, Warns Vitalik Buterin