MoonPay Acquires Meso to Expand Cryptocurrency Payments

- MoonPay Acquires Meso and Expands Global Presence

- Cryptocurrency payments gain new integration

- Startup Meso strengthens MoonPay's structure

MoonPay, a company specializing in cryptocurrency payments infrastructure, announced the acquisition of the startup Meso, in a strategic move to expand its international presence and strengthen its payments ecosystem.

According to an official statement, the goal is to integrate banking systems, card networks, stablecoins, and blockchains into a single regulatory framework that encompasses both US licenses and the MiCA guidelines in force in the European Union. The company seeks to consolidate a global payments network compatible with the growth of cryptocurrencies as a means of exchange.

"We've built trusted platforms that have brought millions into crypto, and now we're building a global network that will move money in all forms and across all markets," said Ivan Soto-Wright, co-founder and CEO of MoonPay.

oh hey look at that we're on TV! 👀 pic.twitter.com/W5u88mJiLB

— MoonPay 🟣 (@moonpay) September 15, 2025

With the incorporation of Meso, the startup's co-founders, Ali Aghareza and Ben Mills, now hold strategic positions within MoonPay—as CTO and SVP of Product, respectively. Both have experience at companies such as PayPal, Venmo, and Braintree.

The company did not disclose the amounts involved in the transaction. However, this is just another step in MoonPay's aggressive expansion strategy through acquisitions. By 2025, the company had already integrated Helio, a payments platform with Solana, into its portfolio, as well as the Decent.xyz platform and Iron, a stablecoin infrastructure company.

Despite the rapid pace of acquisitions, MoonPay recently underwent internal adjustments, including the layoff of 10% of its staff. The decision was attributed to the need to reduce costs and improve the company's operating margins.

Since its founding in 2019, MoonPay has established itself as one of the leading solutions for buying and selling crypto assets, having been valued at US$3,4 billion after raising US$555 million in its Series A.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

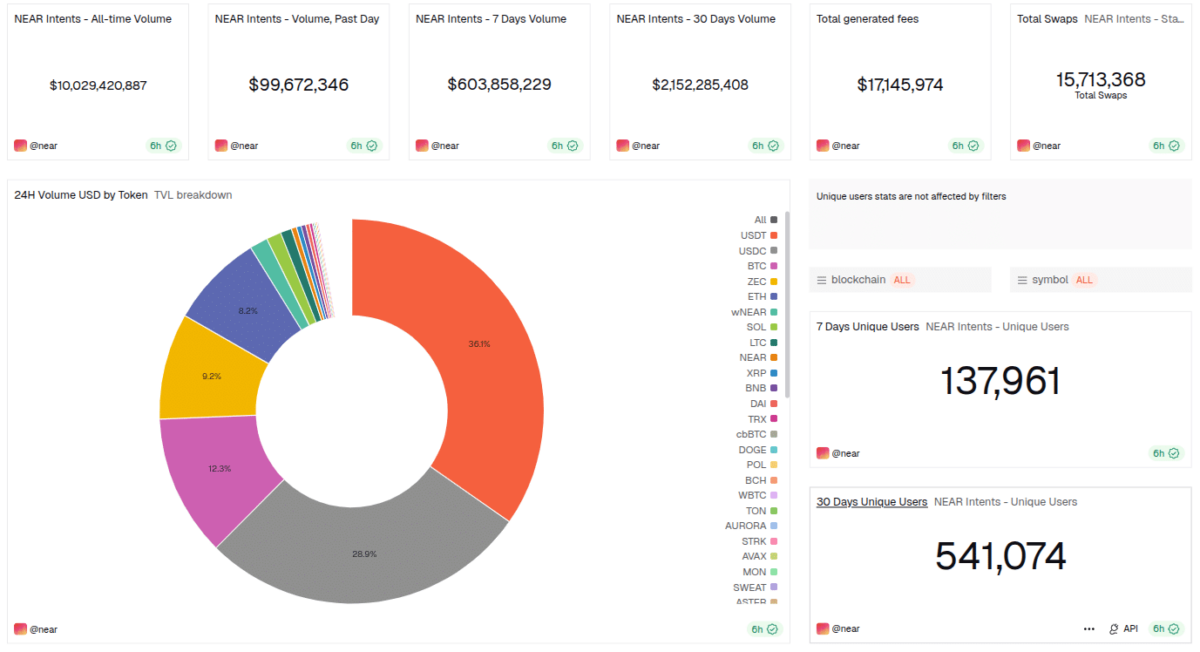

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow

PNC Bank CEO says stablecoins must choose: be a payment tool or a money market fund