Web3 Social Media App UXLINK Reportedly Suffered A $11 Million Hack

A suspected $11.3 million hack has rocked UXLINK, draining key assets and triggering a token crash. With no official response yet, investor confidence faces a steep challenge.

UXLINK’s token value is cratering after Cyvers reported a suspected $11.3 million hack. Hackers apparently stole UXLINK tokens worth $3 million alongside a host of other assets.

The platform confirmed that the breach occurred on their multi-signature wallet and hackers are transferring the funds to multiple CEX and DEXs.

Major UXLINK Hack

UXLINK is an ambitious project, aiming to create a new AI-powered social infrastructure for Web3 ecosystems. Since its launch in 2023, it gained a lot of notoriety, but a recent hack may cause real problems.

Cyvers reported a major suspected hack at UXLINK involving $11.3 million in suspicious transactions. Essentially, one address used delegateCall to remove the admin role, adding a new multisig owner with addOwnerWithThreshold.

This enabled nefarious actors to start draining assets.

Urgent Security NoticeWe have identified a security breach involving our multi-signature wallet, resulting in a significant amount of cryptocurrency being illicitly transferred to both CEXs and DEXs.Our team is working around the clock with both internal and external security…

— UXLINK (@UXLINKofficial) September 22, 2025

Apparently, this hack led to a total of $11.3 million in assets drained from UXLINK. $4 million was in USDT tokens, and other stolen assets include USDC, WBTC, and ETH.

One wallet also received UXLINK tokens worth around $3 million, and immediately began selling around $800,000 worth.

A Crisis in Confidence?

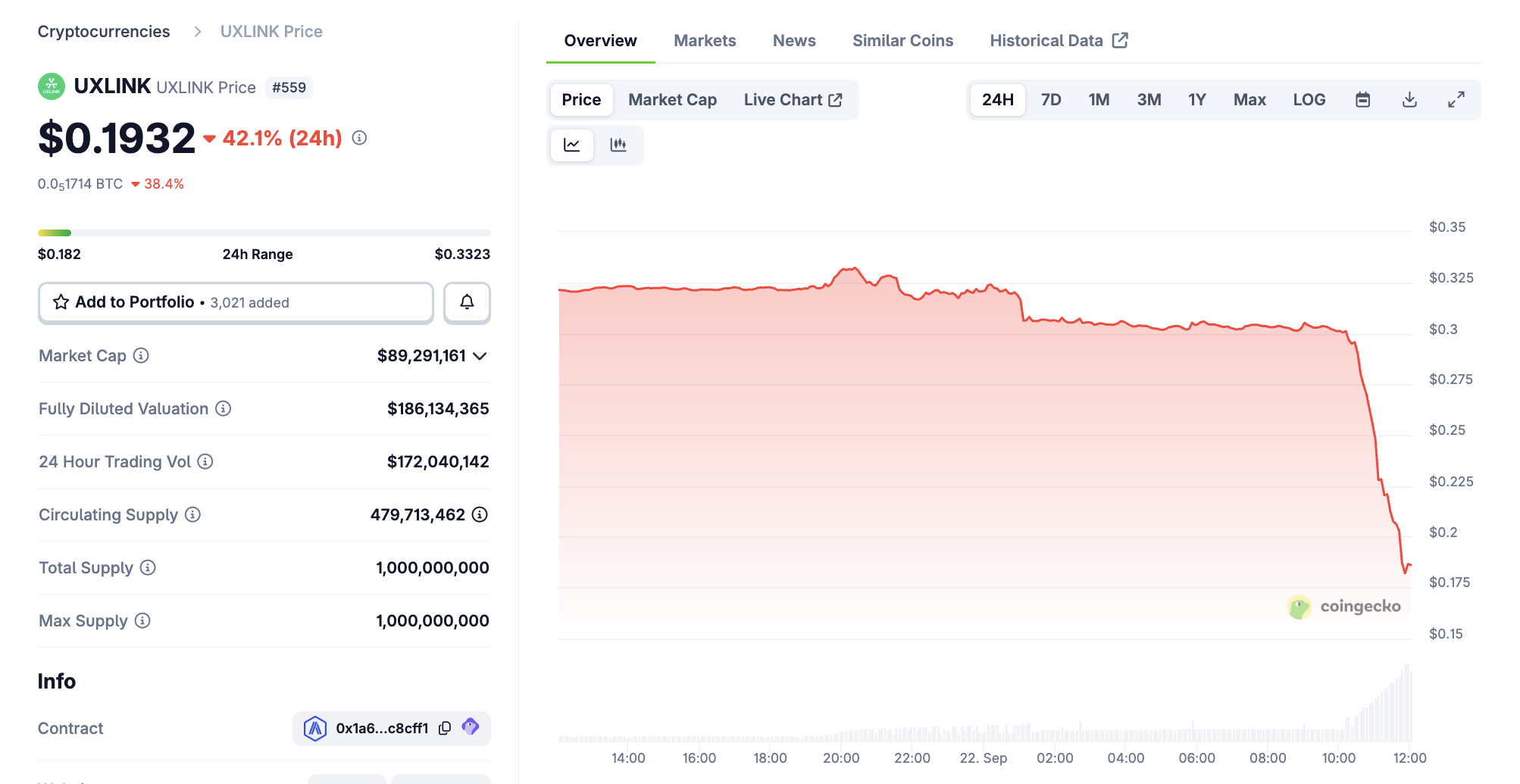

After the hack, this rapid sell-off led to a 1700%+ increase in transaction volume for the UXLINK token. Between the actual criminals and ambient panic selling in the market, this token’s value rapidly collapsed.

The token lost more than $70 million in market cap over the past hour.

UXLINK Price Performance.

UXLINK Price Performance.

It’s unclear what percentage of the firm’s total assets were involved in this security breach, but that’s not the biggest concern. With intense sell pressure and liquidations, the firm will need to get ahead of this PR crisis to prevent a greater lack of confidence.

In situations like this, consumer trust can be much harder to replace than any lost tokens.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Federal Reserve cuts rates again but divisions deepen, next year's path may become more conservative

Although this rate cut was as expected, there was an unusual split within the Federal Reserve, and it hinted at a possible prolonged pause in the future. At the same time, the Fed is stabilizing year-end liquidity by purchasing short-term bonds.

Betting on LUNA: $1.8 billion is being wagered on Do Kwon's prison sentence

The surge in LUNA’s price and huge trading volume are not a result of fundamental recovery, but rather the market betting with real money on how long Do Kwon will be sentenced on the eve of his sentencing.

What is the overseas crypto community talking about today?

What have foreigners been most concerned about in the past 24 hours?

Behind the 15 million financing, does Surf aim to become an AI analyst in the crypto field?

Cyber co-founder starts a new venture.