Bitcoin dominance is crumbling toward critical support near 58%, and a decisive break could push BTC.D toward 56.94%, increasing altcoin upside potential. XRP shows notable relative strength and may lead a rotation higher if Bitcoin loses further market share.

-

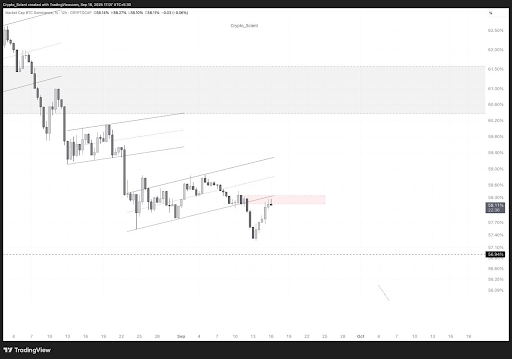

Bitcoin dominance has fallen from ~62.5% to ~58%, testing a major support zone.

-

If 58% fails, traders will watch 56.94% as the next key technical target.

-

XRP is showing relative strength on multi-day charts and could outperform during a BTC.D decline.

Bitcoin dominance drops toward 58% support; watch 56.94% next. Learn market levels, XRP strength, and trader takeaways.

Bitcoin dominance is slipping toward key support near 58%, while XRP shows relative strength and could outperform if BTC.D loses more ground.

- Bitcoin dominance has slid from 62.5% to 58%, showing weakness as sellers continue to control the market trend.

- If the 58% support breaks, Bitcoin dominance could fall further with 56.94% shaping up as the next major target.

- XRP is standing out with relative strength and may lead altcoins higher if Bitcoin dominance keeps falling.

Market summary: Bitcoin’s market dominance is once again facing heavy pressure, increasing risks for BTC and opening potential opportunities for altcoins.

What is Bitcoin dominance doing now?

Bitcoin dominance is currently trading near 58.11%, down from about 62.5% at the start of the month. The decline traces a clear descending trend with multiple failed rallies and increasing sell-side participation, indicating short-term bearish control.

How did BTC.D move to this level?

Dominance fell sharply after buyers failed to defend the 60% area. Repeated retests around 58.5% exposed growing weakness and thinner buying conviction. Volume analysis shows larger selloffs attracted more participation, confirming the downward bias.

Why does 58% matter and what comes next?

Support near 58% acts as a structural pivot: it marks the boundary where market leadership can shift from Bitcoin to altcoins. If 58% collapses, the next confluence target is 56.94%, which aligns with recent lows and broader technical indicators.

How could a break of 58% affect altcoins like XRP?

When Bitcoin dominance declines, capital often rotates into altcoins. XRP is showing relative strength on 12-hour and daily charts—higher highs on rolling volume and resilience versus ETH and BTC. This positions XRP to potentially lead a short to medium-term altcoin rebound.

Testing Key Support Levels

By mid-September, dominance settled near 58.5%, forming a critical support zone. Buyers attempted to defend this area, creating short bursts of stability. However, repeated retests revealed weakening demand and lower highs.

Source: Scient

Source: Scient

Most recently, dominance traded at 58.11%, hovering near support but lacking a strong reversal. Trendlines from recent peaks reinforce the downward trajectory, and candlestick structures show sellers stepping in on rallies.

Next Possible Downside Target

If support around 58% collapses decisively, traders have identified 56.94% as the next major technical target. This level aligns with prior consolidation and is consistent with momentum indicators pointing to extended weakness.

Alternatively, if BTC.D stabilizes above 58% and reclaims breakdown levels, altcoin strength may fade. For now, the market favors a fragile setup that benefits nimble, risk-managed trades.

Frequently Asked Questions

What are the immediate levels to monitor on BTC.D?

Monitor 58% as immediate support and 56.94% as the next downside target. On the upside, watch recent breakdown points and descending trendline resistance for signs of a reclaim.

Is XRP likely to outperform if BTC dominance drops?

XRP currently shows relative strength on 12-hour charts with supportive volume, making it a plausible leader in a rotation. Performance depends on confirmation via sustained price and volume follow-through.

How should traders manage risk around BTC dominance moves?

Use defined stops, size positions conservatively, and confirm moves with increasing volume. Consider scaling exposure into confirmed altcoin strength rather than chasing early bounces.

Key Takeaways

- BTC.D weakness: Dominance has fallen from ~62.5% to ~58% and remains vulnerability to further declines.

- Watch 56.94%: A decisive break of 58% could target 56.94%, increasing altcoin upside potential.

- XRP setup: XRP shows relative strength and volume characteristics that could make it an early leader if rotation occurs.

Conclusion

Bitcoin dominance is testing crucial support near 58%, with 56.94% the next technical target if sellers persist. XRP is an asset to watch for early signs of altcoin leadership. Traders should prioritize confirmed volume and candlestick validation before increasing exposure. For continued coverage and updates, follow COINOTAG reporting and market data.