Date: Tue, Sept 16, 2025 | 05:36 PM GMT

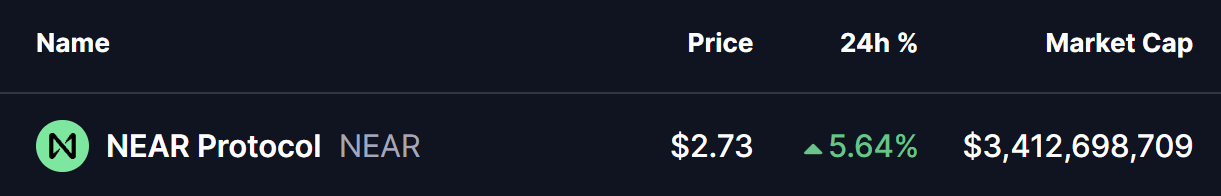

The cryptocurrency market is showing slight resilience ahead of the US Federal Reserve meeting this week, with Bitcoin (BTC) and Ethereum (ETH) both trading in green today. Meanwhile, several altcoins are delivering noticeable gains — including the AI-linked token Near Protocol (NEAR).

NEAR is trading with a solid 5% daily jump. More importantly, its price action is shaping into a harmonic structure that could be signaling a larger upside move in the near term.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the daily chart, NEAR has formed a Bearish Butterfly harmonic pattern. Despite its bearish label, this setup often sees bullish continuation during the “CD leg” as the price advances toward the Potential Reversal Zone (PRZ).

The structure began at Point X ($3.38), dipped to Point A, rebounded to Point B, and retraced lower to Point C near $2.27. From there, NEAR regained momentum, climbing as high as $2.89 before being rejected by a descending resistance trendline.

Near Protocol (NEAR) Daily Chart/Coinsprobe (Source: Tradingview)

Near Protocol (NEAR) Daily Chart/Coinsprobe (Source: Tradingview)

That rejection led to a pullback toward the 200-day moving average (MA) at $2.55, where buyers stepped in strongly, lifting the token back to $2.73 at the time of writing.

Currently, all eyes are on the descending resistance line that has capped NEAR’s recent attempts to break higher.

What’s Next for NEAR?

If bulls defend the 200-day MA and push NEAR above the descending resistance, the token could accelerate toward the PRZ with key targets first at $3.81 (1.272 Fib extension) and then at $4.36 (1.618 Fib extension). These levels mark the completion zone of the harmonic pattern and could represent significant upside potential.

On the downside, a break back below the 200-day MA at $2.55 would weaken bullish momentum and risk delaying the breakout, keeping NEAR in consolidation.