BTC Market Pulse: Week 38

Over the last week, the market managed to recover back to $116k amid anticipation of a Fed rate cut, but is now facing renewed sell pressure.

Overview

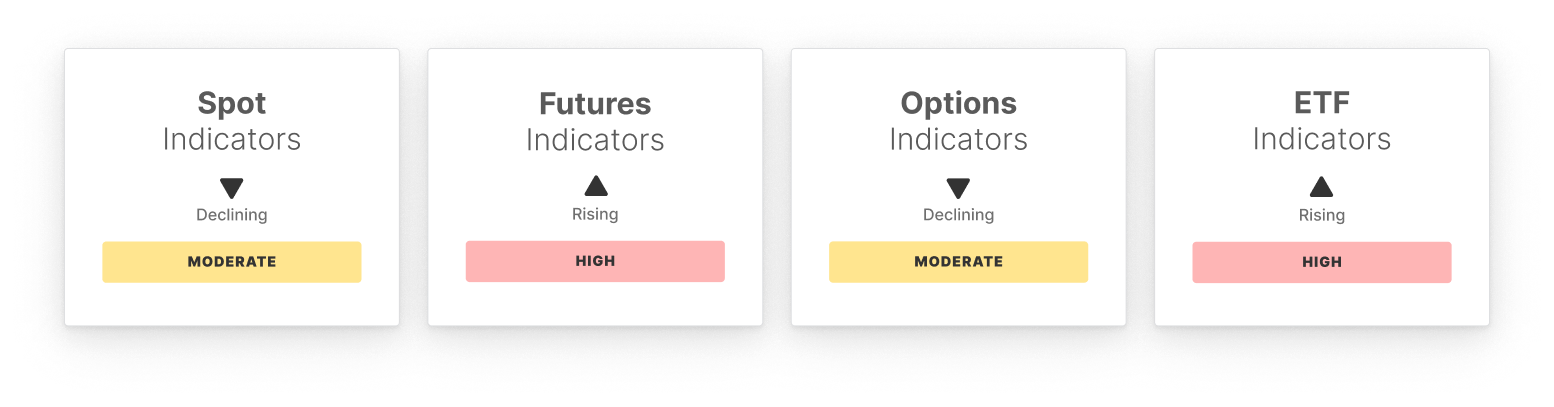

In the spot market, RSI surged into overbought territory, while CVD weakened and volumes held flat, reflecting strong momentum but limited conviction as sellers pressed into strength.

The futures market showed elevated participation, with open interest rising and perpetual CVD spiking on aggressive buy-side flows. Yet, softer funding highlighted reduced long demand, suggesting leverage remains active but sentiment is shifting toward caution.

In the options market, open interest grew, but volatility spreads fell below range and skew declined sharply, pointing to reduced hedging and a more complacent tone. Traders appear less defensive, though this raises the risk of surprise if volatility re-emerges.

Flows into US spot ETFs strengthened significantly, with net inflows far above range and trade volumes steady, signaling robust institutional demand. ETF MVRV climbed, keeping holders in profit, reinforcing cautious optimism from TradFi investors.

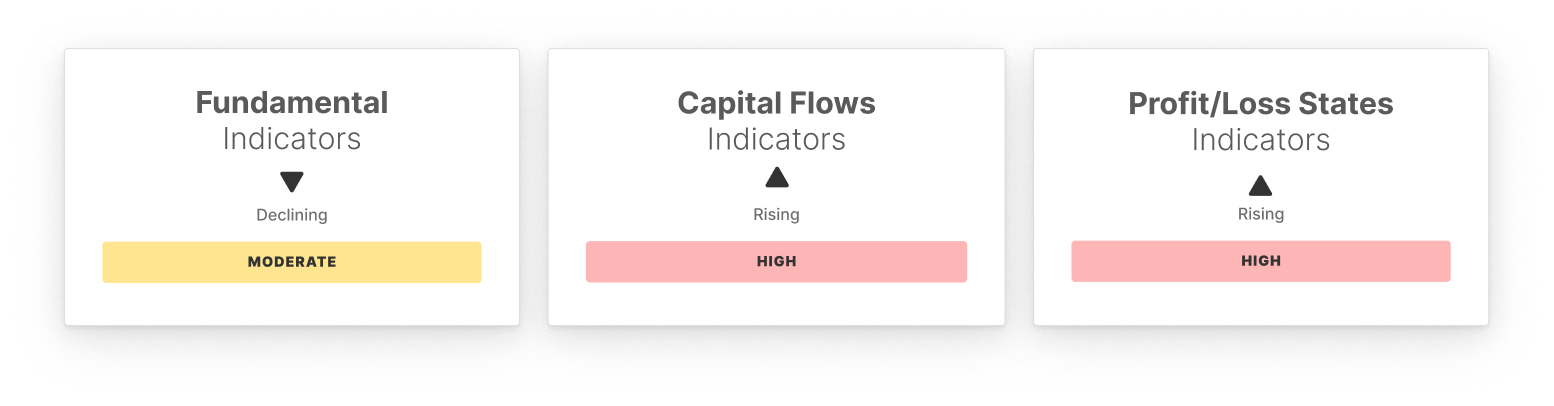

On-chain fundamentals were mixed, with addresses slipping toward cycle lows, but transfer volume increasing, suggesting renewed capital flows despite quieter user activity. Fees dipped, underscoring softer block space demand and subdued speculative pressure.

Capital flows signaled balance, with realized cap change steady, STH/LTH ratio rising slightly, and hot capital share edging higher, showing moderate speculative presence but a stable underlying structure.

Profitability metrics improved, with supply in profit, NUPL, and realized P/L all rising. This highlights broad investor profitability and stronger sentiment, though elevated profit realization raises the risk of demand exhaustion.

In sum, the market benefited from macro-driven momentum, with ETF inflows and futures accumulation supporting the recovery. Yet, weakening spot flows, softer funding, and rising profit-taking point to emerging sell pressure. Sentiment is improving, but fragility remains, leaving Bitcoin vulnerable if demand fails to sustain.

Off-Chain Indicators

On-Chain Indicators

Don't miss it!

Smart market intelligence, straight to your inbox.

Subscribe nowPlease read our Transparency Notice when using exchange data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Base-Solana Bridge Dispute: "Vampire Attack" or Multichain Pragmatism?

The root of the contradiction lies in the fact that Base and Solana occupy completely different positions in the "liquidity hierarchy."

Stable TGE tonight: Is the market still buying into the stablecoin public chain narrative?

According to Polymarket data, there is an 85% probability that its FDV will exceed 2 billion USD on the day after its launch.

The Federal Reserve is likely to implement a hawkish rate cut this week, with internal "infighting" about to begin.

This week's Federal Reserve meeting may feature a controversial "hawkish rate cut." According to the former Vice Chair of the Federal Reserve, the upcoming 2026 economic outlook may be more worth watching than the rate cut itself.

Discover How ZKsync Fast-Tracks Blockchain Security

In Brief ZKsync Lite will be retired by 2026, having achieved its goals. ZKsync team plans a structured transition, ensuring asset security. Future focus shifts to ZK Stack and Prividium for broader application.