Date: Sat, Sept 13, 2025 | 06:45 AM GMT

The cryptocurrency market continues to show strength amid the anticipated potential US Federal Reserve rate cuts, with Ethereum (ETH) reclaiming the $4,700 mark today. Following this, several major altcoins are flashing bullish signals — including AI token Bittensor (TAO).

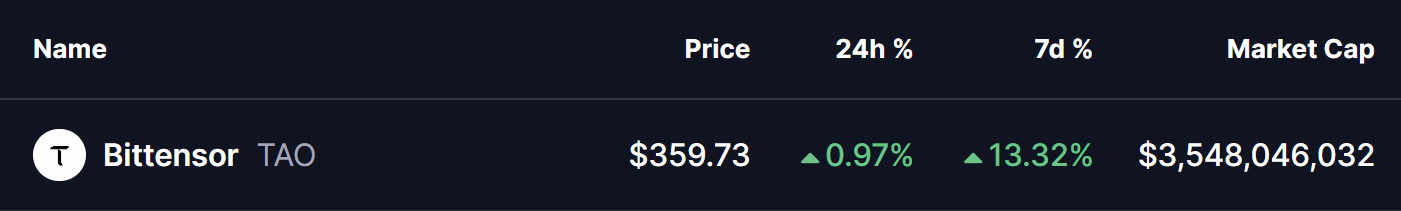

TAO has turned green with a 13% gain over the past week, and more importantly, its chart is now displaying a harmonic structure that could set the stage for further upside momentum.

Source: Coinmarketcap

Source: Coinmarketcap

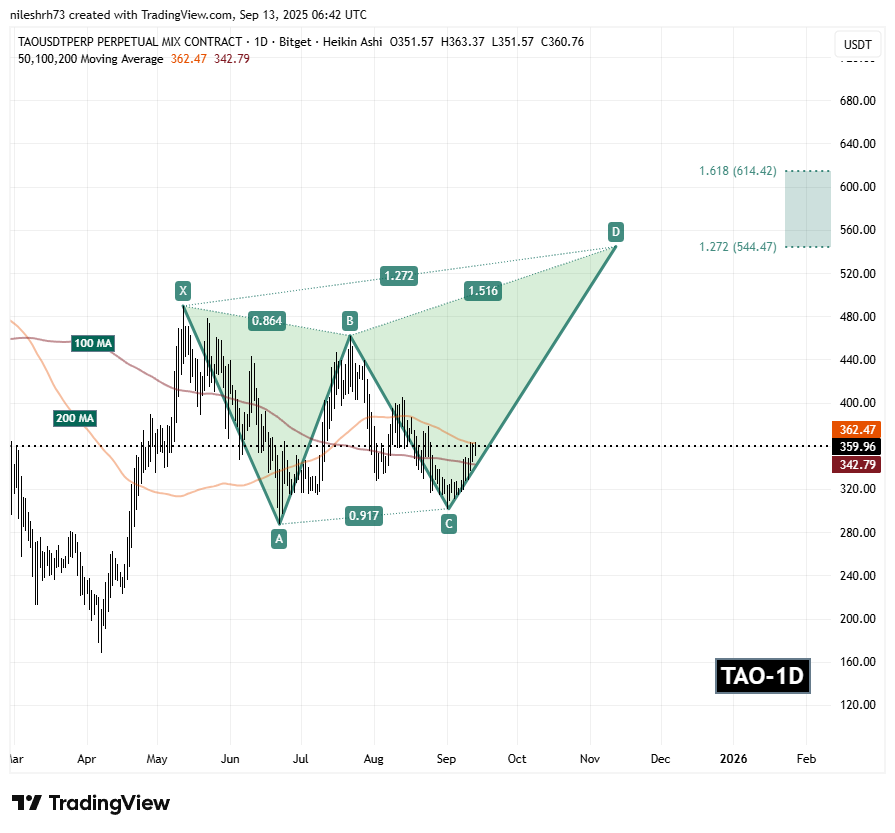

Harmonic Pattern Hints at Potential Upside

On the daily chart, TAO has formed a Bearish Butterfly harmonic pattern. While the name suggests a bearish tilt, the CD leg of this structure often unfolds with a bullish rally before price action approaches the Potential Reversal Zone (PRZ).

The pattern began at Point X ($489.48), dropped to Point A, rallied to Point B, and retraced to Point C near $461.90. From there, TAO regained strength and is now trading around $359.96, reclaiming its 100-day moving average, which shows resilience and steady upside momentum.

Bittensor (TAO) Daily Chart/Coinsprobe (Source: Tradingview)

Bittensor (TAO) Daily Chart/Coinsprobe (Source: Tradingview)

The immediate technical hurdle lies at the 200-day moving average ($362.47). A decisive breakout above this level would likely confirm renewed bullish momentum.

What’s Next for TAO?

If bulls successfully defend the 100-day MA and sustain a move above the 200-day MA, TAO could extend its rally toward the PRZ between $544.47 (1.272 Fibonacci extension) and $614.42 (1.618 extension). These levels are historically where the Butterfly pattern completes, making them critical upside targets.

On the downside, if TAO loses the 100-day MA support, the bullish setup would weaken, opening the door for another round of consolidation.