Strive bets $675 million to acquire Bitcoin treasury company at 200% premium to stock price

Asset manager Strive has reached an agreement to purchase Bitcoin-focused Semler Scientific in a fully equity-based rather than cash-based deal.

Under the terms announced Sept. 22, each Semler Scientific share will convert into 21.05 Strive Class A common shares, valuing the target at $90.52 per share. That price represents a premium of more than 200% compared with its recent market value.

The merger outlines a two-track plan for the future company. Semler’s well-established diagnostic line could be monetized directly or spun out to deliver shareholder returns.

At the same time, Strive and Semler leaders plan to broaden the scope of preventative diagnostics, with a new management team guiding the transition.

Strive’s current directors will remain in place, while Semler Scientific Executive Chairman Eric Semler will join the combined board.

Semler called the arrangement a way to secure “direct participation in one of the most innovative Bitcoin strategies in the public markets,” pointing to the opportunity to evolve the firm’s diagnostic tools into a preventative care platform focused on early detection of chronic illness.

Bitcoin treasury

Alongside the acquisition announcement, Strive disclosed a major balance-sheet move of acquiring 5,816 Bitcoin at an average price of $116,047. This amounted to a total of $675 million, including fees.

This addition lifted Strive’s treasury to 5,886 BTC. According to public data trackers, once the merger closes, the combined company is projected to control more than 10,900 BTC, a holding large enough to place it among the 15 biggest corporate Bitcoin treasuries globally.

Matt Cole, Chairman & CEO of Strive, said:

“We believe our alpha-seeking strategies and capital structure position us to outperform Bitcoin over the long run. This transaction showcases how we can grow Bitcoin holdings and Bitcoin per share at an unmatched pace in the industry to drive equity value accretion.”

These transactions illustrate Strive’s desired positioning strategy as a Digital Asset Treasury operator. Earlier this year, the firm absorbed Asset Entities, which enabled it to rebrand under the Strive name and continue trading on Nasdaq.

At that time, executives described a model built on exchanging equity for Bitcoin, an approach they argued improves tax efficiency, and acquiring companies rich in cash but undervalued in equity markets.

The post Strive bets $675 million to acquire Bitcoin treasury company at 200% premium to stock price appeared first on CryptoSlate.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

PI Price Analysis: PI Holds $0.20 Support After Triangle Breakdown—What’s Next?

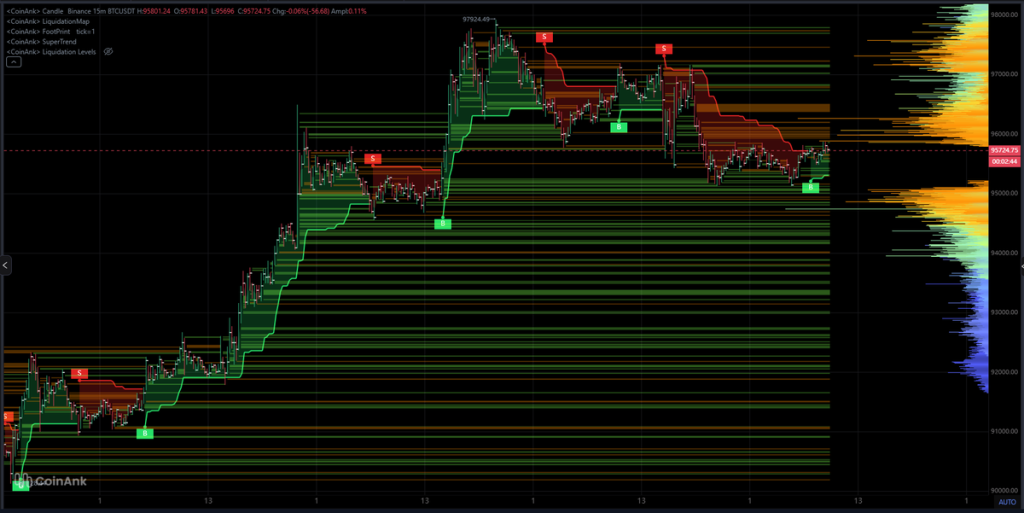

Bitcoin Trend Cools After Spike to $98K: Key BTC Price Levels to Watch Over the Next 48 Hours

Ethereum Price Hits a Key Zone vs. Bitcoin—Is an Altcoin Rotation Finally Starting?