Japanese financial giant Credit Saison launches investment fund for real-world asset startups

ChainCatcher news, according to The Block, the venture capital arm of Japanese financial giant Credit Saison will launch a blockchain investment fund called Onigiri Capital.

The fund has a scale of $50 million, aiming to build an institutional-level bridge between U.S. innovation and Asia's mature blockchain and financial networks, helping founders create global financial products. According to a spokesperson, Onigiri is backed by Saison Capital and has raised $35 million through "joint investment from Credit Saison and external investors." The fund's maximum limit is $50 million, with the possibility of accepting additional capital. The fund will focus on early-stage startups in the real-world asset sector, covering financial infrastructure such as stablecoins, payments, tokenization, and DeFi, with particular attention to connections with Asia. Credit Saison is a large financial services company based in Tokyo, affiliated with Mizuho Financial Group, and is the third-largest credit card issuer in Japan. It is also involved in multiple business sectors, and its venture capital arm has been investing in cryptocurrency companies since 2023.

.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Barcelona Football Club criticized for signing a $22 million sponsorship deal with crypto company ZKP

Swedish payment giant Klarna's first stablecoin, KlarnaUSD, has been launched ahead of schedule

Bitcoin OG opens 5x ETH short position worth $15.04 million

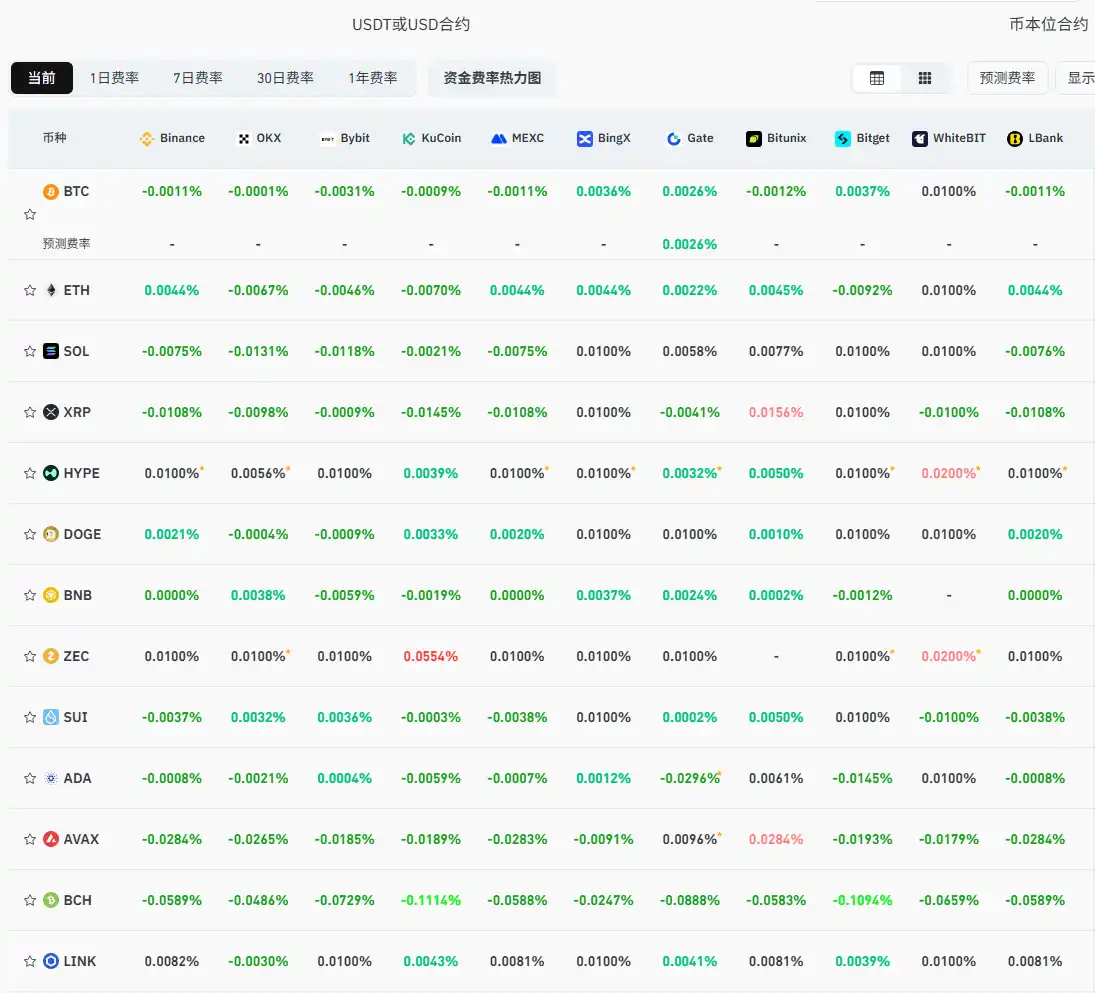

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish