Ethereum’s validator exit queue reached a record ~2.6M ETH (~$12B), signaling large unstaking flows while ETH blobs demand surges and Aave data shows Ethereum mainnet still generates ~87% of protocol revenue; Ether trades near $4,500 amid rising futures Open Interest.

-

$12B in ETH waiting to exit validators — longest queue on record

-

Blob demand rising after EIP-4844 adoption, increasing L2 activity and on-chain burns

-

Ethereum mainnet produced 86.6% of Aave revenue in the last 12 months

Ethereum exit queue tops $12B; ETH blobs surge and Aave shows 87% mainnet revenue — read key impacts and next steps for traders and validators.

What caused the Ethereum (ETH) exit queue to reach $12,000,000,000?

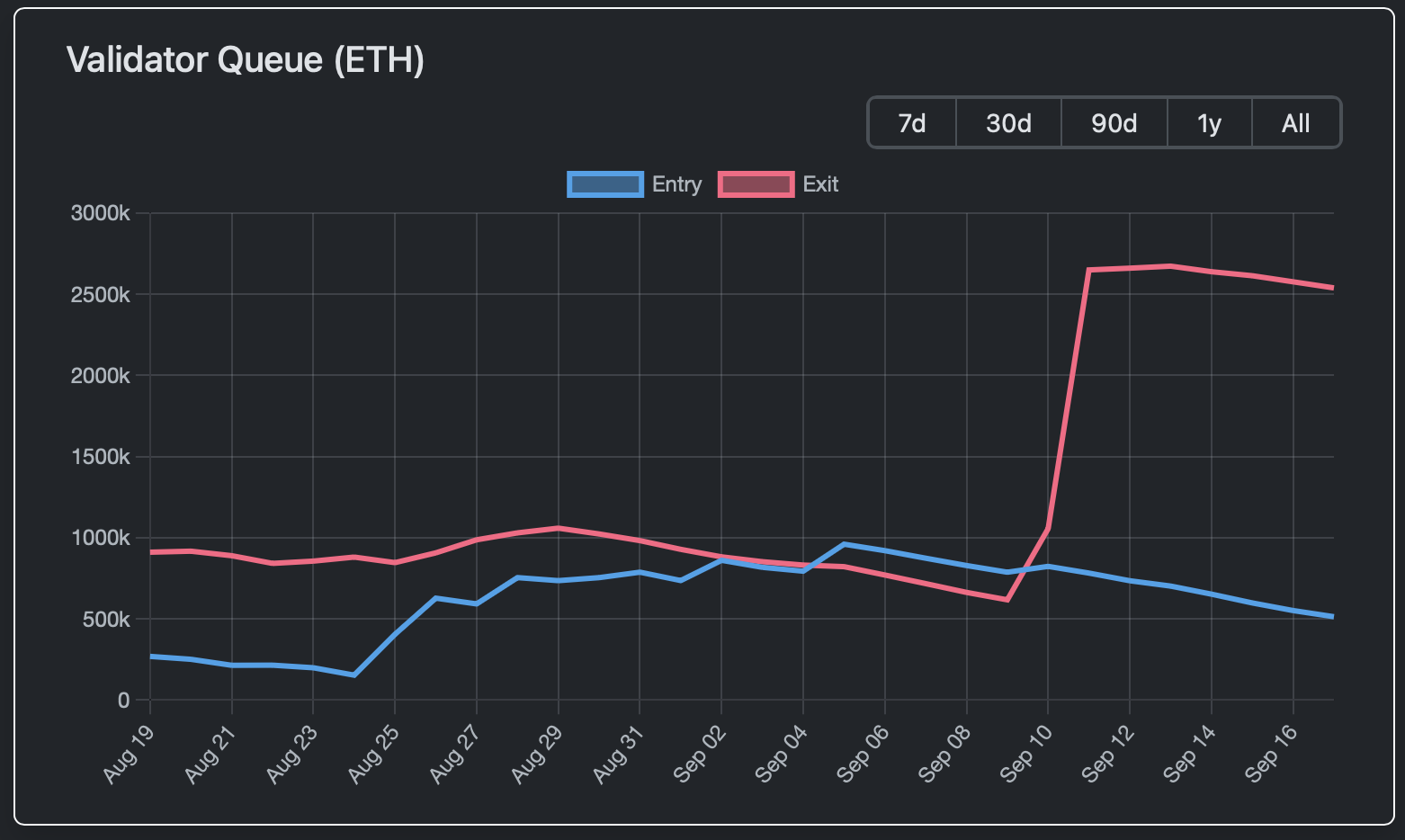

The Ethereum (ETH) exit queue surged as validators signaled withdrawals, creating a backlog of ~2,600,000 ETH (about $12 billion) waiting to be unstaked. The queue implies a minimum 44-day processing window, raising potential selling pressure if large unstaked balances hit markets.

How long will the validator exit queue take to clear and why it matters?

At current withdrawal rates the exit queue will take a minimum of 44 days to clear. Longer wait times mean a sustained period where large sell-side supply could enter spot markets. Conversely, some exits may reflect institutional redeployment into corporate treasuries rather than immediate sell orders.

$12,000,000,000: Ethereum (ETH) exit queue hits all-time high

The Ethereum (ETH) validator exit queue jumped to a record high today. As of press time, over 2,600,000 ETH — roughly $12,000,000,000 in market value — are queued to be unstaked by validators.

Image by Validator Queue

The backlog implies a minimum 44-day wait to fully clear at current withdrawal throughput. That is the longest recorded processing window for the network and increases short-term liquidity risk.

By contrast, new staking interest has decreased: the ETH staking queue fell below 500,000 ETH. This imbalance can amplify market impact if withdrawn ETH is sold, though some exits may represent corporate or institutional reallocation rather than retail selling.

What are Ethereum (ETH) blobs and why are they filling up?

ETH blobs are temporary large data objects introduced via EIP-4844 to optimize L1/L2 data availability. Increased blob usage signals rising L2 activity and higher transaction throughput across rollups.

What does rising blob demand mean for network efficiency and fees?

Blobs reduce calldata costs and streamline L2-to-L1 proofs, lowering fees for rollups. As blob space fills, developers may expand blob capacity to avoid verification delays. Higher blob usage also correlates with elevated ETH burn rates from fee mechanics tied to transaction demand.

Why does Ethereum mainnet still generate most of Aave’s revenue?

Marc Zeller of the Aave Chan Initiative reports that in the past 12 months, Ethereum mainnet accounted for 86.6% of Aave protocol revenue. This shows persistent user preference for mainnet liquidity despite cheaper, faster alternatives.

Other chains where Aave operates — Polygon, Avalanche, Arbitrum, Optimism and Harmony — provide lower fees and faster settlement, but they have not matched mainnet volume. The data suggests L1 scaling remains a priority for many DeFi users.

How is Ethereum (ETH) price reacting to these developments?

Ether is attempting to hold above the psychological $4,500 level. Over the last 24 hours ETH added ~0.51% amid rising spot volumes. Open Interest on futures markets remains elevated, indicating sustained derivative demand.

Image by CoinMarketCap

At press time ETH trades near $4,483 on major spot venues. Traders should monitor exit queue flow, blob utilization, and on-chain burn trends for near-term directional cues.

Frequently Asked Questions

How likely is the exit queue to trigger a price drop?

Large withdrawals increase sell-side liquidity risk, but price impact depends on how much unstaked ETH is actually sold versus redeployed. Institutional exits into treasuries would have a muted sell effect compared with retail liquidations.

What does rising blob usage mean for L2 users?

Rising blob demand typically lowers L2 transaction costs and improves throughput. This benefits users with cheaper rollup transactions and faster confirmation times when blob capacity is sufficient.

Key Takeaways

- Exit queue risk: ~2.6M ETH (~$12B) in queue could pressure markets if sold.

- Blob demand: EIP-4844 blobs indicate growing L2 adoption and higher burn activity.

- Mainnet dominance: Aave data shows Ethereum mainnet produced ~86.6% of revenue over 12 months.

Conclusion

Ethereum’s current dynamics — a record validator exit queue, surging blob utilization, and strong Aave revenue share on mainnet — illustrate a network experiencing both high demand and transitional capital flows. Market participants should track queue progression, blob capacity, and on-chain burn metrics for near-term signals and risk management.