The Argentina peso crisis has accelerated Argentina crypto adoption as citizens shift into stablecoins and Bitcoin to hedge runaway inflation and peso devaluation; Washington has proposed swap lines and debt purchases, but durable recovery depends on credible fiscal reform and reserve rebuilding.

-

Argentina peso crisis drives rapid stablecoin demand

-

US officials are considering swap lines, direct currency purchases and Treasury tools to stabilize markets.

-

Central bank spent roughly $1.1 billion defending the peso amid heavy capital outflows; crypto volumes surged on local platforms.

Argentina peso crisis fuels crypto adoption; learn how stablecoins and Bitcoin are being used as a hedge — read analysis and actions to watch.

Argentina peso crisis and political uncertainty have triggered heavy capital flight and rising crypto demand, with US officials offering stabilization options while Argentines turn to stablecoins and Bitcoin as real-time hedges.

What is the Argentina peso crisis and how is it affecting markets?

The Argentina peso crisis is a rapid depreciation of the peso triggered by political uncertainty, high inflation and investor flight. The central bank spent about $1.1 billion over three days to defend the currency, while domestic asset prices and dollar bonds plunged amid heavy outflows.

How is the US responding to stabilize Argentina?

US Treasury officials, led by Scott Bessent, described Argentina as a “systemically important ally” and said multiple stabilization options are on the table, including swap lines, direct currency purchases and use of the Treasury’s Exchange Stabilization Fund to buy Argentine debt. These proposals briefly restored confidence, sending the Merval higher in US dollar terms, though the market remains under pressure.

Source: Scott Bessent

Why is Argentina crypto adoption accelerating?

Electoral uncertainty and a managed currency band that still allows wide dollar fluctuations (between 948 and 1,475) have pushed Argentines toward stronger stores of value. Stablecoins and Bitcoin are being used both as hedges against peso debasement and for international payments, remittances and decentralized finance access.

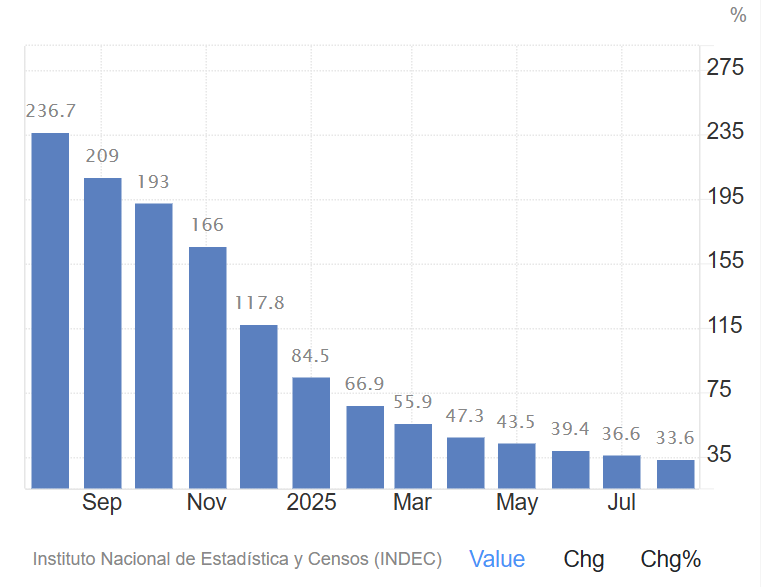

Although inflation has fallen sharply since Milei took office in December 2023, Argentina’s annual rate remains firmly in the double digits. Source: TradingEconomics

How are local platforms and users responding?

Crypto platforms report increased stablecoin volumes. Ignacio Gimenez, business manager at Lemon, noted Sept. 14 marked the platform’s highest daily stablecoin purchases since 2024. From mid‑August, stablecoin sales predominated, indicating users converting crypto to pesos when the dollar spikes and vice versa during political shocks.

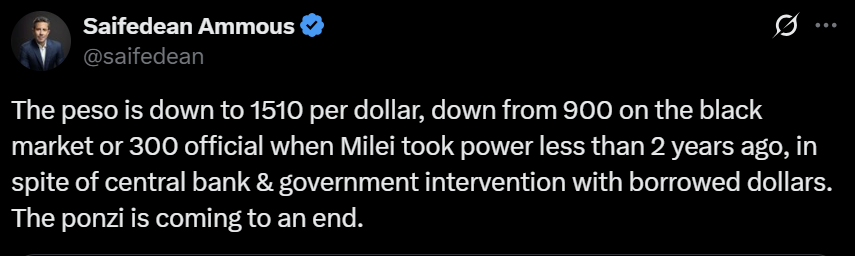

Source: Saifedean Ammous

What do economists and commentators say about fiscal risks?

Critics including economist Saifedean Ammous argue that Argentina’s fiscal mix has widened monetary expansion and debt pressures, citing bond auctions priced at high nominal yields (annual rates cited as high as 88%) and the peso’s steep decline since 2023. These assessments highlight the limits of short‑term stabilizers absent credible fiscal consolidation.

How are Argentines using stablecoins? (Step-by-step)

- Buy stablecoins on local exchanges or apps when the dollar rises to preserve purchasing power.

- Hold stablecoins for remittances or cross‑border payments to avoid peso conversion losses.

- Use decentralized finance protocols for interest or liquidity options not available in local banks.

- Convert to Bitcoin selectively as a long‑term store of value when volatility permits.

Frequently Asked Questions

How large were central bank interventions during the peso sell-off?

The central bank spent approximately $1.1 billion over three days to defend the peso, a significant use of reserves given roughly $20 billion in liquid foreign reserves reported in market commentary.

Will US stabilization tools solve Argentina’s problems?

Short‑term tools like swap lines or debt purchases can restore market liquidity, but durable recovery requires credible fiscal reform, reserve rebuilding and sustained investor confidence.

Are Argentines preferring Bitcoin or stablecoins?

Both are used: stablecoins are the immediate hedge and payment rail, while Bitcoin is increasingly seen as a longer‑term store of value; some local platforms report more users holding Bitcoin than crypto dollars.

Key Takeaways

- Market pressure: The peso tumbled amid political uncertainty, triggering heavy outflows and asset price declines.

- US response: Washington has put stabilization tools on the table, temporarily restoring some confidence.

- Crypto as hedge: Argentina crypto adoption, especially stablecoins and Bitcoin, is accelerating as citizens seek real‑time protection and payment alternatives.

Conclusion

Argentina’s peso crisis has catalyzed a notable rise in Argentina crypto adoption as households and businesses seek hard‑currency substitutes and digital rails for payments. While US stabilization measures can ease immediate pressure, lasting recovery hinges on fiscal credibility and reserve rebuilding. Monitor policy signals and local crypto volumes for the next market inflection.