Will Tesla and xAI merge? Hedge fund tycoon: It feels inevitable

Positive remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a possible merger between Tesla and xAI.

The optimistic remarks from SkyBridge Capital founder Anthony Scaramucci have further fueled expectations of a potential merger between Tesla and xAI. Well-known tech analyst and Deepwater Asset Management co-founder Gene Munster analyzed that the combination of the two could help Tesla reach its ambitious market cap target of $8.5 trillion.

Written by: Li Xiaoyin

Source: Wallstreetcn

The possibility of a merger between Tesla and Elon Musk’s AI startup xAI is evolving from market speculation to a serious discussion.

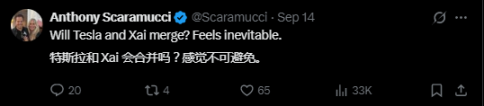

On Sunday, SkyBridge Capital founder Anthony Scaramucci posted on social platform X, stating that as Musk accelerates the integration of AI into his business empire, a merger between Tesla and xAI “feels inevitable.” This statement further stoked already rising expectations of a merger.

Scaramucci’s tweet came after news broke that Tesla shareholders had submitted a formal proposal. According to reports, the proposal urges Tesla’s board to authorize an investment in xAI, marking the first time the capital connection between the two companies has been placed on the formal agenda.

Deeper signals are hidden in Tesla’s recently disclosed new decade-long compensation plan for Musk. As previously mentioned by Wallstreetcn, according to Morgan Stanley’s analysis, the plan includes a key clause allowing for the adjustment of performance targets in the event of a “significant” acquisition, which has been widely interpreted as paving the way for a potential future merger with xAI, making the synergy between the two companies part of Tesla’s long-term strategy.

Shareholder Proposal Fuels Merger Expectations

The direct impetus to bundle Tesla with xAI comes from investors themselves. According to Tesla’s proxy statement, 56-year-old investor Stephen Hawk from Florida submitted a shareholder proposal suggesting the company invest in xAI. This proposal will be voted on at the company’s annual shareholder meeting on November 6, alongside Musk’s highly controversial compensation plan.

Stephen Hawk stated in an email that he was inspired by Musk’s previous posts on social media hinting at cooperation between the two parties. He believes that “formally establishing this partnership is crucial to ensuring both parties’ clear mutual interests.”

In fact, Musk himself is open to the idea. Not only has he solicited opinions from fans on the X platform, but he also told investors in July this year, “We will act according to the wishes of shareholders.” This makes the outcome of the shareholder meeting vote a potentially key step in determining the future relationship between the two companies.

Musk’s New Compensation Plan Hints at Merger Signals

For investors, what may be more substantive than the shareholder proposal is Musk’s long-term compensation plan, which could be worth up to $1 trillion.

Earlier this month, Morgan Stanley analysts including Adam Jonas pointed out in a research report that the plan aims to address investor concerns about Musk’s attention being divided among xAI, SpaceX, and other companies.

The report states that Musk has made it clear he wants to hold at least 25% of Tesla’s equity to have veto power in the event of a change in company control, and the new plan provides an incentive path for this. More importantly, a supplementary clause regarding acquisitions in the plan has attracted significant market attention. The clause stipulates that “market capitalization and adjusted EBITDA milestone targets may be adjusted to account for Tesla acquisition activities deemed to have a significant impact on milestone achievement.”

Analysts believe this wording leaves flexible institutional space for the future combination of interests between Tesla and xAI. The Morgan Stanley report bluntly states that this provides a clear “interface” for the merger of the two companies, indicating that such integration is already part of Tesla’s long-term strategic considerations.

Tesla’s Market Cap Poised to Reach $8.5 Trillion

Market expectations for a merger are based on the existing synergies between the two companies.

Musk has always positioned Tesla as a “real-world AI” company, with its core being the driving force behind autonomous driving and the Optimus humanoid robot. The Grok large language model developed by xAI has already been integrated as an AI companion into Optimus and some Tesla vehicles. In addition, xAI has also purchased Tesla’s industrial batteries to power its data centers.

Some analysts believe that a merger would unlock tremendous value. Well-known tech analyst and Deepwater Asset Management co-founder Gene Munster suggested earlier this month that the combination of Tesla and xAI could help the former reach its ambitious market cap target of $8.5 trillion.

Now, this view is becoming mainstream. With xAI’s own valuation already exceeding $100 billion and seeking a valuation as high as $200 billion, how to allow Tesla shareholders to share in the huge gains brought by its AI breakthroughs has become a key issue Musk needs to address.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin security reaches a historic high, but miner revenue drops to a historic low. Where will mining companies find new sources of income?

The current paradox of the Bitcoin network is particularly striking: while the protocol layer has never been more secure due to high hash power, the underlying mining industry is facing pressure from capital liquidation and consolidation.

What are the privacy messaging apps Session and SimpleX donated by Vitalik?

Why did Vitalik take action? From content encryption to metadata privacy.

The covert war escalates: Hyperliquid faces a "kamikaze" attack, but the real battle may have just begun

The attacker incurred a loss of 3 million in a "suicidal" attack, but may have achieved breakeven through external hedging. This appears more like a low-cost "stress test" targeting the protocol's defensive capabilities.