Written by: Matt Hougan, Chief Investment Officer at Bitwise

Translated by: Luffy, Foresight News

In my usual CIO memos, I try to share my views on market dynamics. For example, last week I wrote about why it’s “Solana season” now and predicted that Ethereum’s main competitors would make a strong push by the end of the year. Since then, SOL has risen by 7.72%, which is quite impressive.

But observing the crypto market today feels like watching the pre-game show of the Super Bowl. With rate cuts, a surge in ETP inflows, growing concerns about the US dollar, and the strong momentum of tokenization and stablecoins, the market is poised for a major rally at the end of the year. However, as investors, most of us are still on the sidelines. Why is that?

First, historically, August and September are the two worst-performing months of the year for crypto. But more importantly, major developments—such as the recent approval of bitcoin ETPs by major brokerages or progress on new legislation in Congress—often take time to materialize.

So, while we wait, I want to give you some insight into the US Securities and Exchange Commission’s (SEC) stance on crypto ETP approvals. In my view, the SEC is preparing to fully open up this market.

Universal Listing Standards

Currently, spot crypto ETPs are approved by the SEC on a case-by-case basis. If you want to launch a spot crypto ETP based on a new asset in the US (such as a Solana ETP or Chainlink ETP), you must submit a special application to the SEC, requesting the right to do so.

In your application, you must demonstrate certain market conditions: that the market has sufficient liquidity to support the ETP, that the market is not subject to manipulation, and so on.

It’s no exaggeration to say this takes time. The SEC’s review process for each application can take up to 240 days, and even then, approval is not guaranteed. The first spot bitcoin ETP application was submitted in 2013, but it wasn’t until 2024 that the SEC approved related products. Applying has always been a costly and risky endeavor.

But as we speak, the SEC is working to establish “universal listing standards” for crypto ETPs. The idea is: under universal listing standards, as long as an application meets certain clearly stated requirements, the SEC will almost certainly approve it. And the process will be much faster: applications will be approved within 75 days or less.

What are the requirements?

The SEC is still working on this and is listening to feedback from the crypto industry. Currently, most proposals suggest that as long as the underlying asset has futures contracts traded on a US-regulated futures exchange, issuers should be able to launch spot crypto ETPs. Eligible futures exchanges include giants like the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (Cboe), but may also include lesser-known derivatives platforms like Coinbase Derivatives Exchange and Bitnomial. Assuming a broader list is approved, crypto assets that may soon be eligible for ETPs include Solana, XRP, Chainlink, Cardano, Avalanche, Polkadot, Hedera, Dogecoin, Shiba Inu, Litecoin, and Bitcoin Cash, among others. As more futures contracts are launched, this list will likely grow.

What History Tells Us

The universal listing standards could be approved as early as October, and their adoption may bring a large number of new crypto ETPs. This is easy to imagine intuitively, and the history of ETFs also supports this.

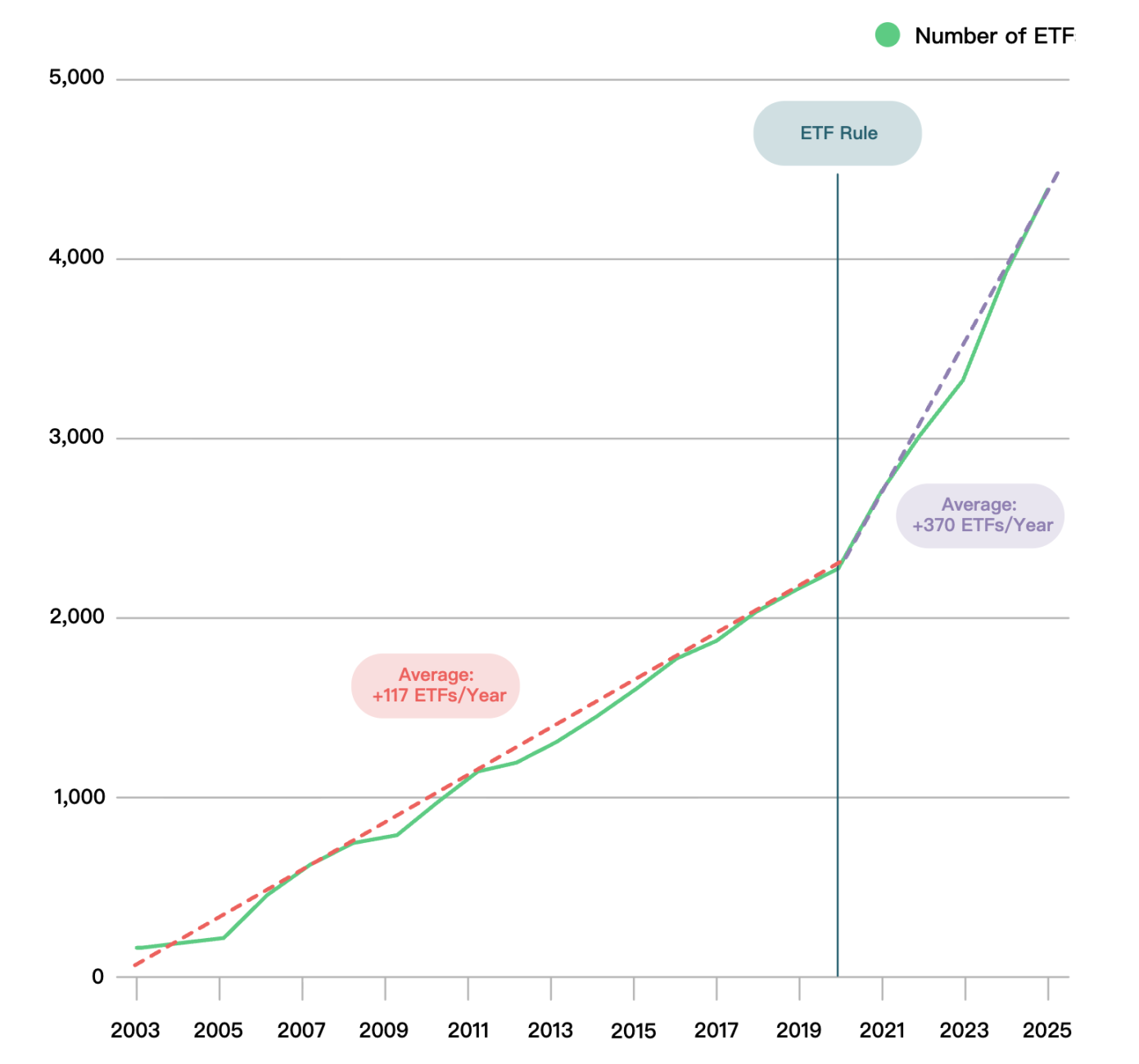

Until the end of 2019, all ETFs followed the same case-by-case regulatory approach that crypto ETPs currently follow. But in 2019, the SEC passed the “ETF Rule,” establishing universal listing standards for equity and bond ETPs. Subsequently, the number of ETF issuances surged.

The following chart from ETFGI shows the number of ETFs listed in the US each year. Before the ETF Rule was passed, an average of 117 new ETFs entered the market each year. Since the ETF Rule took effect, this number has more than doubled to 370 per year.

Source: Bitwise, ETFGI

As the number of ETFs increased, the number of ETF issuers also rose sharply, because it became much easier for companies to launch ETFs.

I expect the same thing to happen in the crypto space. We should see the emergence of dozens of single-asset crypto ETPs as well as index-based crypto ETPs, and we’ll see many traditional asset managers also launching spot crypto ETPs.

What This Means for Crypto Asset Prices

Investors may easily misunderstand the impact on the market. The mere existence of crypto ETPs does not guarantee massive inflows. There needs to be fundamental interest in the underlying asset.

For example, spot Ethereum ETPs were launched in June 2024, but it wasn’t until April 2025, when interest in stablecoins began to rise, that they really started to attract capital. Similarly, I suspect that ETPs based on assets like Bitcoin Cash will struggle to attract inflows unless the asset itself sees renewed momentum.

However, the significance of ETPs is that if fundamentals start to improve, the asset is more likely to see a significant price increase. Most of the world’s capital is controlled by traditional investors, and when ETPs exist, it becomes much easier for these investors to allocate funds to the crypto space.

There’s also a bigger, perhaps harder-to-quantify point: ETPs demystify crypto. They make crypto less intimidating and more accessible to ordinary investors. For crypto natives with a dozen wallet addresses, Chainlink, Avalanche, and Polkadot are no longer strange-sounding tokens; they are ticker symbols anyone can access in a brokerage account. This brings more real-world attention to crypto and its many use cases. People are more likely to notice articles about Chainlink partnering with Mastercard for payments, Wyoming issuing stablecoins on Avalanche, or Standard Chartered exploring cross-border payments using Ripple technology.

The SEC’s adoption of universal listing standards is a “coming of age” moment for crypto—a signal that we have entered the mainstream—but it’s just the beginning.