US Congress Debates Bitcoin Law with Crypto Industry Leaders

- Bitcoin Law Proposes Government Purchase of 1 Million BTC

- Crypto and TradFi company leaders participate in the roundtable

- Strategies seek neutral financing at no cost to taxpayers

US lawmakers are holding a roundtable today with 18 industry executives cryptocurrency conference to discuss the next steps of the Bitcoin Act. The bill, introduced in March by Senator Cynthia Lummis, calls for the U.S. government to acquire 1 million Bitcoins over five years using budget-neutral financing mechanisms.

Attendees include prominent figures in the crypto sector, such as Michael Saylor of Strategy, Tom Lee of BitMine, and Fred Thiel of Marathon Digital (MARA). Representatives from mining companies such as CleanSpark, along with Matt Schultz and Margeaux Plaisted, as well as executives from Bitdeer and MARA itself, have also confirmed their attendance. The meeting also includes cryptocurrency venture capital fund managers such as Off the Chain Capital and Reserve One, as well as Andrew McCormick, head of eToro's US operations.

From the traditional financial industry, executives such as David Fragale of Western Alliance Bank and Jay Bluestine of Blue Square Wealth participated in the debate, reinforcing the initiative's hybrid nature. The meeting was organized by Digital Chambers and the Digital Power Network, organizations that advocate and promote cryptocurrency-related policies in Washington.

The main focus is on building political consensus to make the Bitcoin Law viable. Proposals under consideration include the revaluation of Treasury gold certificates and the use of tariff revenues as a funding source. According to representatives from Digital Chambers, the goal is to ensure that BTC purchases are made without directly burdening taxpayers.

In addition to funding strategies, the roundtable will address the legislative obstacles that have slowed the project's progress over the past six months. The goal is to anticipate potential objections and work to build a broader base of support in Congress.

If implemented, the proposal would make the United States the largest institutional buyer of Bitcoin on record, expanding the cryptocurrency's presence within the country's economic policy and reinforcing its role as a long-term strategic asset.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

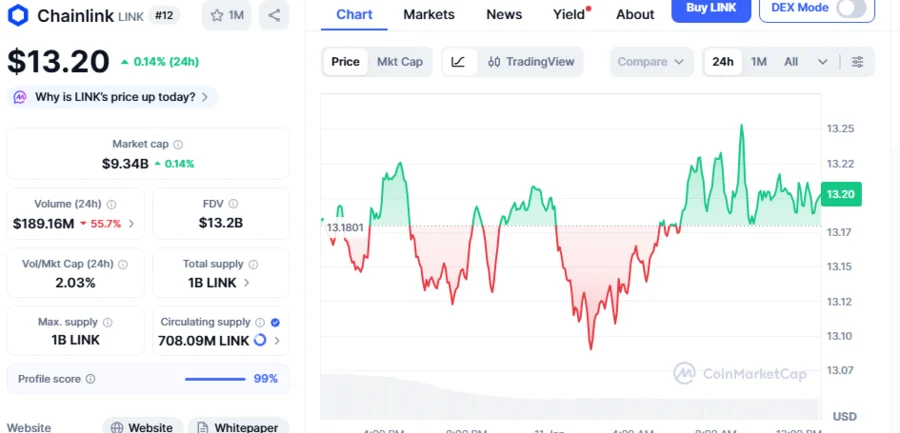

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026