Monero Price Soars 6% Amid Reorg Shock That Sparked Network Concerns

- Monero price jumps 6% as the network endures a record 18-block reorganization event.

- XMR breaks out of a symmetrical triangle, confirming bullish technical momentum.

- Whale accumulation and positive funding rates strengthen the bullish outlook.

Monero’s XMR token has shaken off weeks of quiet trading and burst into action. After spending early September trapped between $275 and $264, the privacy coin broke free of its narrow range last Friday and hasn’t looked back.

Momentum built over the weekend, despite the sudden 18-block reorganization on the network, which sparked questions about Monero’s resilience and security, adding a layer of caution to the bullish mood. XMR reached a high of $308 on Monday and is trading at $305 at press time. That leaves the token up roughly 6% in the past 24 hours, underscoring the strength behind its latest breakout.

Monero Faces Largest Reorg in Its History

Monero has been shaken by the largest blockchain reorganization in its history, an 18-block reorg that has undermined confidence in the privacy coin’s network. The incident, which began at block height 3,499,659, invalidated 118 transactions and surpassed the 10-block safeguard meant to protect users from such disruptions.

According to cryptocurrency podcaster Xenu, who was among the first to report the development, the reorg was allegedly linked to Qubic, a layer-1 AI-focused blockchain and mining pool that at one point controlled more than 51% of Monero’s hashrate. Xenu remarked that Qubic appeared to be seeking ways to remain relevant and address the decline in its token price.

Cryptocurrency protocol researcher Rucknium warned that “it is highly likely that temporary rolling DNS checkpoints will be deployed very soon,” adding that the community has little time left to raise objections before such measures are introduced.

The reorg has also rattled market participants. Author Vini Barbosa announced he would no longer accept payments in Monero until the issue is sorted, reflecting growing concerns about the network’s reliability at a time of heightened scrutiny.

XMR Breaks Out of Symmetrical Triangle Pattern

Monero has made a decisive breakout from a symmetrical triangle pattern, an action that has focused attention back on the privacy token’s technical outlook. The breakout has anchored XMR around the 38.20% Fibonacci retracement level of $304.43, which at this moment acts as immediate support and a potential launchpad for further movement.

The first hurdle on the upside is the 50% Fibonacci Retracement around $326.42, an area likely to test bullish conviction. Beyond that, the 61.80% retracement around $348.80 is coinciding with a wider area of resistance between $344 and $357, an area regarded as critical for trend reversals.

Source:

TradingView

Source:

TradingView

Sustaining momentum past this area could pave the way for renewed higher retracements, with the 78.60% level at $380.39 and the year’s high at $420, achieved in late May, as longer-term objectives. Still, downside risks are not left out of the picture.

Should XMR retreat, support can be expected to be around 23.60% at $276.98. A retest at this level could yield bullish confirmation, signaling what analysts refer to as a breakout and retest pattern.

This setup recommends expectations of long entries at a reduced cost, anticipating an upward move in advance. Still, it’s important to note that a decisive break below this zone would invalidate the bullish outlook and signal potential for deeper losses.

Related: PEPE Jumps 16% as Bulls Target Breakout Toward $0.000016

On-Chain Data Suggests Room for Sustained Growth

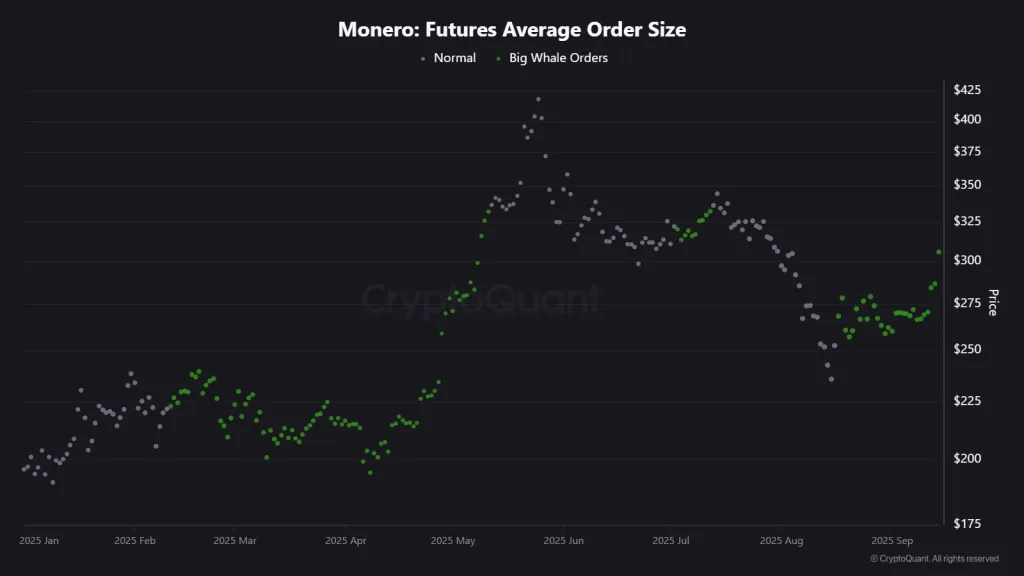

On-chain signals are painting a bullish picture for Monero as large whale orders are continuing to emerge at decisive times. The steady flow of large players since mid-August indicates that institutional players and deep-pocket traders are gradually placing orders, supporting confidence in the market structure for XMR.

Source:

CryptoQuant

Source:

CryptoQuant

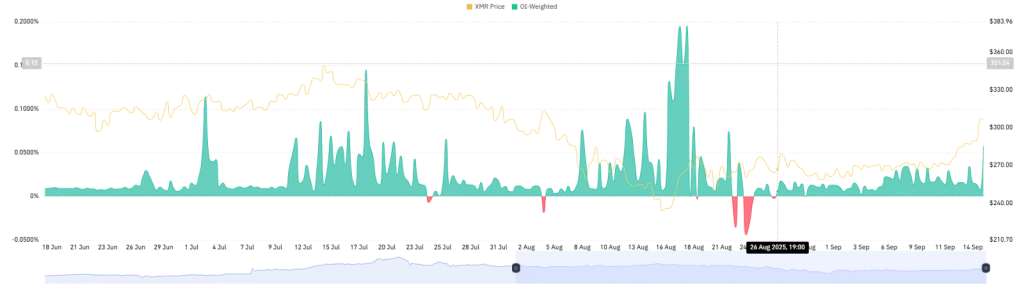

This increased appetite matches changes in derivatives data. Open interest-weighted funding rates have stood firmly in positive territory since late August, indicating that traders are now positioning for higher prices instead of retreating.

Source:

Coinglass

Source:

Coinglass

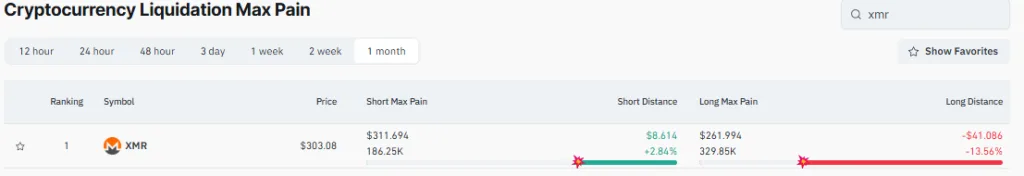

The trend highlights a strengthening conviction in the market’s upward potential. Liquidation dynamics add another layer to this outlook. With Monero trading near $303, short positions face maximum pain at $311, a narrow 2.84% move higher.

Source:

Coinglass

Source:

Coinglass

By contrast, long positions do not hit their own max pain until $262, leaving far more cushion to the downside. The imbalance tilts pressure onto shorts, setting the stage for a potential squeeze that could fuel further price gains as bearish bets are forced to unwind.

Conclusion

Monero’s outlook remains tilted toward the bulls, with technical momentum, on-chain accumulation, and favorable derivatives data aligning to support higher prices. Yet, the network’s recent reorganization underscores ongoing risks that traders cannot ignore. For now, momentum favors the upside, with support levels providing confidence and resistance zones guiding the next tests.

The post Monero Price Soars 6% Amid Reorg Shock That Sparked Network Concerns appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026