- Pepe declined 8.0% in 24 hours, trading at $0.059731 with support at $0.059607 and resistance at $0.00001065.

- RSI levels at 25.59 and 24.58 place Pepe in oversold territory, signaling strong selling pressure.

- Pepe gained 5.7% against BTC and 1.7% against ETH, showing mixed performance across trading pairs.

Pepe (PEPE) experienced a sharp decline in its market value, losing 8.0% in the past 24 hours. The token is currently trading at $0.059731, with its immediate support level set at $0.059607 . The minimal price-support difference shows the market moving in a narrow trend. However, the resistance level is much higher at $0.00001065, signaling that any recovery attempt will be confronted.

Price Performance and Key Market Levels

The 24-hour decline placed downward pressure on Pepe’s short-term outlook. Notably, the support level of $0.059607 is now under close watch. Any movement below this threshold could indicate further weakness in the near term. At the same time, resistance at $0.00001065 continues to cap upward moves, keeping the trading structure compressed.

The token is also tracked against other assets, where it shows varying movements. Pepe trades at 0.0108618 BTC, posting a 5.7% increase, while against Ethereum it stands at 0.082328 ETH, showing a 1.7% gain. These pairings highlight that while Pepe faces declines in U.S. dollar terms, its performance against other leading cryptocurrencies remains more balanced.

Technical Indicators and Market Signals

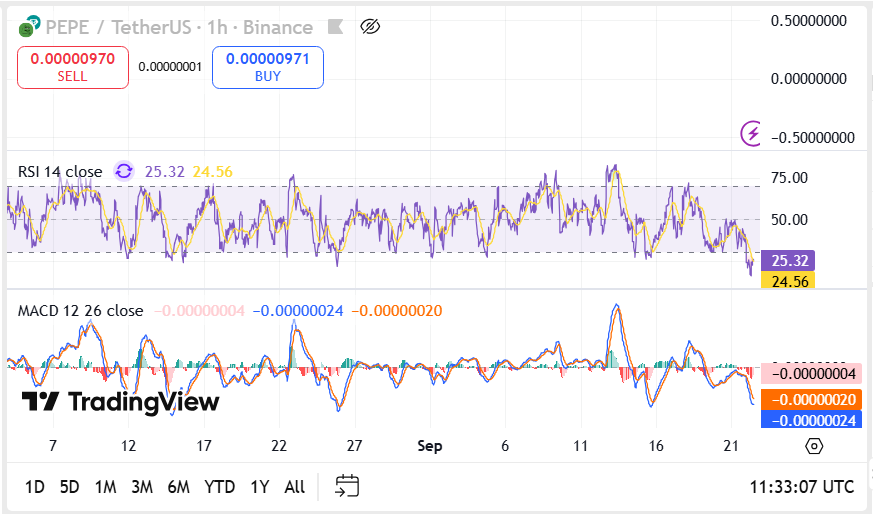

Technically, the momentum indicators shed further light on action in the market. The Relative Strength Index (RSI) is at 25.59 today, near 24.58. These are levels that place the token in oversold territory, demarcating the degree of selling pressure that was felt recently.

Source: TradingView

Source: TradingView

Conversely, Moving Average Convergence Divergence (MACD) is negative momentum. MACD line is at -0.00000004 and the signal line holds -0.00000020. Both lines remain below zero, which substantiates the current downward inclination.

These indicators as a whole indicate that the market is reacting to the recent decline very strongly. However, they also spot possible volatility, as fast reversals usually follow oversold conditions.

Wider Market Context and Outlook

Despite the recent downtrends, Pepe still attracts near notice among cryptocurrency markets. More importantly, its standing between support and resistance levels affects short-term direction of trading . Sellers likely are monitoring whether the support level of $0.059607 can keep prices stable in the coming sessions.

At the same time, the broader altcoin market has not yet entered a full-scale cycle. This context keeps tokens like Pepe in focus as participants track upcoming moves. With technical levels tightening, attention remains firmly on whether the token sustains current support or challenges the set resistance.